AGOA.info Knowledge Base

What are AGOA preferences for the Category 9 handloomed / handmade / folklore and ethnic printed fabrics?

AGOA Products, Eligibility Criteria and Origin Rules View full article

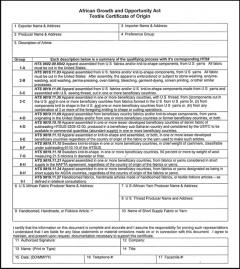

African exporters of certain handloomed, handmade, ethnic printed fabrics and folklore items may be able to export their products duty free under AGOA. Such exports are however subject to a country obtaining a special permission for Category 9 exports, named after the "Group 9" on the AGOA textile certificate of origin to which they relate.

Categories 1 to 8 represent mainstream garments of which production is basically industrial in nature, while Category 9 was added to encourage exports of small-scale cottage industry, handmade, folklore articles and ethnic printed fabrics from AGOA beneficiary countries.

These products become eligible through an application and bilateral consultation process between the applicant government (AGOA beneficiary's trade ministry) bilateral consultations between the government of an AGOA beneficiary country and the US government's the Committee for the Implementation of Textile Agreements (CITA).

Countries wishing to apply for Category 9 approvals should have already begun the approval process for the Textile Visa – the initial necessary step to become generally eligible for the textile benefits under AGOA.

Details of the relevant steps and the qualifying products are set out in this Guide.

To view individual countries' Category 9 authorisations, visit the AGOA.info country eligibility table here.

You can also view or download individual countries' Category 9 authorisations in the respective country sections.

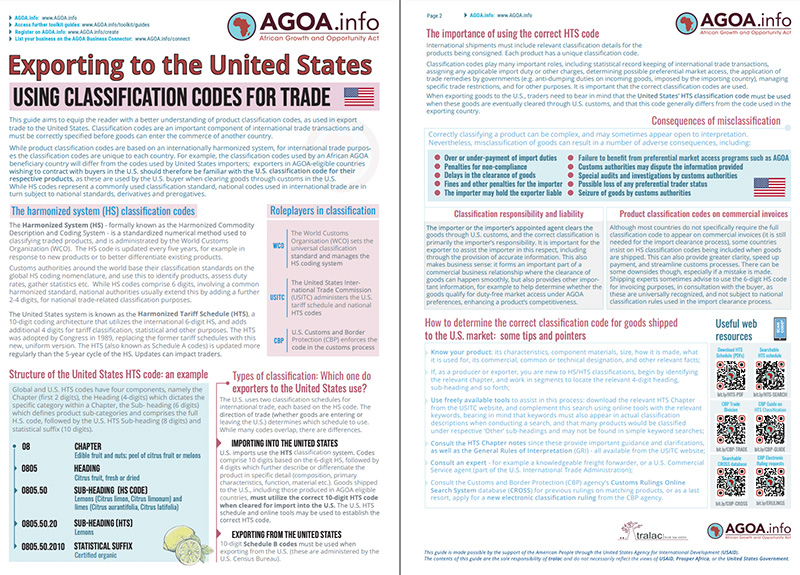

What are product classification codes and why does my product need one?

Classification Codes View full article

Accurate product classifications are a critical part when exporting to the United States - or any other international destination. Without the correct Harmonized Tariff Schedule code (HTS), traders can face legal issues, fines, delays in clearing shipments, or having their shipment seized.

A HTS Code is used to identify and classify goods that are to be cleared through customs.

A 10-digit import classification is required on the documents to clear goods into the US (even though preference status, such as AGOA eligibility, is determined at the 8-digit level - use the tool here).

For trade with the United States, it is important to establish the unique 10-digit code as used by the US. While the first 6 digits of this code are harmonized globally (this is the 'Harmonized System nomenclature', or HS), the following 4 digits are unique to the US and usually differ from classification codes used by other countries.

You can download and review each chapter of the US classification system, as well as the associated general notes, at this link.

In order to identify the correct and full classification code, the relevant Chapter can be used as a basis to help identify the correct and full product classification of the product to be shipped. It should be noted that it is important to review the Notes to each HTS Section (found in the first Chapter of each Section), together with the product-specific classifications. At times, the correct 10-digit classification would be under a 'Other' classification code. It is sometimes best to consult experienced freight forwarders and classification specialists for assistance.

A general recommendation for traders to establish the correct HTS code for their product would be to peruse the HTS Schedule (chapter documents). If the trader is already familiar with HS codes, or has the 6-digit code available, the AGOA Product lookup tool (at this link) can help identify the AGOA status of the product. However, note that while the tool provides details on the AGOA eligibility and associated import duties (for non-eligible goods, or goods not meeting the rules of origin), the 10-digit code can be found in the HTS Chapter listings.

You can also view and download an AGOA.info Guide to the US tariff classification system at this link.

AGOA stands for “African Growth and Opportunity Act”. As the name suggests, AGOA forms part of United States trade legislation and was signed into law in May 2000 under President Bill Clinton. The AGOA legislation was initially enacted to cover the period 2000 – 2008, but has been extended a number of times since then, most recently in 2015 through an Act of Congress (and following a lengthy hearings process). It now expires in 2025.

