Toolkit Downloads

AGOA: Frequently Asked Questions for the textile and apparel sectors (English)

AGOA: Frequently Asked Questions for the textile and apparel sectors (Portuguese)

AGOA: Frequently Asked Questions for the textile and apparel sectors (French)

US Strategy towards Sub-Saharan Africa (2022)

Sub-Saharan Africa is critical to advancing our global priorities. It has one of the world’s fastest growing populations, largest free trade areas, most diverse ecosystems, and one of the largest regional voting groups in the United Nations (UN). It is impossible to meet this era’s defining challenges without African contributions and leadership. The region will factor prominently in efforts to: end the COVID-19 pandemic; tackle the climate crisis; reverse the global tide of democratic backsliding; address global food insecurity; strengthen an open and stable international system; shape the rules of the world on vital issues like trade, cyber, and emerging technologies; and confront the threat of terrorism, conflict, and transnational crime. This strategy reframes the region’s importance to U.S. national security interests. In November 2021, Secretary of State Antony Blinken affirmed that “Africa will shape the future— and not just the future of the African people but of the world.” Accordingly, this strategy articulates a new vision for how and with whom we engage, while identifying additional areas of focus. It welcomes and affirms African agency, and seeks to include and elevate African voices in the most consequential global conversations. It calls for developing a deeper bench of partners and more flexible regional architecture to respond to urgent challenges and catalyze economic growth and opportunities. It recognizes the region’s youth as an engine...

Trade Report - Southern Africa's Trade with the United States

This trade data report provides insights into the trade flows between a number of Southern African AGOA beneficiary countries and the United States. The data is based on official U.S. import statistics. A general overview is provided with aggregate two-way trade between the Southern African country and the U.S. (imports, exports, balance of trade), in tabular and chart format. A second chart categorizes U.S. imports with each country by import category (AGOA, no preferences claimed, etc.). For each country, trade data by sector is shown for the past three years (2019-2021), along with 2022 data for the first quarter. This includes imports and exports, and further distinguishes U.S. imports by aggregate and by share of AGOA/GSP preference. Disaggregated data tables for each country show U.S. imports by HTS 4-digit classification, in descending order by value, irrespective of a product’s preference status. This provides greater insight into the leading tariff lines being imported into the U.S. from the country concerned. The final data table shows only products that entered the U.S. duty-free under AGOA/GSP preference, for each country, and indicates which tariff lines (at the HTS 8-digit level) are benefiting from these trade preferences.

AGOA - Basic Exporter Guide and Checklist

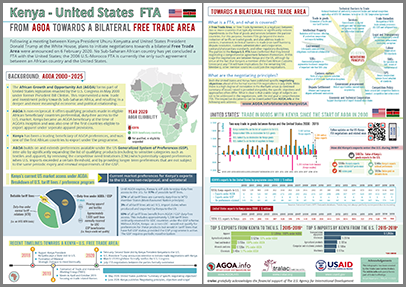

Brochure | Kenya-United States FTA

Information brochure on the proposed US-Kenya FTA, including trade data and negotiating principles. Double-sided A4. For printing purposes, set 'fit to page' on your printer.

United States GSP Guidebook 2020

The U.S. Generalized System of Preferences (GSP), a program designed to promote economic growth in the developing world, provides preferential duty-free treatment for approximately 3,500 products from a wide range of designated beneficiary developing countries (BDCs), including many least-developed beneficiary developing countries (LDBDCs). An additional approximately 1,500 products are GSP-eligible only when imported from LDBDCs. The GSP program, first authorized by the Trade Act of 1974, came into effect on January 1, 1976. Authorization of the GSP program expired on December 31, 2017. On March 23, 2018, the President signed legislation authorizing the GSP program through December 31, 2020, retroactive to January 1, 2018. The purpose of this Guidebook is to facilitate public understanding of the GSP program and the documents that implement the program. Much of the information contained in this guide overlaps with AGOA requirements.

AGOA Exporter User Manual

The purpose of the African Growth and Opportunity Act (AGOA) Export User Manual is to provide current and potential exporters to the United States of America (U.S.) with information needed to comply with requirements of U.S. customs laws and to take advantage of AGOA. As a practical document, it offers step-by-step guidance on what you need to know if you are interested in exporting goods to the U.S., including: • Information on the entry process • Classification • Valuation of goods • Determination of country of origin • Admissibility of goods • Assessment of duty

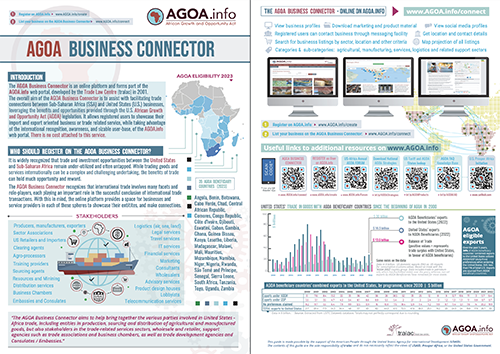

AGOA Business Connector Brochure [Updated 2023]

AGOA.info brochure on the AGOA Business Connector. See www.AGOA.info/connect Double-sided brochure, updated 2023

Tanzania: Regional profiles of cashew nut production and processing investment opportunities

Cashew nuts are grown in the Southern parts of Tanzania, on the opposite side of the border of the cashew-growing region of Mozambique. Cashew nuts originate from Brazil; Portuguese traders brought the seeds to Africa in the 16th century. The trees soon found their way to Mtwara region; an Indian Ocean port on trade routes once plied by David Livingstone. Tanzania is now the World’s 3rd largest producer of cashews and maybe the world’s most important, with production growing 450% (data collected from 2004 – 2018)...

