AGOA Quotas

Import quotas control the amount or volume of various commodities that can be imported into the United States during a specified period of time.

AGOA removes United States import duties on eligible goods shipped from a qualifying Sub-Saharan African AGOA beneficiary country, subject to the product being the growth or manufacture of the beneficiary country (i.e. meet the rules of origin for apparel or general goods). This allows US buyers of qualifying goods to import these goods without having to pay standard US import duties (tariffs).

However, AGOA does not remove possible quantitative restrictions (quotas) on imports into the United States.

Quotas are administered by the US Customs and Border Protection Agency (CBP).

CBP's duties are to administer, enforce, and monitor these restrictions.

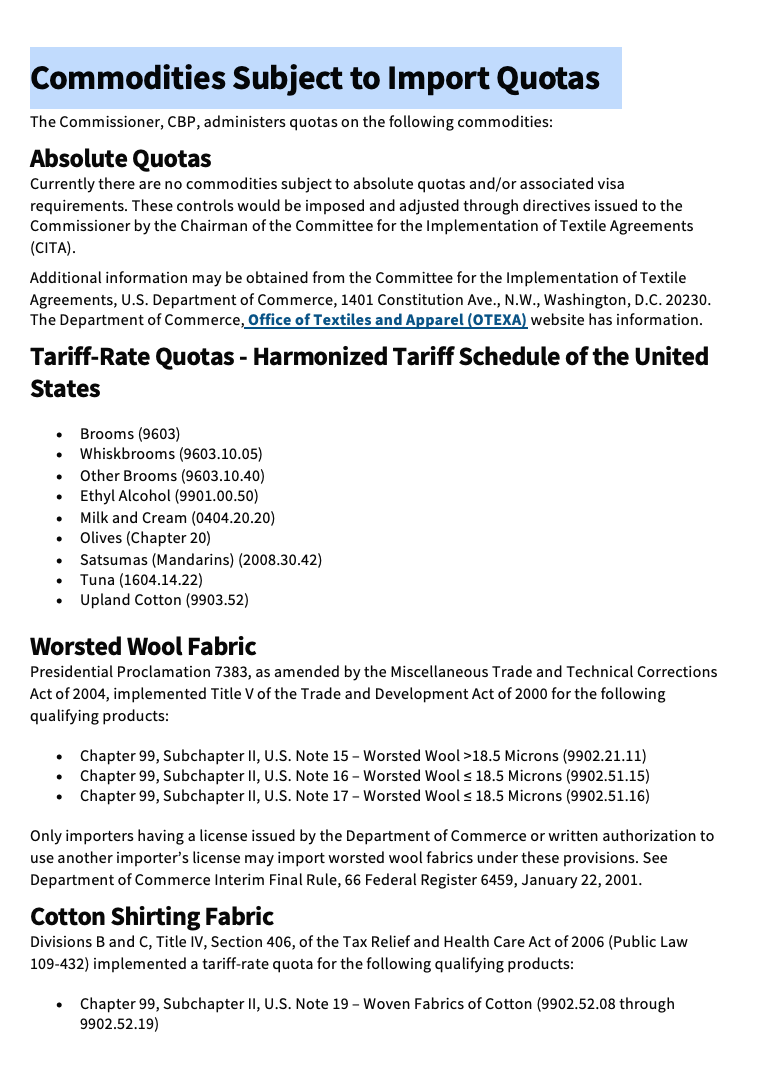

There are potentially three types of import quotas that are administered by the CBP, and described in further detail below. These are (1) Absolute quotas, (2) tariff-rate quotas (TRQs), as well as (3) tariff preference levels (TPLs).

Absolute quotas

An absolute quota restricts the quantity of specific goods from entering the United States. Once the quantity permissible under the quota has been reached, no further entries or withdrawals for consumption of such goods subject to that quota are permitted , until the next quota period is opened. Goods subject to such quotas may not enter US commerce and must be warehoused, re-exported or destroyed once the quota level for the relevant period has been attained.

