AGOA Apparel Rules of Origin

Rules of Origin (RoO) are the requirements which set out the working and processing that must be undertaken locally in order for a product to be considered the “economic origin” of the exporting country.

This distinction becomes necessary and important where some of the materials used in the production or manufacture of a good are imported from other countries.

The purpose of RoO is to prevent trade deflection and transhipment, whereby goods made elsewhere are merely routed through a beneficiary country (of trade preferences) with no or insufficient local value-adding activities having taken place. Without RoO, trade preferences would be exploited and severely undermined by non-beneficiary countries. The stringency of the relevant RoO impacts on the ability of producers and exporters to meet their requirements and can have a significant impact on trade.

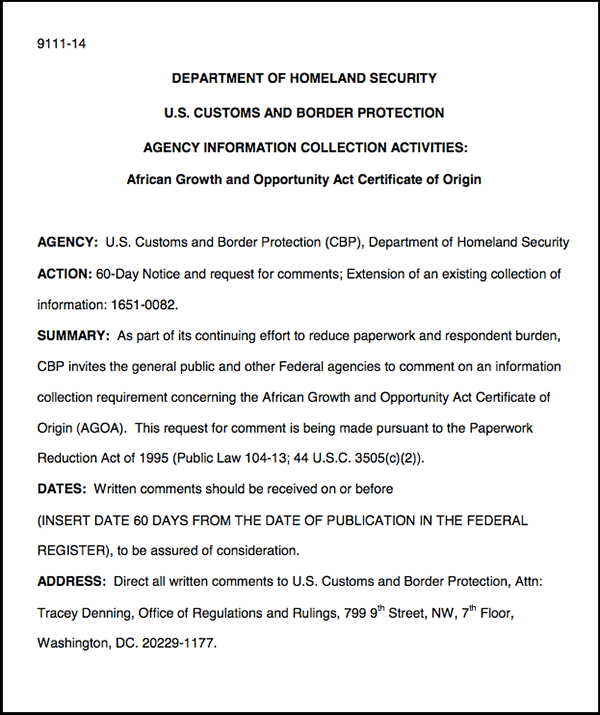

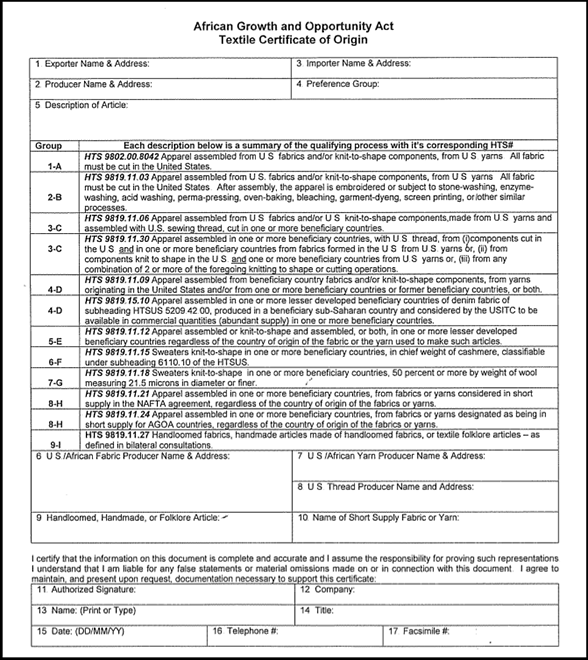

While apparel and textiles articles are not included under the General System of Preferences (GSP) program, on which AGOA is based, AGOA nevertheless provides qualifying countries with duty-free market access for these items, provided adherence with the RoO and general administrative requirements including the textiles certificate of origin.

Main features of AGOA's 'wearing apparel' provisions:

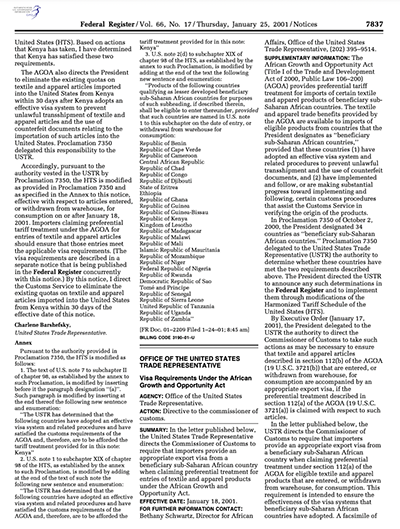

- Countries from AGOA-eligible Sub-Saharan African countries wanting to export apparel duty-free into the United States under AGOA must first be certified as having complied for the 'Wearing Apparel' provisions” (follow link to Country Eligibility in the About AGOA menu). This entails having taken adequate steps to "establish effective product visa systems to prevent illegal transshipment and the use of counterfeit documentation, as well as having instituted required enforcement and verification procedures".

