AGOA's General Rules of Origin

Rules of Origin (RoO) are the requirements which set out the working and processing that must be undertaken locally in order for a product to be considered the “economic origin” of the exporting country.

This distinction becomes necessary and important where some of the materials used in the production or manufacture of a good are imported from other countries.

The purpose of RoO is to prevent trade deflection and transhipment, whereby goods made elsewhere are merely routed through a beneficiary country (of trade preferences) with no or insufficient local value-adding activities having taken place.

Without RoO, trade preferences would be exploited and severely undermined by non-beneficiary countries. The stringency of the relevant RoO impacts on the ability of producers and exporters to meet their requirements and can have a significant impact on trade.

Generally, preferential RoO are based on the principle that a good must be “wholly produced” in the beneficiary country, or where imported materials are used, that these be substantially transformed locally in order for (local) origin to be conferred on them. Different tests are available to help in the determination of origin, some of which apply to AGOA (more later): these include a tariff heading jump (whereby the final product is classified under the HS coding nomenclature under a different heading to its non-originating imported materials), a percentage test (whereby a certain percentage or weight threshold must be met, usually expressed as a minimum threshold of local content), or a technical requirement (whereby specific technical or processing conditions must be met, as defined).

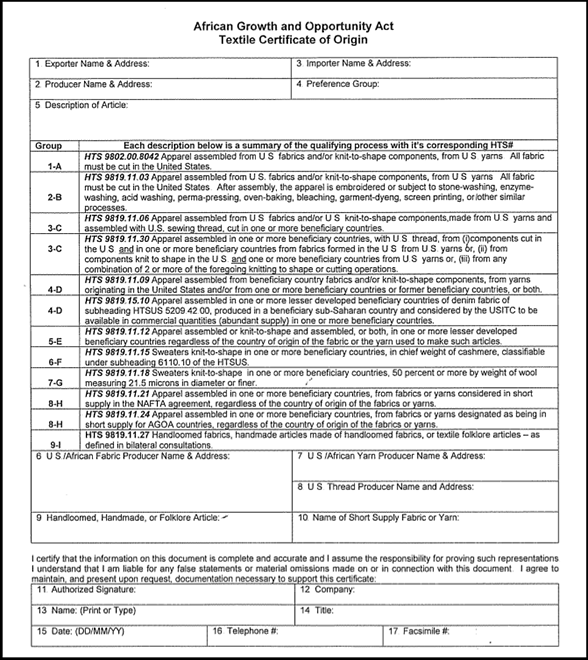

AGOA RoO are based on a percentage methodology, where local content must exceed a certain threshold (details below). Special rules are applicable to the apparel sector. As a general requirement, AGOA requires that goods, which are listed as eligible for AGOA preferences, must be the "growth, product or manufacture" of an AGOA-beneficiary Sub-Saharan African (SSA) country. They become the "growth, product or manufacture" of the AGOA beneficiary by meeting the local content threshold (via the percentage test).

The salient features of AGOA's general (non-textiles and apparel) Rules of Origin are as follows:

- The product must be imported directly from the AGOA-beneficiary country into the United States;

- Items must be "growth, product or manufacture" of one or more AGOA-beneficiary countries (these requirements can be met jointly by more than one AGOA beneficiary - this concept is called ‘cumulation of origin’);

- Products may incorporate materials sourced from outside countries (i.e. non AGOA-beneficiaries) provided that the sum of the direct cost or value of the materials produced in one or more designated AGOA-beneficiary countrie(s), plus the "direct costs of processing" undertaken in the AGOA-beneficiary countrie(s), equal at least 35% of the product's appraised value at the US port of entry (See Note below);

- Cost of local materials + direct cost of processing must >= 35%

- In addition, a total of up to 15% of the 35% local content value (as appraised at the US port of entry) may consist of US-originating parts and materials. This concept is called “bilateral cumulation of origin”).

Insufficient processing / simple operations

Notwithstanding meeting the 35% local content rule, it is important that the local processing represents a substantial process. The following "simple processing" criteria are considered insufficient as a benchmark for obtaining local economic origin, meaning that the local processing must go beyond the list of activities listed below:

- simple combining or packaging operations, or

- mere dilution with water or mere dilution with another substance that does not materially alter the characteristics of the article

*Note:

The US Customs will generally appraise the merchandise at the full value of the transaction, which includes the following components:

- Packaging costs, selling commission, royalty and licensing fees incurred by a buyer, and the value of free assistance that may have been provided to the buyer conditional upon the sale.

- Included under the "direct costs of processing" are the cost of labour, engineering or supervisory quality control, machinery costs (and depreciation of machinery and equipment), as well as Research and Development costs (R&D).

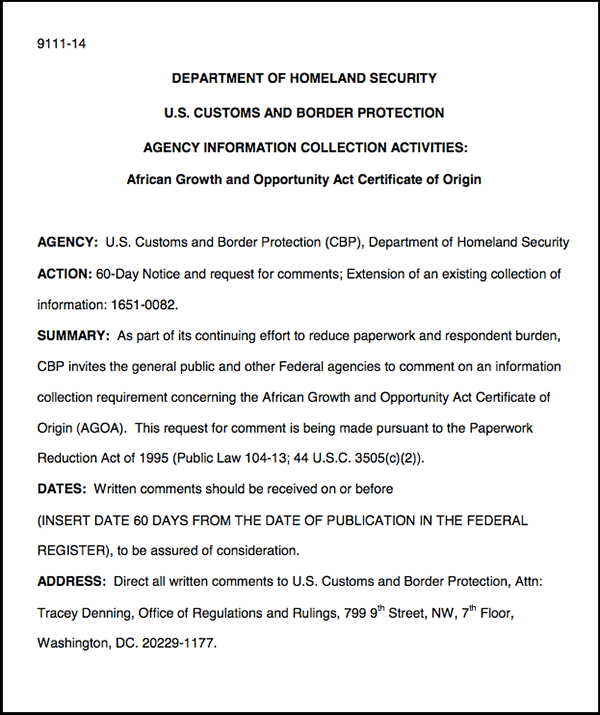

Legislation and Implementing Regulations governing US Rules of Origin:

- General Note 16 to HTSUS (19 U.S.C. § 1202)

- 19 U.S.C. § 3701

- 19 CFR §§ 10.178a,10.211