Sector Data: Automotive Chapter 87

Note:

Activate / deactivate individual data series by clicking on the series name at the bottom of the chart

Automotive sector exports (Ch87), by AGOA beneficiary, disaggregated by program

Chapter 87 automotive sector goods, by country, by program, $ million values, 2000-2023 YTD

Automotive sector exports (Ch87), by AGOA beneficiary, disaggregated by program

Chapter 87 automotive sector goods, by country, by program, $ million values, 2000-2023 YTD

** On mobile & Desktop if the table is too wide, please use the scroll left and right to view the data off screen.

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2022 YTD to NOVEMBER | 2023 YTD to NOVEMBER | 2022-2023 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total: | 150.51 | 359.48 | 573.24 | 776.81 | 591.85 | 287.48 | 475.65 | 577.39 | 1,927.82 | 1,444.09 | 1,623.72 | 2,142.37 | 2,015.14 | 2,195.28 | 1,379.36 | 1,451.72 | 1,581.67 | 1,261.21 | 618.91 | 408.18 | 592.54 | 865.32 | 1,561.70 | 1,377.99 | 1,772.14 | 28.60% | |

| AGOA (excluding GSP) | South Africa | 241.17 | 483.19 | 634.23 | 422.03 | 138.07 | 354.54 | 467.43 | 1,821.19 | 1,369.04 | 1,553.06 | 2,023.25 | 1,925.22 | 2,120.78 | 1,307.03 | 1,357.91 | 1,504.15 | 1,188.40 | 544.74 | 344.25 | 551.63 | 799.66 | 1,504.66 | 1,326.22 | 1,675.63 | 26.35% | |

| AGOA (excluding GSP) | Nigeria | 0.03 | N/A | ||||||||||||||||||||||||

| AGOA (excluding GSP) | Ghana | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.06 | 0.02 | N/A | |||||||||||||

| AGOA (excluding GSP) | Namibia | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | N/A | ||||||||||||||

| GSP (excluding GSP for LDBC only) | South Africa | 67.1 | 47.75 | 42.98 | 72.84 | 85.77 | 72.6 | 68.67 | 64.3 | 46.84 | 39.16 | 42.37 | 36.6 | 44.93 | 39.85 | 46.93 | 38.89 | 48.53 | 30.23 | 27.4 | 17.25 | 15.15 | 18.77 | 20.96 | 19.5 | 13.95 | -28.45% |

| GSP (excluding GSP for LDBC only) | Ghana | 0.01 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Kenya | 0.02 | 0.01 | 0.09 | 0.01 | 0.09 | 0.02 | N/A | |||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Mauritius | 0.05 | 0.01 | 0.04 | N/A | ||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Namibia | 0.01 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Nigeria | 0.2 | 0.01 | N/A | |||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Sierra Leone | 0.04 | 0.02 | N/A | |||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Tanzania | 0.02 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Zambia | 0.01 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Madagascar | N/A | |||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Angola | 0.01 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Congo-Brazza | N/A | |||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Cote d`Ivoire | 0.02 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | Gabon | 0.01 | N/A | ||||||||||||||||||||||||

| GSP for LDBC countries only | Sierra Leone | N/A | |||||||||||||||||||||||||

| No program claimed | South Africa | 83.18 | 70.09 | 46.71 | 69.13 | 83.77 | 76.39 | 49.25 | 44.12 | 59.47 | 35.55 | 26.67 | 80.73 | 43.43 | 33.1 | 23.96 | 53.71 | 28.02 | 39.34 | 45.15 | 44.51 | 23.96 | 44.69 | 32.41 | 29.59 | 79.34 | 168% |

| No program claimed | Mozambique | 0.06 | 0.09 | 0.03 | 0.07 | 0.01 | 0.01 | 0.01 | 0.28 | 0.07 | 0.05 | 0.7 | 1244.54% | ||||||||||||||

| No program claimed | Senegal | 0.01 | 0.03 | 0.03 | 0.03 | 0.03 | 0.11 | 0.34 | 0.47 | 0.49 | 0.54 | 0.87 | 0.81 | 0.7 | -13% | ||||||||||||