- Apparel made in qualifying Sub-Saharan African countries from U.S. fabric, yarn, and thread is provided with duty-free and quota-free access to the U.S. market without limitations. Such apparel may also have been "embroidered or subject to stone-washing, enzyme-washing...screen-printing or other similar processes" (see page 9 of original AGOA legislation)

- Apparel made in qualifying Sub-Saharan African countries from domestically produced fabric and yarns, or from fabrics and yarns produced in AGOA-beneficiary countries in Sub-Saharan Africa, qualifies for preferences. Such market access into the U.S. is subject to a quantitative restriction (currently 3.5% of overall garment imports by the United States from all sources). To date, this cap has not been an effective quote as aggregate AGOA apparel exports were significantly below the threshold. The cap is measured in Square Meter Equivalents (SMEs), and has no dollar equivalent. Rather, it is based on the aggregate SMEs of all apparel articles imported into the US in the preceeding 12-month period for which data is available.

- Apparel otherwise eligible for preferential treatment under AGOA shall not be ineligible for the duty-free benefits simply because the article contains certain interlinings of foreign origin, as long as the value of such interlinings (and any findings and trimmings) does not exceed 25 percent of the cost of the components of the assembled apparel article.

- "De Minimis Rule" (see the AGOA Legislation, page 13): Apparel otherwise eligible for preferential treatment under AGOA shall not be ineligible for such treatment simply because the article contains fibers or yarns not wholly formed in the U.S. or in one or more AGOA-beneficiary SSA countries if the total weight of all such fibers and yarns is not more than 10 percent of the total weight of the article.

- A special rule for 'Lesser Developed Countries' (LDCs, classified as such by their GNP per capita being less than $ 1,500 in 1998 as measured by the World Bank), which initially allowed such countries duty-free access for apparel made from non-originating fabric for a 4-year period until September 30, 2004 (see pages 9-10 in AGOA Act under Downloads). AGOA III extended this provision by a further three years to September 2007, and AGOA IV to 2012. This was extended in September 2012 to the end of 2015. Some countries, like South Africa, Gabon and the Seychelles are not designated as LDCs and therefore do not benefit from this waiver from normal rules of origin.

- Manufacturers of apparel wishing to export duty-free to the U.S. under AGOA are required to "maintain complete records of the production and the export of covered articles,including materials used in the production, for at least 2 years after the production or export" (see AGOA Legislation, page 14 in Downloads/Legal section). For this purpose, manufacturers are required to draw up and sign a "Certificate of Origin", a sample of which can be accessed in the Downloads/General section.