Guideline for sampling and testing for aflatoxin

Guideline for Sampling and Testing for Aflatoxin is a user guide created by the Eastern Africa Grain Council in partnership with the USAID Hub. This guide will assist farmers, traders, processors and certified graders to understand and apply the correct procedure in determination of aflatoxins in grains. It aims at ensuring that farmers, traders, grain handlers, and processors meet the maximum aflatoxin levels, reduce post-harvest wastage and provide safe, appropriate and quality grain to consumers. The guide is useful to anyone working on grain quality analysis as it outlines the procedures for sample preparation, and can be adapted to train graders or grain inspectors on determination of aflatoxins before grading of grain.

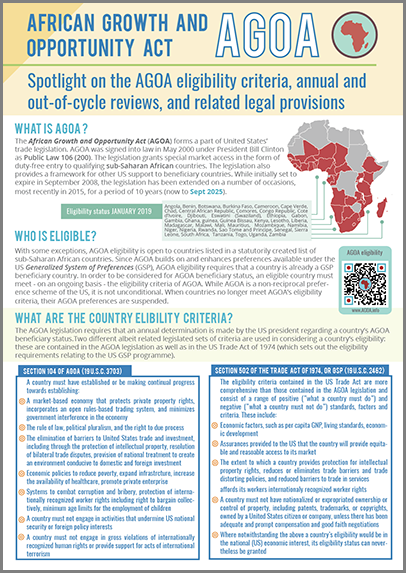

AGOA legal, eligibility and review provisions

An overview of AGOA's legal provisions including the eligibility criteria, annual reviews, out-of-cycle review provisions, procedures, and current eligibility status for AGOA and related textile provisions. Double-sided brochure

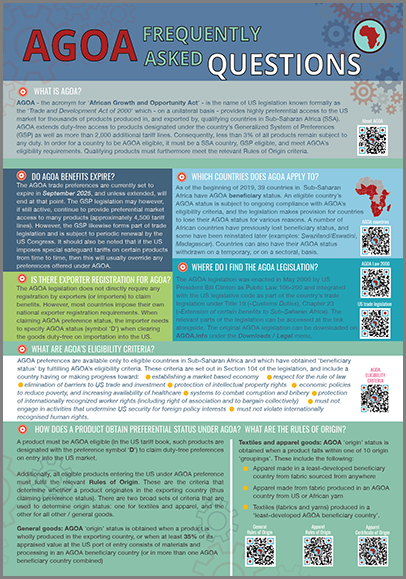

AGOA - Frequently Asked Questions FAQ brochure

AGOA.info brochure that addresses various AGOA related questions, such as What is AGOA? Do AGOA benefits expire? Which countries does AGOA apply to? What about exporter registration? Where do I find the AGOA legislation? What are the AGOA eligibility criteria? How does a product obtain preferential origin status under AGOA? What benefits are offered under AGOA? What is the AGOA Forum? How do I know whether my product qualifies under AGOA? How can I obtain clarity on the preference status of my product prior to export to the US? Where do I obtain additional support relating to AGOA? Double-sided brochure.

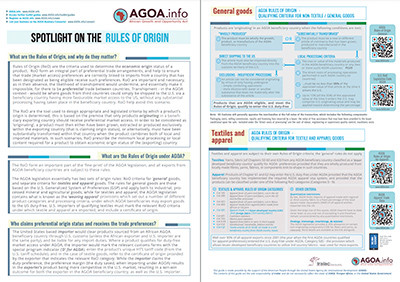

AGOA Rules of Origin [Updated 2023]

What are the AGOA Rules of Origin and why do they matter? Who claims origin status and who receives benefits? What are the provisions for general goods and for textiles/apparel? Double-sided brochure

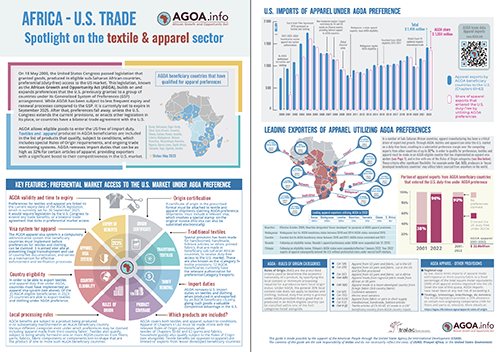

AGOA sector focus - Spotlight on textiles and trade under AGOA [Updated 2023]

An overview of key features of exports of textiles and apparel products to the US by AGOA beneficiaries, including the relevant rules of origin provisions. Double-sided A4 brochure. For optimised printing, set 'fit to page'. Includes trade data to end 2022