| No program claimed | Zambia | 0.08 | 0.08 | 0.41 | 0.37 | 0.33 | -11.50% | ||||||||||||||||||||

| No program claimed | Mauritius | 0.01 | 0.26 | 0.01 | 0.1 | 0.08 | 0.44 | 1.23 | 0.9 | 0.26 | 0.4 | 0.35 | 0.12 | 0.13 | 0.07 | 0.39 | 0.03 | 0.03 | 0.32 | 955.87% | |||||||

| No program claimed | Namibia | 0.01 | 1.1 | 0.11 | 0.01 | 0.07 | 0.09 | 1.43 | 0.14 | 0.23 | 0.13 | 0.16 | 0.53 | 0.53 | 0.23 | -57.14% | |||||||||||

| No program claimed | Sierra Leone | 0.04 | 0.12 | 0.03 | 0.05 | 0.02 | 0.08 | 0.05 | 0.08 | 0.09 | 0.05 | 0.08 | 0.06 | 0.09 | 0.17 | 0.05 | 0.04 | 0.34 | 0.38 | 0.13 | 0.26 | 0.11 | 0.1 | 0.2 | 93.02% | ||

| No program claimed | Botswana | 0.52 | 0.01 | 0.1 | 0.08 | 0.08 | 0.18 | 123.82% | |||||||||||||||||||

| No program claimed | Ghana | 0.09 | 0.25 | 0.04 | 0.03 | 0.02 | 0.01 | 0.03 | 0.15 | 0.01 | 0.54 | 0.25 | 0.17 | 0.16 | 0.11 | 0.19 | 0.18 | 0.15 | -17.58% | ||||||||

| No program claimed | Congo-Brazza | 0.04 | 0.04 | 0.04 | 0.02 | 0.01 | 0.01 | 0.08 | 1119.78% | ||||||||||||||||||

| No program claimed | Kenya | 0.07 | 0.06 | 0.02 | 0.03 | 0.05 | 0.25 | 2.24 | 0.87 | 0.02 | 0.06 | 0.21 | 0.25 | 0.05 | 0.02 | 0.06 | 0.05 | 0.04 | 0.04 | 0.04 | 0.06 | 54% | |||||

| No program claimed | Nigeria | 0.01 | 0.01 | 0.04 | 1.17 | 0.01 | 0.05 | 0.15 | 0.17 | 0.01 | 0.09 | 0.01 | 0.02 | 0.07 | 0.04 | 0.06 | 58.47% | ||||||||||

| No program claimed | Djibouti | 0.01 | 0.01 | 0.01 | 0.04 | N/A | |||||||||||||||||||||

| No program claimed | Gambia | 0.02 | 0.08 | 0.02 | 0.02 | 0.01 | 0.04 | N/A | |||||||||||||||||||

| No program claimed | Rwanda | 0.06 | 0.03 | N/A | |||||||||||||||||||||||

| No program claimed | Niger | 0.01 | 0.01 | 0.08 | 0.1 | 0.01 | 0.02 | 0.15 | 0.03 | 0.13 | 0.12 | 0.03 | 0.02 | 0.02 | 0.02 | -4.03% | |||||||||||

| No program claimed | Togo | 0.02 | N/A | ||||||||||||||||||||||||

| No program claimed | Gabon | 0.01 | 0.01 | 0.79 | 0.02 | 0.14 | 0.01 | 0.04 | 0.11 | 0.05 | 0.04 | 0.01 | -77.03% | ||||||||||||||

| No program claimed | Tanzania | 0.01 | 0.01 | 0.05 | 0.05 | 0.03 | 0.04 | 0.01 | 0.04 | 0.03 | 0.03 | 0.01 | N/A | ||||||||||||||

| No program claimed | Cen African Rep | 0.01 | 0.04 | 0.07 | 0.06 | 0.01 | 0.01 | 0.01 | -50.71% | ||||||||||||||||||