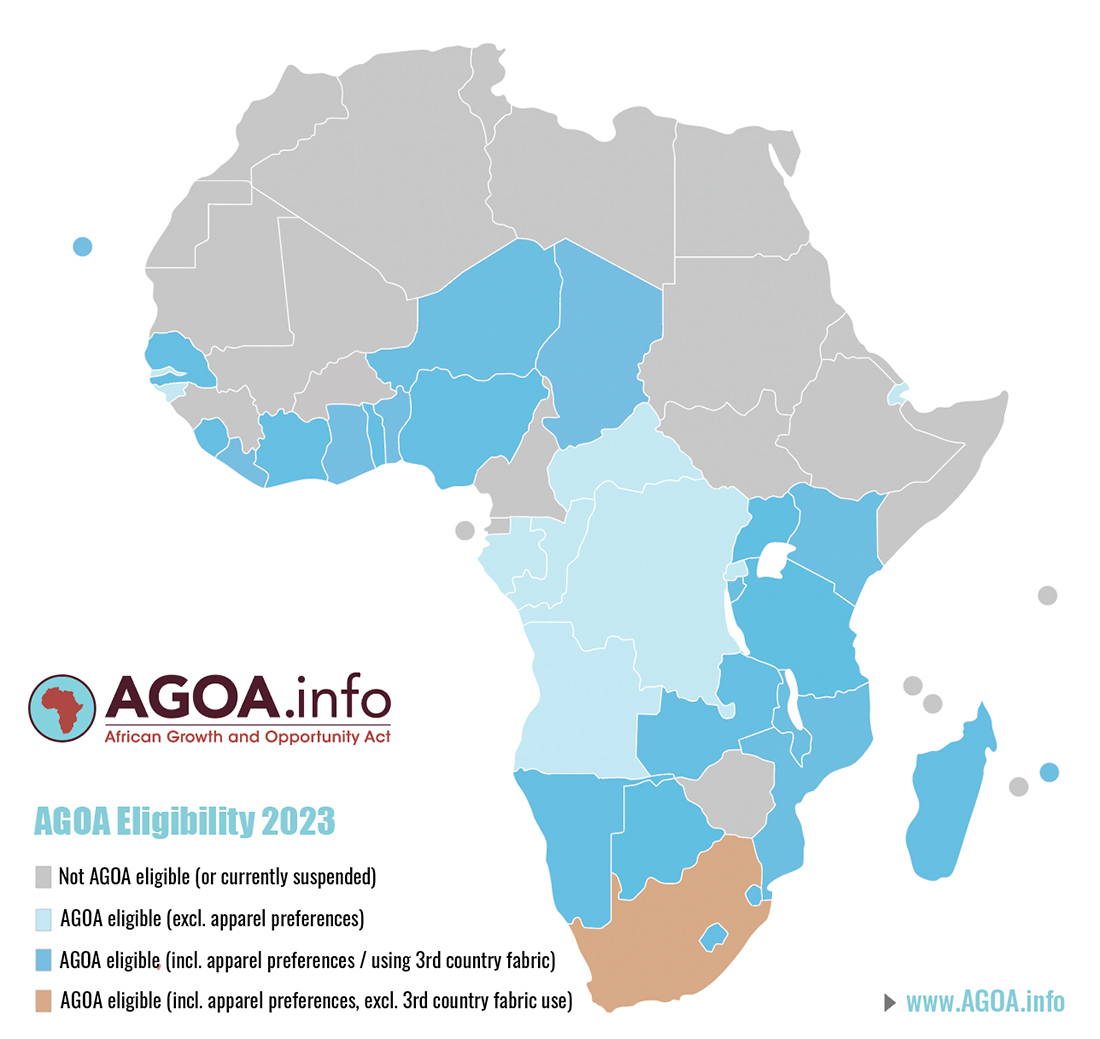

Country Eligibility (Wearing apparel provisions)

Textile preferences:

Relevant Definitions:

- "Wholly formed" – when used with reference to yarns or thread, means that all of the production processes, starting with the extrusion of filament or the spinning of all fibers into yarn or both and ending with a yarn or plied yarn, took place in a single country, and when used with reference to fabrics, means that all of the production processes, starting with polymers, fibers, filaments, textile strips, yarns, twine, cordage, rope, or strips of fabric and ending with a fabric by a weaving, knitting, needling, tufting, felting, entangling or other process, took place in a single country.

- "Knit to shape" – applies to any apparel article of which 50 percent or more of the exterior surface area is formed by major parts that have been knitted or crocheted directly to the shape used in the apparel article, with no consideration being given to patch pockets, appliques, or the like. Minor cutting, trimming, or sewing of those major parts will not effect the determination of whether an apparel article is “knit-to-shape”.

- The use of non AGOA-originating collars, cuffs, drawstrings, padding / shoulder pads, waistbands, belts attached to garments, straps with elastic and elbow patches is permitted without compromising the AGOA-status of the garment. This is an amendment under the so-called "AGOA III" amendments.

- "Findings And Trimmings General Rule": An article otherwise eligible for preferential treatment shall not be ineligible for such treatment because the article contains findings or trimmings of foreign origin, if the value of such findings and trimmings does not exceed 25 percent of the cost of the components of the assembled article. Examples of findings and trimmings are sewing thread (except if the thread is under 9819.11.06), hooks and eyes, snaps, buttons, `bow buds', decorative lace trim, elastic strips, and zippers, including zipper tapes, and labels. Elastic strips are considered findings or trimmings only if they are each less than 1 inch in width and used in the production of brassieres.