The key feature of this legislation is that it abolished (for imports into the US) import duties on over 6,000 products ('tariff lines'), if these were manufactured in a Sub-Saharan African country that has qualified as a beneficiary of AGOA preferences. While the majority of these products already benefited from the US Generalized System of Preferences, this program was subject to more regular Congressional re-authorization processes which often resulted in periods in-between where no GSP preferences could be claimed (or duty-free claims were deferred). AGOA has provided longer-term certainty to traders.

The AGOA legislation is unilateral and non-reciprocal. This means that it forms part of US legislation, and the trade preferences relate only to the 'opening' of the US market by way of preferential market access to qualifying exports from AGOA beneficiary countries. AGOA does not require the same concessions from AGOA beneficiaries for imports from the US.

Prior to AGOA, countries classified as developing and least-developed and listed as GSP-eligible were able to export goods to the US under preferential (duty-free) conditions under the GSP. This is in many ways similar to the GSP that many other industrialized countries offer developing countries. But as mentioned above, GSP reauthorization is required more frequently and last expired at the end of 2020, and by mid 2023 had not been re-authorized by the US Congress.

AGOA therefore allocated duty-free status to virtually every GSP product, including those reserved for LDC beneficiaries, while also adding preference status to a further approximately 1,700 tariff lines (including textiles and clothing, provided that AGOA beneficiary countries have implemented an AGOA visa system for relevant preferential exports).

What is the background to the AGOA legislation?

Getting Started: AGOA Program Info View full article

During the 1990s, the United States realized that it offered few tangible long-term trade benefits to exporters from African countries. In addition, the US wanted to create a more meaningful partnership with African countries based on economic growth and trade, by offering non-reciprocal trade and economic benefits and opportunities to qualifying Sub-Saharan African countries. Despite the US already having a trade preference program in place - the Generalized System of Preferences - AGOA was aimed at offering more attractive and longer-term benefits and incentives beyond those available to Sub-Saharan African countries under the GSP, while also being tied to a range of other commitments and additional US support.

The AGOA legislation originated in the US Congress. It was widely supported by Democrats and Republicans in a strong showing of bipartisanship, and easily passed both chambers of Congress (the House of Representatives, and the Senate) prior to being signed into law by President Bill Clinton. At the time, the legislation covered the years 2000 – 2008. Later legislative amendments have updated and extended AGOA - first to 2012, then 2015, and then to its current expiry date September 30, 2025.

Are AGOA benefits permanent, or how long do they last?

Getting Started: AGOA Program Info View full article

AGOA forms part of United States legislation and and may be amended, extended or repealed by the US Congress prior to its automatic expiry on 30 September 2025.

While AGOA preferences are available to sub-Saharan African countries, not all countries are currently eligible beneficiaries. In order to be an AGOA beneficiary, a country must be listed as such and fulfil AGOA's eligibility provisions. This status is reviewed annually, and countries that no longer meet the eligibility criteria may lose their AGOA beneficiary status - this can also happen on an ad-hoc basis outside of the annual review period.

When a country that is not AGOA eligible - or which has lost its AGOA beneficiary status - fulfils the AGOA eligibility criteria, the US President may consider reinstating that country's AGOA beneficiary status. See, for example the official proclamation, regarding the status of Lomé.

Under the most recent extension of AGOA, its preferences and privileges were extended by a further 10 years from 2015 to 2025. This extension included the special preferences for wearing apparel, which allows beneficiaries subject to conditions to utilize imported fabric in their manufacturer of AGOA-compliant garments.

In summary, AGOA preferences are not permanent (they currently expire on 30 September 2025) and neither is a country's beneficiary status (eligible countries must continue to fulfil AGOA's eligibility criteria). Countries reaching a certain level of development may also be graduated out of the program.

The original AGOA legislation was signed into law as Title 1 of the Trade and Development Act of 2000 (Public Law 106-200) during May 2000.

Find the text of the legislation at this link.

Following the initial enactment of the AGOA legislation, with an original end date of September 2008, a number of updates were passed by the US Congress – some of these were technical amendments (for example: Miscellaneous Trade and Technical Corrections Act of 2004) while others extended the legislation beyond its original 8-year term (for example: the AGOA Acceleration Act of 2004 ).

Other amendments addressed provisions of the AGOA legislation that were initially set for earlier expiry, for example the special wearing apparel provisions that granted beneficiary countries favourable rules of origin for clothing exports under AGOA (specifically, the third country fabric provisions).

The most recent extension of AGOA, covering the period 2015 – 2015, is known as the AGOA Enhancement Act of 2015 and can be found at this link.

All AGOA and related legislation can be downloaded from this site’s Legal Documents archive.

What trade benefits does AGOA provide?