| No program claimed | Congo-Kinshasa | 0.01 | 0.01 | 0.01 | 0.25 | 0.01 | 0.01 | 0.12 | 0.04 | 0.12 | 0.38 | 0.02 | 0.02 | -82.15% | |||||||||||||

| No program claimed | Madagascar | 0.01 | 0.01 | 0.13 | 0.05 | 0.21 | 0.2 | 0.22 | 0.22 | -100% | |||||||||||||||||

| No program claimed | Chad | N/A | |||||||||||||||||||||||||

| No program claimed | Cote d`Ivoire | 0.02 | 0.01 | 0.01 | 0.02 | 0.01 | 0.08 | 0.01 | 0.79 | 0.01 | -100% | ||||||||||||||||

| No program claimed | Eswatini | 0.26 | 0.04 | 0.01 | 0.01 | 0.01 | 0.1 | 0.05 | 0.07 | 0.14 | 0.03 | 0.04 | 0.01 | 0.01 | -100% | ||||||||||||

| No program claimed | Guinea-Bissau | 0.03 | 0.01 | 0.01 | -100% | ||||||||||||||||||||||

| No program claimed | Lesotho | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | N/A | ||||||||||||||

| No program claimed | Liberia | 0.04 | 0.02 | 0.14 | 0.02 | N/A | |||||||||||||||||||||

| No program claimed | Cabo Verde | 0.02 | 0.02 | 0.16 | 0.11 | 0.02 | 0.01 | 0.02 | 0.01 | 0.03 | 0.03 | -100% | |||||||||||||||

| No program claimed | Malawi | 0.01 | 0.01 | 0.01 | -100% | ||||||||||||||||||||||

| No program claimed | Sao Tome & Prin | 0.05 | 0.01 | 0.14 | 0.01 | 0.01 | 0.02 | 0.05 | 0.05 | 0.01 | 0.01 | -100% | |||||||||||||||

| No program claimed | Benin | 0.02 | 0.01 | 0.01 | 0.01 | -100% | |||||||||||||||||||||

| No program claimed | Angola | 0.01 | N/A | ||||||||||||||||||||||||

| No program claimed | Uganda | 0.03 | 0.01 | 0.01 | 0.04 | 0.04 | -100% |

Source: USITC

South Africa's automotive (Ch 87) exports to USA, by HS4 heading and differentiated by propgram

$ million, full year data 2000 - 2023 YTD, by program

South Africa's automotive (Ch 87) exports to USA, by HS4 heading and differentiated by propgram

$ million, full year data 2000 - 2023 YTD, by program

** On mobile & Desktop if the table is too wide, please use the scroll left and right to view the data off screen.

| Program | Heading | Description | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2022 YTD to NOVEMBER | 2023 YTD to NOVEMBER | 2022-2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total: | 150.28 | 359.01 | 572.88 | 776.19 | 591.57 | 287.06 | 472.46 | 575.85 | 1,927.50 | 1,443.75 | 1,622.10 | 2,140.58 | 2,013.58 | 2,193.73 | 1,377.92 | 1,450.51 | 1,580.70 | 1,257.97 | 617.28 | 406.01 | 590.74 | 863.12 | 1,558.03 | 360.54 | 756.09 | 109.71% | ||

| AGOA (excluding GSP) | 8703 | MOTOR CARS AND OTHER MOTOR VEHICLES DESIGNED TO TRANSPORT PEOPLE (OTHER THAN PUBLIC-TRANSPORT TYPE), INCLUDING STATION WAGONS AND RACING CARS | 232.32 | 471.74 | 623.22 | 409.49 | 122.95 | 329.05 | 438.68 | 1,804.37 | 1,362.66 | 1,543.94 | 2,014.87 | 1,914.46 | 2,113.13 | 1,299.29 | 1,350.38 | 1,495.88 | 1,180.65 | 537.21 | 339.45 | 546.24 | 781.83 | 1,482.22 | 1,306.28 | 1,642.41 | 25.73% | |