Tariff-rate quotas (TRQ)

These allow a specific quantity of goods to be entered or withdrawn from warehouse for consumption at a reduced (or zero) duty rate throughout a specific period, until the quota level has been achieved. After that, goods may still be imported into the US but are subject to standard US import duties as specified by the US tariff schedule. An example of a TRQ involves 'peanut butter and paste' which is subject to four TRQs: One for 'Canada' (=>14,500 tons), 'Argentina' (=>3,650 tons), countries 'listed in U.S. Note 6 of Chapter 20' of the tariff schedule (most other countries - referred to in the quota bulletin as "20 AUSN 6 Countries") (=>1,600 tons), and 'other countries or areas' (=>250 tons).

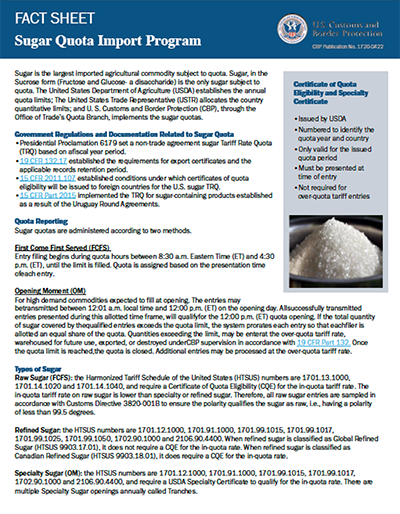

Current examples of products subject to TRQs include cocoa powder, cotton, dairy products, tobacco, peanut butter and paste, peanuts, sugars, animal feed, and products containing over 10% by dry weight of sugar.

Tariff Preference Levels (TPL)