AGOA Products, Eligibility Criteria and Origin Rules View full article

AGOA’s benefits go beyond simple market access, and include or have facilitated closer collaboration between the US and African countries in many other areas, technical and economic assistance, aid, investment finance, political and strategic collaboration in certain areas, and so on. For example, trade capacity building is an important feature of AGOA as the legislation directs the US President to provide support in this area to AGOA beneficiaries, for example through the US Agency for International Development (USAID) which administers certain projects in support of AGOA for example under the ATI (Africa Trade and Investment project), which work to increase AGOA utilization and regional producers’ access to international markets.

One of the key benefits however remains preferential market access to the US market that is given to over 6,000 products when these originate in the African AGOA beneficiary country.

By removing US import duties on products covered by AGOA, producers and exporters in AGOA beneficiary countries indirectly receive a competitive advantage over exporters in other countries, who may need to pay standard US import duties, which for certain textile articles might be more than 30% on the value of the product. The preference claim is always made by the US importer.

This is a win-win scenario both for African producers and exporters as well as for US importers and consumers, as AGOA preferences result in more competitive sourcing of products, compared to US importers sourcing such goods from elsewhere. When the US importer clears goods under AGOA preference, the applicable AGOA program indicator must be chosen (symbol ‘D’ when completing the paperwork). Apparel products are classified separately in the tariff database under Chapter 98 and the US import filing includes must include the specific rules of origin category under which the preference claim is made. The US GSP program uses the 'A' program indicator but only allows preferential access when the GSP is active.

‘D’ – AGOA duty-free treatment

‘A’ – Generalized System of Preferences

While even a small duty rate can translate into a significant competitive advantage for African producers exporting to the US, the competitive dynamics of the product and industry and the size of the preference margin also play an important role in determining how valuable AGOA preferences are in each scenario: the greater the potential duty saving, the greater the relative advantage of using AGOA when clearing goods for import into the US, and for ensuring that the goods meet the minimum local content and processing requirements to be considered a product of the beneficiary country. In highly competitive sectors where even a small percentage saving can translate into a valuable advantage, AGOA preferences can play an important role in helping to facilitate trade between Africa and the US.

*** See later section on ‘Origin’ and its associated requirements under AGOA

When does a product qualify for AGOA duty-free treatment?

AGOA Products, Eligibility Criteria and Origin Rules View full article

In order for a product to qualify for AGOA preferences, a number of factors are considered.

These include the following:

(1) the product must be included in the list of AGOA eligible products (such products are denoted with the special program indicator 'D' in the US tariff schedule), or they must be a qualifying apparel or textile item;

(2) It must be imported into the United States directly from the AGOA beneficiary country or pass through another country in a sealed container and addressed to a location in the United States;

(3) The article must be the growth, product, or manufacture of the AGOA beneficiary country by fulfilling the relevant Rules of Origin requirements for general or apparel items, respectively

(4) If foreign materials are imported into the AGOA country first, to be used in the production of an AGOA-eligible product, the sum of the cost of the materials produced in the AGOA beneficiary country, plus the costs of processing, must equal at least 35 percent of the product’s appraised value when the product is sold for export into the United States (see section on Rules of Origin). Apart from the 35% local content requirement, any imported non-originating materials used in the calculation of local content (35%) must have been substantially transformed locally in the exporting country claiming AGOA origin through a double transformation (into a separate and distinct intermediate article of commerce having a distinctive name, character or use - see United States v. Gibson-Thomsen Co., Inc., 27 CCPA 269 (1940).

(5) In the case of clothing/apparel, the 35% rule does not apply directly, instead, the goods need to comply with the respective textile and apparel Rules of Origin requirements and be entered into the US under their respective RoO category;

(6) The US importer must request duty-free treatment under AGOA on the relevant customs entry form (Form 7501) by placing an “D” in column 27 in front of the US tariff number that identifies the imported article.

Find additional details at this link on AGOA's product eligibility principles.

If a product does not qualify for AGOA benefits, does that mean that import duties must be paid when such goods are shipped to the USA?

AGOA Products, Eligibility Criteria and Origin Rules View full article

When a product is not covered by AGOA preferences, standard import terms and conditions apply when such goods are imported into the US, irrespective of whether the good was produced in an AGOA beneficiary country.