| AGOA (excluding GSP) | 8708 | PARTS AND ACCESSORIES FOR TRACTORS, PUBLIC-TRANSPORT PASSENGER VEHICLES, MOTOR CARS, GOODS TRANSPORT MOTOR VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 3.17 | 4.03 | 2.43 | 3.88 | 3.7 | 14.09 | 15.75 | 9.52 | 2.93 | 6.13 | 5.46 | 6.02 | 5.09 | 4.44 | 2.71 | 1.45 | 3.41 | 3.89 | 2.07 | 1.62 | 13.13 | 14.61 | 13.14 | 23.76 | 80.79% | |

| AGOA (excluding GSP) | 8707 | BODIES (INCLUDING CABS), FOR TRACTORS, PUBLIC-TRANSPORT PASSENGER VEHICLES, MOTOR CARS, GOODS TRANSPORT VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 5.68 | 7.41 | 8.56 | 8.64 | 11.39 | 11.35 | 12.96 | 7.28 | 3.43 | 3 | 2.92 | 4.62 | 2.56 | 3.23 | 4.69 | 5.84 | 4.31 | 3.63 | 2.64 | 3.76 | 4.68 | 7.84 | 6.79 | 9.16 | 34.77% | |

| AGOA (excluding GSP) | 8704 | MOTOR VEHICLES FOR THE TRANSPORT OF GOODS | 0.11 | 0.93 | 0.23 | N/A | ||||||||||||||||||||||

| AGOA (excluding GSP) | 8714 | PARTS AND ACCESSORIES FOR MOTORCYCLES, BICYCLES AND OTHER CYCLES, INCLUDING PARTS AND ACCESSORIES FOR DELIVERY TRICYCLES AND INVALID CARRIAGES | 0.02 | 0.01 | 0.02 | 0.03 | 0.05 | 0.04 | 0.02 | 0.02 | 0.03 | 0.02 | 0.08 | 0.01 | 0.07 | N/A | ||||||||||||

| AGOA (excluding GSP) | 8706 | CHASSIS FITTED WITH ENGINES FOR TRACTORS, MOTOR VEHICLES FOR PASSENGERS, GOODS TRANSPORT VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 0.13 | 0.04 | 0.03 | 0.02 | N/A | |||||||||||||||||||||

| AGOA (excluding GSP) | 8712 | BICYCLES AND OTHER CYCLES (INCLUDING DELIVERY TRICYCLES), NOT MOTORIZED | N/A | |||||||||||||||||||||||||

| AGOA (excluding GSP) | 8716 | TRAILERS AND SEMI-TRAILERS; OTHER VEHICLES, NOT MECHANICALLY PROPELLED; AND PARTS THEREOF | 0.01 | N/A | ||||||||||||||||||||||||

| AGOA (excluding GSP) | 8702 | MOTOR VEHICLES FOR THE TRANSPORT OF TEN OR MORE PERSONS, INCLUDING THE DRIVER | 0.05 | N/A | ||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | 8708 | PARTS AND ACCESSORIES FOR TRACTORS, PUBLIC-TRANSPORT PASSENGER VEHICLES, MOTOR CARS, GOODS TRANSPORT MOTOR VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 61.81 | 42.04 | 38.12 | 68.73 | 82.67 | 66 | 62.12 | 56.25 | 41.1 | 34.89 | 37.97 | 33.85 | 42.97 | 38.43 | 43.88 | 33.65 | 41.88 | 28.08 | 27.38 | 17.24 | 15.13 | 18.77 | 20.96 | 19.5 | 13.95 | -28.45% |

| GSP (excluding GSP for LDBC only) | 8716 | TRAILERS AND SEMI-TRAILERS; OTHER VEHICLES, NOT MECHANICALLY PROPELLED; AND PARTS THEREOF | 5.29 | 5.71 | 4.84 | 4.08 | 3.09 | 6.47 | 6.47 | 7.96 | 5.67 | 4.21 | 4.35 | 2.72 | 1.96 | 1.41 | 3.05 | 5.24 | 6.62 | 2.16 | 0.01 | 0.01 | 0.02 | N/A | ||||