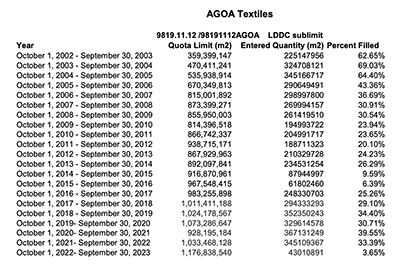

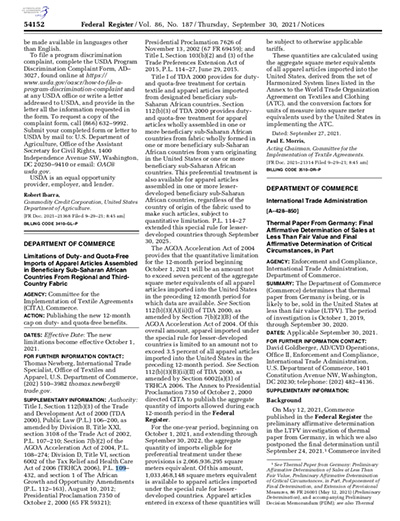

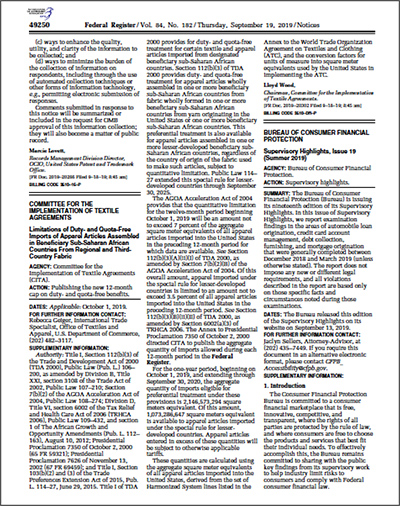

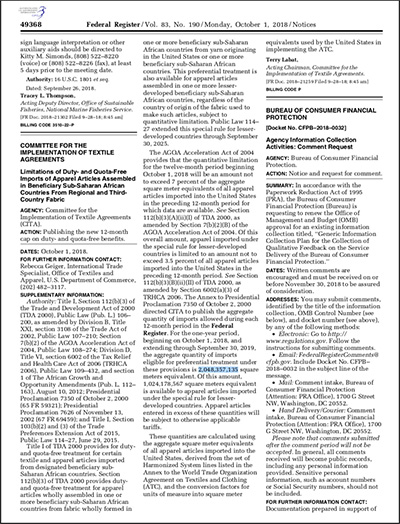

These are sometimes established by trade agreements or trade-related legislation; they are similar to TRQs in that any quantities that are imported into the US in excess of the specified tariff preference level are subject to standard US import tariffs and other restrictions that may be in place. An example of such a TPL is the system in place under AGOA that limits the quantity of apparel that is imported into the US under AGOA's duty-free preference (the TPL is re-adjusted annually based on total US imports of apparel, and has never been fully utilized, and has therefore not been a restriction on traders trading under AGOA).

First come, first served

It is important to note that quotas are typically allocated on a first-come-first-served basis and cannot be reserved. The date and time of presentation to the CBP determines the quota processing order. The date and time is established based on the latest of the following three factors: (1) Date of arrival, (2) date of payment, and (3) date of Entry Summary Submission that is error free.

If a US importer has not yet taken possession of goods subject to a higher duty because the quota has already been filled, and elects not to pay the higher duty, the goods may be entered into a foreign trade zone or bonded warehouse until the opening of the next quota period, and then re-entered with revised documentation (as needed). The goods may also be re-exported or be destroyed under CBP supervision.

Various CBP resources are available that allow traders to obtain more information on US quotas and their administration, and to check quota fill rates (utilization rates).

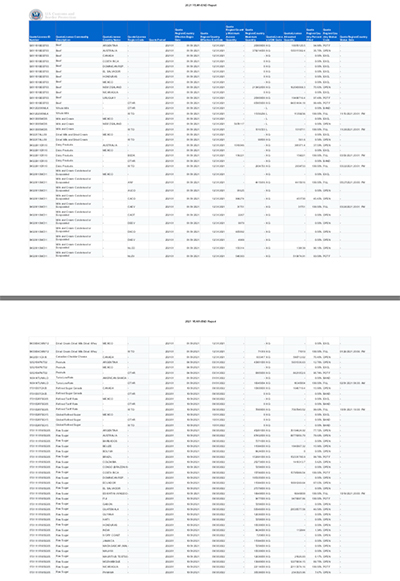

Commodities subject to quota: Resource listing commodities that are subject to administration by the CBP. This (currently) includes numerous general TRQs as well as TPL quotas linked to textiles and apparel trade under AGOA.

Quota bulletins: Quota information is issued for the trade community by the Quota and Agriculture Branch within the CBP Office of Trade. It provides specific quota-related information for various agricultural products. See example of peanut butter and paste.

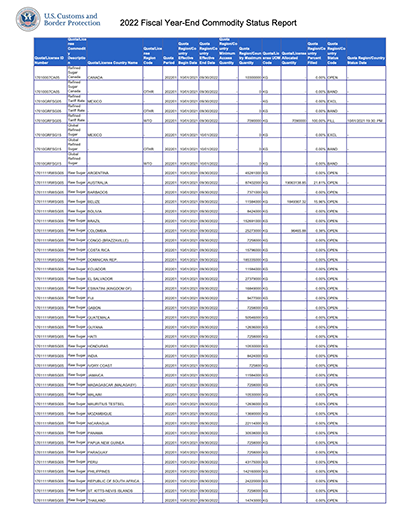

Commodity Status Reports: Drop-down lists with current and year-end commodity status reports, as well as current and historic tariff preference levels fill list. These listings are designed to allow one to track a quota as it is in the process of filling, as well as giving the date and time of quotas that have already been filled.

Quota FAQs: CBP section with detailed FAQs relating to its administration of US import quotas.