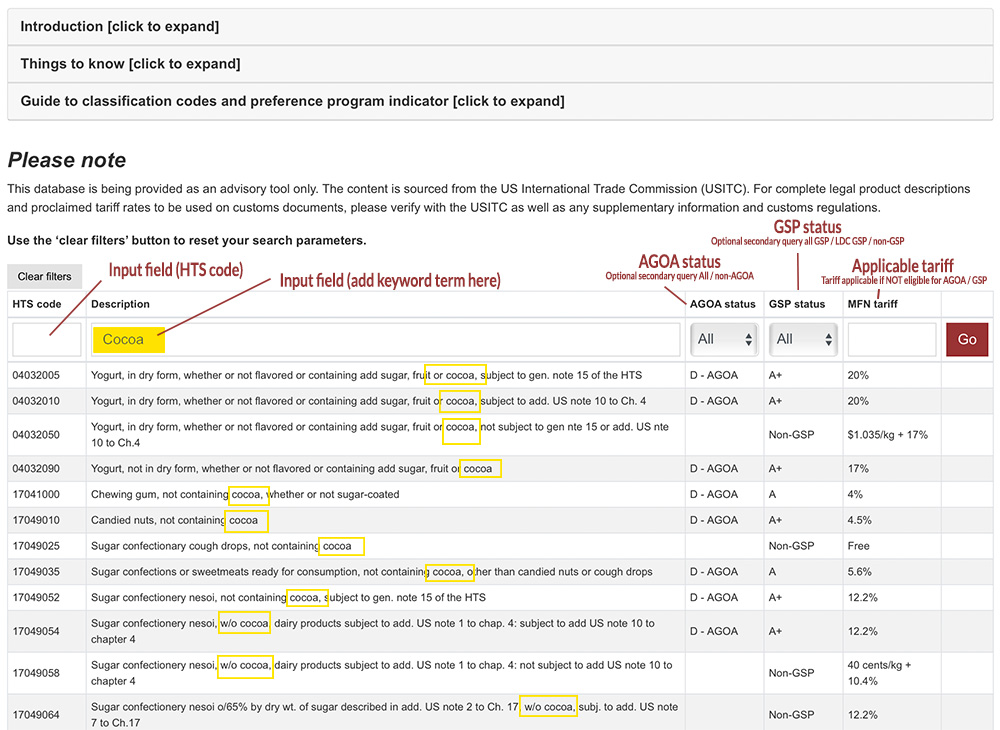

However, even if a product is not covered by the AGOA preference program, this does not necessarily mean that an import duty will always be due. Many products - in fact well over 4,000 tariff lines - are not subject to an import duty in the US tariff schedule under normal tariff relations (NTR). The AGOA.info classification and tariff lookup tool can assist the user correctly establish the status of their product at this link.

What products are covered by AGOA

AGOA Products, Eligibility Criteria and Origin Rules View full article

AGOA covers more than 6,700 products based on the HTS-8 tariff classification. This includes approximately 5,100 products (tariff lines) that fall under the GSP as well as more than 1,600 tariff lines that are duty-free only for exports to the US from AGOA beneficiaries. A searchable list of products eligible for duty-free export to the US is available at this link.

What is the HTS-8 product classification?

The HTS refers to the US Harmonised Tariff System nomenclature, and is based (up to the 6th digit) on the internationally standardized Harmonized Commodity Description and Coding System, managed by the World Customs Organisation. It classifies all traded products into sections, chapters, headings, sub-headings and so on.

Let’s take, for example, "pineapples in packages":

- Section II represents vegetable products (and comprises Chapters 6 - 14)

- Chapter 08 covers ‘edible fruit and nuts, peel of citrus/melons’

- Heading 0804 covers dates, figs, pineapples, avocadoes etc.

- Sub-Heading 0804.30 covers pineapples

- The 8-digit sub-division 0804.30.40 covers ‘pineapples in crates or other packages’

Using the above example and using the AGOA product lookup tool here:

Tariff line 08043040 has a standard US import duty of 1.11 / kg (as of 2023)

It also has the AGOA ‘D’ code in the US tariff book, meaning that when imported into the US from an AGOA beneficiary, this import duty is not applicable. The same product is also eligible for GSP preferences (program indicator A+) which indicates that when the GSP is in force, imports into the US from least-developed beneficiary countries under the GSP would also be able to claim preferential entry.

Link to AGOA Eligibility Lookup Tool

.

What are Rules of Origin and how do they pertain to AGOA?

AGOA Products, Eligibility Criteria and Origin Rules View full article

Rules of Origin (RoO) are the criteria that define the origin of a product, and more specifically, describe the minimum content or processing that must be undertaken on any non-originating materials used, in order to confer local origin status on the product.

RoO form an integral part to any preferential trade arrangement in that they help ensure that any trade benefits accruing under such an arrangement are for goods that originate in the beneficiary country, rather than being claimed by goods that are produced elsewhere and that may have been transhipped through a beneficiary country, or with only minimal value being added.

RoO generally distinguish between two different types of goods:

(a) those that are wholly produced in the exporting country from local (originating) materials, and

(b) those that utilize local and foreign materials but are further processed locally in order to result in a substantial transformation.

In the former, the origin status of a product tends to be undisputed and can readily be attributed to the country where the product is grown or manufactured. Examples would include products made from minerals extracted from the soil, fish caught in inland waters and processed locally, agricultural products, and any product made exclusively from locally made inputs.

In the latter scenario, RoO become particularly important since the product is made up using both local and foreign inputs; here the RoO specify what minimum amount of processing and value-adding activity must take place locally, before a product can be deemed to be of local origin.

The AGOA legislation distinguishes between textile and non-textile goods in terms of origin criteria:

Textile goods (such as wearing apparel) can qualify based on the specific processing and origin criteria set out in a number of different textile categories - such as (local) "manufacture using third country fabric", or "manufacture from regional fabric" - whereas all other goods are subject to a general 35% local content rule. Up to 15% of the 35% may comprise materials produced in the US.