- "Certain Interlinings General Rule": An article otherwise eligible for preferential treatment shall not be ineligible for such treatment because the article contains certain interlinings of foreign origin, if the value of such interlinings (and any findings and trimmings) does not exceed 25 percent of the cost of the components of the assembled article. Interlinings eligible for the treatment described above include only a chest type plate, a `hymo' piece, or `sleeve header', of woven or weft-inserted warp knit construction and of coarse animal hair or man-made filaments.

- "De Minimis Rule": An article otherwise eligible for preferential treatment shall not be ineligible for such treatment because the article contains fibers or yarns not wholly formed in the United States or one or more beneficiary Sub-Saharan African countries if the total weight of all such fibers and yarns is not more than 10 percent (increased under AGOA III from 7 percent) of the total weight of the article.

Summary of Rules of Origin categories for apparel under AGOA

- Apparel of US yarns and fabric & knit to shape components, with fabrics cut in US (Cat 1-A)

-

Apparel of US yarns and fabric, or knit to shape components, with fabrics cut in US & subjected to further working e.g. embroidery, stonewashing, acid washing, perma-pressing, oven-baking, bleaching, garment dyeing, screen printing etc. (Cat 2-B)

-

Apparel of US yarns and fabric or US knit to shape components, and/or US and beneficiary knit to shape components, from US yarns and thread, fabric cut in US or beneficiary countries (Cat 3-C) [applies to AGOA LDC beneficiaries that have obtained wearing apparel clearance]

-

Apparel assembled from beneficiary country fabrics or Knit to shape components, from US or beneficiary SSA yarns ( Cat. 4-D) [applies to South Africa]

-

Apparel assembled or knit to shape & assembled, or both, in one or more beneficiary Lesser DC, regardless of country of origin or fabric or yarn (aka 3rd country fabric) used to make such articles (Cat 5-E)

-

Knit to shape sweaters in chief weight cashmere (Cat 6-F)

-

Knit to shape sweaters >50% by weight of wool measuring 21.5 microns in diameter or finer (Merino wool) (Cat 7-G)

-

Apparel made of yarns and fabrics not produced in commercial quantities in US (Cat 8-H)

-

Eligible hand-loomed, handmade, folklore articles and ethnic printed fabrics - as defined in bilateral consultations (Cat 9)

-

Textile or textile articles originating entirely in one or more lesser developed beneficiary country (Cat 0). This covers fibres, yarn, fabric, made up goods such as towels, blankets, sheets, floor coverings etc.

-

Quotas apply on imports of regional or third country fabric apparel <7% of apparel imported into US in prior year; of which the 3rd country fabric applicable to SSA (LDC countries' limit is <3.5 % of all apparel imported into US)

-

Findings and trimmings (hooks and eyes, snaps, sewing threads, elastic strips, decorative lace trims and zippers) of foreign origin 25% of value of assembled components

-

Certain components – use of non AGOA produced collars, cuffs, drawstrings, padding, shoulder pads, waist bands, belts attached to garments, straps with elastic, elbow patches, allowed.

| Country | CoO Issuing Authority | Location | Web Link |

| Benin | Chamber of Commerce, Industry and Handicrafts of Benin |

Rue du Commerce, Cotonou, Benin |

Phone: +229 21 31 10 18 Email: This email address is being protected from spambots. You need JavaScript enabled to view it.; This email address is being protected from spambots. You need JavaScript enabled to view it.; This email address is being protected from spambots. You need JavaScript enabled to view it. Website: http://www.ccibenin.org/ |

| Botswana | Botswana Export Development and Investment Authority | Plot 54351, CBD, Gaborone, Botswana Postal Address: Private Bag 00445, Gaborone, Botswana |

Phone: +267 36 31000 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.bedia.co.bw |

| Cabo Verde | Cabo Verde Chamber of Commerce, Industry and Services of Sotavento | Avenida Cidade Lisboa - CP 102, Praia, Cabo Verde |

Phone: +238 260 44 00 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Chad | Chadian Chamber of Commerce, Industry, Mines and Crafts | Avenue Mobutu, BP 1507, N'Djamena, Chad |

Phone: +235 22 52 01 89 / +235 22 52 12 27 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.cci-tchad.td |

| Côte d Ivoire | Ivorian Chamber of Commerce and Industry |

Avenue Noguès, Plateau, Abidjan, Côte d'Ivoire |

Phone: +225 20 31 46 46 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.cci.ci |

| Eswatini | Eswatini Investment Promotion Authority | 1st Floor, Nkonyeni House, Lot 1955, Corner Gwamile; Mdada Streets, Mbabane, Eswatini |