Under the 35% rule, only locally made materials and processing contributes to this threshold, and only imported materials that have undergone a double transformation and result in a substantially different material or intermediate good may be counted as 'local' content for the purpose of being included as part of the 35% minimum requirement.

RoO are intended to ensure that only goods that have attained the economic origin of the beneficiary country will benefit from trade preferences, thus ensuring local value-adding activities and preventing transshipment of goods from other countries.

All goods exported to the US and claiming AGOA preferences must meet the relevant RoO.

See the next section for further details.

What are some of the specifics of the textiles and apparel Rules of Origin under AGOA?

AGOA Products, Eligibility Criteria and Origin Rules View full article

As outlined elsewhere, the general 35% (local content) rule does not apply to textiles and apparel, for which a number of separate and different rule categories apply.

AGOA beneficiary countries whose exporters wish to export textiles and apparel to the US under AGOA must first implement a so-called apparel visa system (see a related announcement relating to Madagascar), which pertains to the monitoring and control of inputs such as fabric used in the production of apparel, as well as maintaining adequate records pertaining to the use of any non-originating imported fabric. As of 2023, approximately 25 of the 35 current AGOA beneficiaries had implemented the requisite apparel visa system and were current AGOA beneficiaries, enabling them to ship qualifying apparel under AGOA.

The textile and apparel rules of origin (additional details about these provisions are available here) are set out in more than a dozen separate categories each with their own special classification code, for which the US tariff database uses a special tariff book chapter and associated headings, subheadings and 8-digit sub-divisions (>> see HTS Chapter HTS 98 / Heading HTS 9819 / Sub-heading HTS 9819.11 / division HTS 9819.11.03 onwards).

The three most prominent RoO categories (and HTS codes) for textiles and apparel relating to AGOA exports - with the bulk of AGOA trade - are as follows:

Textiles:

>> HTS 9819.11.33

Textiles classified under chapters 50 through 60, as well as chapter 63, which are produced in a LDC AGOA beneficiary, and which are made from fibers, yarns, fabrics, fabric components or components knit-to-shape in one or more such AGOA beneficiaries. (Note that South Africa is currently the only AGOA beneficiary that is not considered an LDC country, meaning that textile preferences do not apply to South African exports)

Apparel:

>> HTS 9819.11.12

Apparel articles assembled or knit-to-shape in a LDC AGOA beneficiary, regardless of the country of origin of the fabric or the yarn used to make such articles. This provision applies to almost all current AGOA beneficiaries that qualify for textiles and apparel exports under AGOA, with the exception of South Africa (not a LDC beneficiary under AGOA). South African exporters are therefore more limited in terms of where they can source fabric from and still meet the Rules of Origin provisions.

>> HTS 9819.11.09

Apparel articles assembled in an AGOA beneficiary country from fabric wholly formed in one or more such AGOA beneficiaries from yarn originating in the US or in an AGOA beneficiary (or former beneficiary) country. This provision applies to South African exporters, as South Africa is not classified as an LDC beneficiary country. This means that apparel must be assembled from AGOA beneficiary country fabrics or knit to shape components, which in turn must have been made from US or AGOA beneficiary country yarns. Exporters from South Africa may however use certain components sourced from third countries (including collars, cuffs, drawstrings, belts attached to garments, padding, shoulder pads) provided the value of such items is less than 25% of the total cost of the garment. Under the de minimis provisions, up to 10% by weight may also comprise non-originating fibers and yarns.

Follow this link to the AGOA textile data section.

A certificate of origin is a document that confirms that a product meets the local processing requirements needed to confer origin status for a particular trade preference scheme. The certificate can be seen as a declaration by the exporter that the the products in the shipment meet the relevant rules of origin.

In international trade, the responsibility of clearing goods through customs rests primarily with the importer or the importer’s appointed agents. AGOA makes provision for a certificate of origin - known as a movement certificate - only for textile goods, in line with AGOA’s 'wearing apparel' provisions.

Only exporters in countries that are authorized to ship textiles and apparel under preference (under the separate wearing apparel provisions), and have developed an authorised ‘visa’ system (which manages and tracks the utilization of non-originating textile inputs), are able to obtain a textile certificate of origin for AGOA purposes.

A certificate of origin is required for each shipment of textiles and apparel claiming AGOA preferences. The US importer obtains the certificate of origin from the manufacturer prior to presentation of such entries to the US Customs Service claiming an AGOA preference. The importer is required to possess the certificate of origin and to be able to present it upon demand by the US Customs Service (CBP). The visa arrangement establishes documentary procedures for each shipment of eligible textile and apparel products from a designated beneficiary sub-Saharan African country to the US.

In the AGOA beneficiary table at this link a user can check which countries have fulfilled the wearing apparel provisions. You can also visit the individual country sections and download the wearing apparel authorization for each country that has obtained it.

For non-AGOA goods, the responsibility for compliance with the RoO lies jointly with the producer/exporter and the importer, although it is the importer that clears the goods into the United States and makes the relevant declarations. The importer must take steps and obtain relevant evidence and assurances from the producer / exporter in the AGOA beneficiary country that the goods in question fulfil the 35% local content rule that confers origin status on the African AGOA beneficiary country.

It is important to note that the textile certificates have to be provided by the exporter and not the importer - please contact your local customs office or chamber of commerce for assistance with the relevant local rules for obtaining and completing a certificate of origin.

Download a sample certificate here.

Which countries do AGOA eligibility and preferences apply to?

Country Eligibility Criteria and AGOA Beneficiary Status View full article

The AGOA legislation makes provision only for countries of Sub-Saharan Africa to be eligible as AGOA beneficiaries. However, not all eligible countries are currently AGOA beneficiaries.

Qualification is not automatic and countries are required to meet a number of conditions on an ongoing basis in order to benefit from AGOA preferences when exporting to the United States.

When a country of Sub-Saharan Africa does not meet (or no longer meets) the AGOA eligibility requirements, its preferential market access to the US market under AGOA can be suspended. The US conducts an annual review of all AGOA beneficiary countries, a process that includes public hearings, and which allows for submissions.

Over the years, some AGOA beneficiary countries lost their AGOA status due to non-compliance with the AGOA eligibility requirements. Some have regained AGOA status, for example Madagascar, Eswatini, DRC and others.

A list of countries that are currently eligible as an AGOA beneficiary can be viewed in the table at the following link.

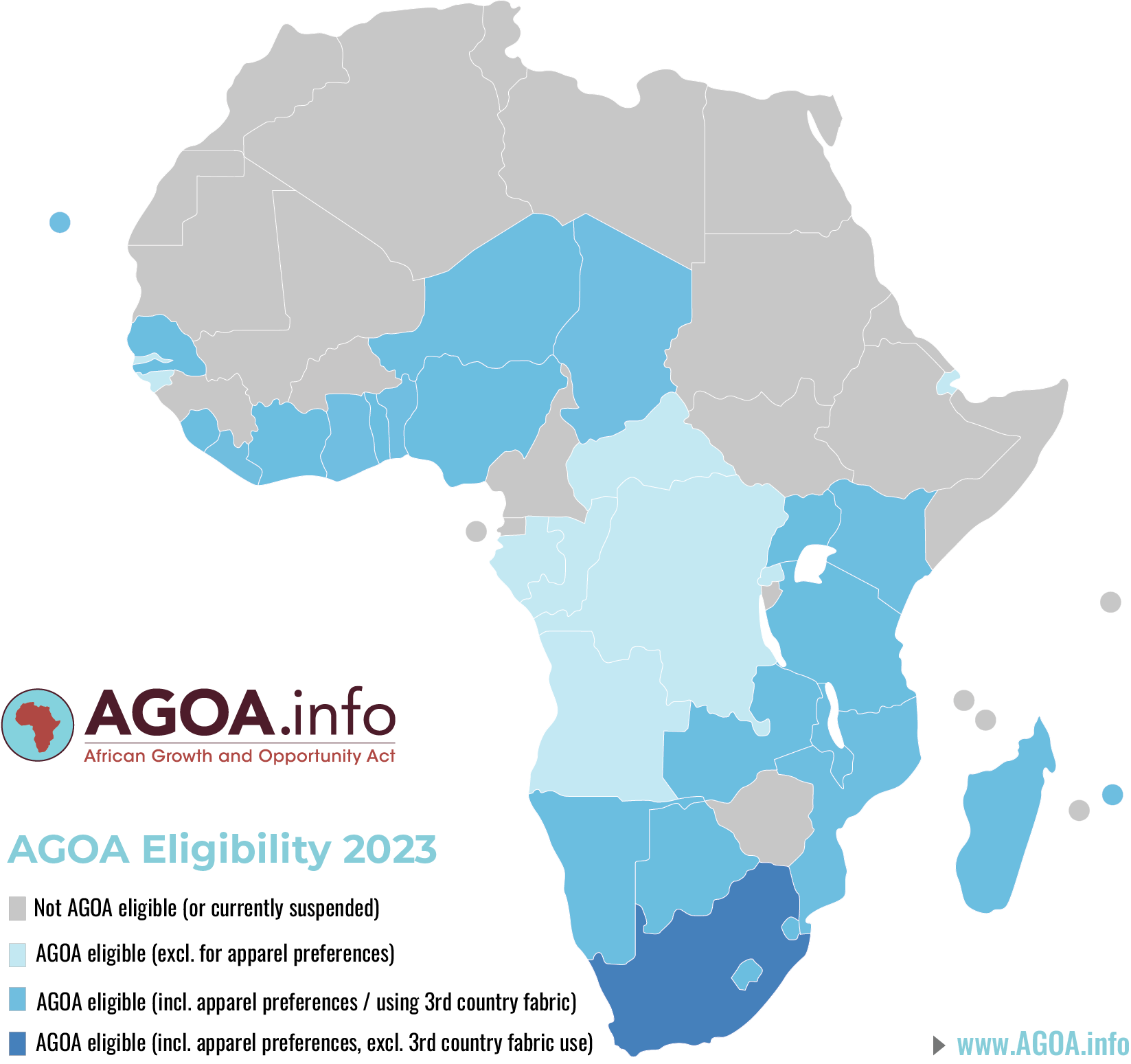

The map below provides a snapshot of Sub-Saharan African countries' current AGOA beneficiary status.