Phone: +268 2404 5344 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.investeswatini.org.sz |

| Ghana | Ghana Export Promotion Authority | Starlets 91 Road, Opposite Accra Sports Stadium, P.O. Box M96, Accra, Ghana |

Phone: +233 302 669 331-7 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.gepaghana.org |

| Kenya | Kenya Revenue Authority, Rule of Origin Dpt. (Customs) | Nairobi, Times Tower, Haile Sellasie Avenue | Website: http://infotradekenya.go.ke/procedure/453/65?l=en |

| Lesotho | Lesotho Revenue Authority | LRA Headquarters, Kingsway Road, P.O. Box 64, Maseru 100, Lesotho |

Phone: +266 22 313 166 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.lra.org.ls |

| Liberia | Liberia Chamber of Commerce | 36 Carey Street, P.O. Box 775, Monrovia, Liberia |

Phone: +231 77 986 8989 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.liberiachamber.org |

| Madagascar | Industry, Handicrafts and Agriculture of Antananarivo Chamber of Commerce | Chamber of Commerce,  Lot II R 3 Ambatobe, Antananarivo, Madagascar |

Phone: +261 20 22 340 66 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. Website: www.cciaa-antananarivo.com |

| Malawi | Malawi Confederation of Chambers of Commerce and Industry | 61 Masauko Chipembere Highway Chichiri Trade Fair Ground; Central Region Office, Plaza House, City Center, Lilongwe, Malawi |

Phone: +265 1 830 955 / +265 1 830 950 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. website: www.mccci.org |

| Mauritius | Mauritius Export Association | 4th Floor, Unicorn House 5 Royal Street, Port Louis | Certificates of Origin - Mauritius Chamber of Commerce and Industry, MCCI |

| Mozambique | Regional Directorate of Customs |

South HQ: Rua Consiglier Pedroso, no 130 – Maputo Central HQ: Praça dos Trabalhadores – Edifício dos CFM - 1o andar – Beira North HQ: Rua do Porto, no 30 – Nacala |

South HQ: +258 21 32 41 43

Central HQ: +258 23 32 41 65

North HQ: +258 26 52 65 11 |

| Namibia | Namibia Chamber of Commerce And Industry | Southport Building 13A First floor, Hosea Kutako Dr. Southern Industrial area, Windhoek, Namibia | Trade and Investment (Website ncci.org.na) |

| Niger | Chamber of Commerce, Industry and Crafts of Niger | BP 12100, Niamey, Niger |

Phone: +227 20 73 31 74 / +227 20 73 31 75 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Nigeria | Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture |

8A, Oba Akinjobi Way, Ikeja GRA, Lagos. Plot 701B, Central Business District, Abuja. |

Website: www.naccimaecertify.com |

| Senegal | Chamber of Commerce, Industry and Agriculture of Dakar | Avenue Albert Sarraut, BP 24 224, Dakar, Senegal |

Phone: +221 33 849 77 00 / +221 33 849 77 07 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Sierra Leone | Sierra Leone Chamber of Commerce, Industry and Agriculture | 1 Bathurst Street, P.O. Box 59, Freetown, Sierra Leone |

Phone: +232 80 102030 Email: This email address is being protected from spambots. You need JavaScript enabled to view it. |

| South Africa | South African Revenue Services | Multiple offices across the country | Website: www.sars.gov.za |

| Tanzania | Tanzania Chamber of Commerce, Industry and Agriculture |

Tanzania Chamber of Commerce, Industry & Agriculture PPF HOUSE, Morogoro road/ Samora Avenue

|

Website: http://www.tccia.com/ |

| Togo | Togolese Chamber of Commerce and Industry |

Angle Avenue de la Présidence - Avenue Georges Pompidou BP 360 Lomé

|

Website: http://www.ccit.tg/ |

| Uganda | Uganda Revenue Authority |

URA towers, Meza Nine floor, Nakawa, Kampala

|

Website: www.ura.go.ug |

| Zambia | Customs International and Policy Office Assistant Commissioner Customs Services Office | Lusaka & Ndola | Website: www.zra.org.zm |

![AGOA sector focus - Spotlight on textiles and trade under AGOA [Updated 2023]](https://agoa.info/images/articles/15550/agoatextileapparelsectorguide.png)