How does a country qualify to become an AGOA beneficiary country?

Country Eligibility Criteria and AGOA Beneficiary Status View full article

The US President may designate a country as a beneficiary Sub-Saharan African country eligible for AGOA preferences if he determines that the country meets the eligibility criteria set forth in:

(1) Section 104 of AGOA (see 19 U.S.C. 3703); and

(2) section 502 of the 1974 US Trade Act (see 19 U.S.C. 2462).

Only countries in Sub-Saharan Africa can be AGOA beneficiaries, since the legislation specifically seeks to enhance the trade, investment and political relationship between the US and Sub-Saharan Africa. In order for a country to qualify as an AGOA beneficiary, and to maintain its beneficiary status, it must meet a number of criteria set out for this purposes by the AGOA legislation as well as by the US Trade Act of 1974 (see links above). A country must also be eligible for the US Generalized System of Preferences (GSP), whose eligibility requirements and those of AGOA essentially overlap.

While GSP eligibility does not imply AGOA eligibility, 47 of the 48 Sub-Saharan African countries are currently GSP eligible.

Among the required criteria, a country must have established, or make continual progress towards establishing, a market based economy, political pluralism, respect private property rights, incorporate an open rules-based trading system, eliminate barriers to US trade and investment, respect internationally recognized human rights, protect worker rights and so forth.

In addition, the country may not engage in activities that undermine US national security or foreign policy interests.

A more complete list can be found at this link.

Countries that do not meet these criteria may lose their AGOA beneficiary status. The US routinely - at least on an annual basis - assesses ongoing compliance with these criteria and in the event of a country no longer meeting the criteria will place that country on notice pending suspension from receiving AGOA preferences. Under the most recent AGOA legislation (2015), a variety of stakeholders including private organizations and entities have the right to apply for an AGOA beneficiary’s status under the AGOA legislation to be reviewed, should there be evidence of a country not or no longer meeting the AGOA eligibility requirements (See details of the petition process at this link to the relevant section of the Trade Preferences Extension Act of 2015.

Primary drivers for such an eligibility review may be, for example, when trade or investment barriers that unfairly target US exports or companies are put in place.

During 2015, South Africa was subject to an extensive AGOA Eligibility Review, owing to concerns by the US about South Africa's treatment of certain imports of chicken, beef and pork. Documents from this review can be viewed here.

As of 2023, 35 countries were designated as AGOA beneficiaries.

The AGOA legislation (Public Law 106-200) makes provision for the establishment of a United States-Sub-Saharan Africa Trade and Economic Cooperation Forum (“AGOA Forum”).

Hosting of this significant annual event alternates between Washington D.C. in the US, and an African country. The last few AGOA Forums were held in Washington (2014), Libreville Gabon (2015), Washington (2016) and Lomé Togo (2017), Washington (2018), Côte d’Ivoire (2019), Washington (2020) respectively.

In Sec. 103, containing the legislation’s policy statements, reference is made to the US Congress’ support for an AGOA Forum.

Sec. 105 deals with the AGOA Forum in particular, and instructs the President of the United States to convene “annual high-level meetings between appropriate officials of the United States Government and officials of the governments of sub- Saharan African countries in order to foster close economic ties between the United States and sub-Saharan Africa”.

>> For additional details on the past few annual AGOA Forums, including copies of the agenda as well as related documents, visit the AGOA Forum section.

Where can I obtain assistance relating to AGOA?

AGOA Resources and Technical Support View full article

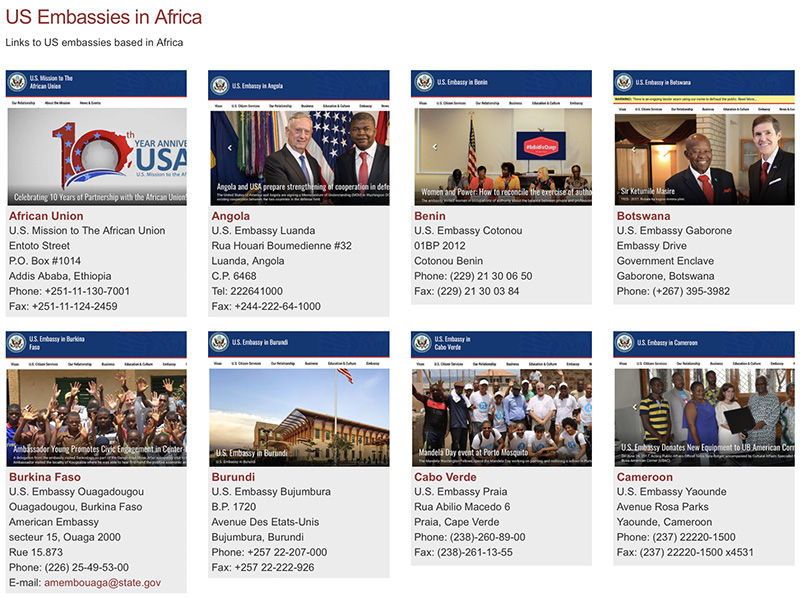

There's a wealth of information and advice relating to AGOA right here on the AGOA.info website. However, for more technical and practical assistance relating to exporting under AGOA, and depending on which country you are based in and what economic activity you are involved in, you should consider contacting the US embassy located in your country.

A detailed list of US embassies in Africa along with their contact details and website address can be found in the AGOA Web Resources section on this site, and specifically the section on US embassies.

The US, through the USAID, has previously funded various Trade and Investment Hubs in Africa. These were located in Accra, Ghana (West Africa Trade and Investment Hub), in Nairobi Kenya (East Africa Trade and Investment Hub) and in Gaborone Botswana (Southern African Trade and Investment Hub). Highly qualified and experienced staff and advisors are able to assist with your AGOA-related technical questions and support needs.

It is also recommended to contact your local chamber of commerce or manufacturers' association as many of these have a specialized trade desk that may be of assistance with specific trade-related queries. Find links to chambers at the following link.

Other relevant resources available on this site:

Sector Associations and Export Promotion (Africa)

Development and Finance organizations (United States)

Government departments (United States)

Regulatory authorities (United States) (relevant to licensing and authorizations, esp. relating to agricultural products)

You can also complete the form at the bottom of this page when you have a specific technical query - we will try to assist. However, be sure to access key resources on this site, including:

What is AGOA? An introduction

The AGOA product and tariff lookup tool

AGOA Country Eligibility

AGOA Rules of Origin

AGOA Rules of Origin for textile goods

Information on US quotas

Information on US trade remedies (when goods produced elsewhere are sold at less than fair value on the US market).

The US tariff schedule - download it chapter by chapter

Document downloads (guides, reports, legislation, AGOA reviews, research etc.) - all found in the Downloads menu above.

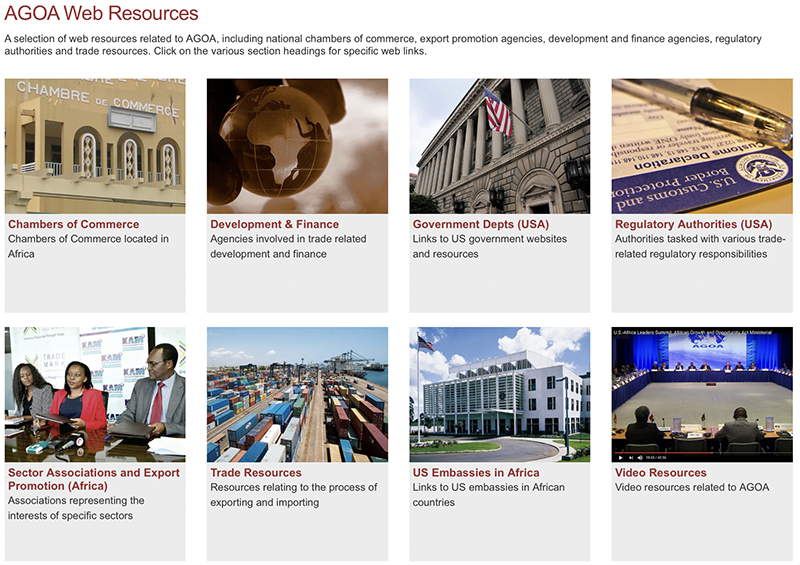

Where do I find AGOA resources including training videos?

AGOA Resources and Technical Support View full article

Please have a look at the Web Resources section on this site - it contains web links to a number of useful resources relating to AGOA, including training videos. Other web resource sections include chambers of commerce, development and finance organisations, US government departments, regulatory authorities, African sector associations, think-tanks and general trade resources.

The AGOA legislation encourages countries to develop an 'AGOA Utilization Strategy'. What do these look like?

AGOA Resources and Technical Support View full article

A number of countries have developed an AGOA Utilization Strategy, helping to focus them on better utilizing the benefits provided by AGOA.

Two dozen such strategies can be downloaded from this site at the following link. Guidelines on developing an AGOA strategy are available in the following document.

No, an exporter is not required to "register" in relation to the AGOA legislation in order to take advantage of its benefits when exporting goods to the US.

However, each country has different rules and regulations and many countries require that an exporter be registered for export purposes (this is unrelated to AGOA per se) with local customs or revenue authorities. Often this also involves receiving a unique exporter authorization number. These are national country-specific measures and different from country to country: it is advisable to contact the customs or revenue authorities in the home country to see what registration measures and related formalities may be required.

What is however important to bear in mind is that while the exporter is not required to register as a 'participant' under the AGOA program,

(a) the country must be a current AGOA beneficiary country (see relevant section here),

(b) the product(s) must be AGOA-eligible, and

(c) the product must originate in an African AGOA beneficiary country in accordance with AGOA’s Rules of Origin provisions.