| GSP (excluding GSP for LDBC only) | 8703 | MOTOR CARS AND OTHER MOTOR VEHICLES DESIGNED TO TRANSPORT PEOPLE (OTHER THAN PUBLIC-TRANSPORT TYPE), INCLUDING STATION WAGONS AND RACING CARS | 0.01 | 0.07 | 0.01 | N/A | ||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | 8711 | MOTORCYCLES (INCLUDING MOPEDS) AND CYCLES FITTED WITH AN AUXILIARY MOTOR, WITH OR WITHOUT SIDECARS; SIDECARS | 0.01 | 0.01 | 0.01 | N/A | ||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | 8712 | BICYCLES AND OTHER CYCLES (INCLUDING DELIVERY TRICYCLES), NOT MOTORIZED | N/A | |||||||||||||||||||||||||

| GSP (excluding GSP for LDBC only) | 8714 | PARTS AND ACCESSORIES FOR MOTORCYCLES, BICYCLES AND OTHER CYCLES, INCLUDING PARTS AND ACCESSORIES FOR DELIVERY TRICYCLES AND INVALID CARRIAGES | 0.02 | 0.05 | 0.08 | 0.09 | 0.07 | 0.05 | 0.05 | 0.03 | 0.01 | 0.01 | 0.01 | N/A | ||||||||||||||

| No program claimed | 8704 | MOTOR VEHICLES FOR THE TRANSPORT OF GOODS | 30.7 | 27.35 | 19.71 | 37.41 | 49.33 | 26.26 | 4.53 | 0.38 | 0.23 | 0.03 | 4.42 | 0.11 | 0.2 | 0.32 | 20.14 | 6.42 | 13.77 | 8.48 | 14.89 | 0.29 | 8.74 | 1.63 | 1.63 | 50.59 | 3004.47% | |

| No program claimed | 8708 | PARTS AND ACCESSORIES FOR TRACTORS, PUBLIC-TRANSPORT PASSENGER VEHICLES, MOTOR CARS, GOODS TRANSPORT MOTOR VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 19.18 | 17.45 | 25.14 | 21.98 | 25.16 | 43.1 | 42.31 | 35.93 | 36.24 | 19.25 | 21.1 | 48.27 | 33.69 | 20.81 | 20.84 | 30.74 | 18.13 | 14.71 | 20.93 | 20.85 | 17.76 | 30.15 | 25.9 | 23.63 | 22.72 | -3.82% |

| No program claimed | 8714 | PARTS AND ACCESSORIES FOR MOTORCYCLES, BICYCLES AND OTHER CYCLES, INCLUDING PARTS AND ACCESSORIES FOR DELIVERY TRICYCLES AND INVALID CARRIAGES | 1.06 | 0.07 | 0.69 | 1.11 | 1.17 | 0.87 | 0.79 | 0.82 | 0.79 | 0.84 | 0.74 | 0.71 | 1.32 | 0.73 | 0.75 | 1.36 | 1.51 | 1.37 | 1.59 | 1.55 | 1.54 | 2.68 | 2.01 | 1.87 | 1.96 | 4.95% |

| No program claimed | 8703 | MOTOR CARS AND OTHER MOTOR VEHICLES DESIGNED TO TRANSPORT PEOPLE (OTHER THAN PUBLIC-TRANSPORT TYPE), INCLUDING STATION WAGONS AND RACING CARS | 23.35 | 23.41 | 0.15 | 1.55 | 0.16 | 3.2 | 0.47 | 18.9 | 11.76 | 0.34 | 23.09 | 0.47 | 0.02 | 0.05 | 0.17 | 0.26 | 0.44 | 0.55 | 0.25 | 1.53 | 1.62 | 1.21 | 1.78 | 47.35% | ||

| No program claimed | 8710 | TANKS AND OTHER ARMORED FIGHTING VEHICLES, MOTORIZED, WHETHER OR NOT FITTED WITH WEAPONS, AND PARTS OF SUCH VEHICLES | 2.07 | 0.76 | 0.41 | 1.35 | 1.31 | 0.02 | 0.26 | 5.28 | 2.6 | 3.37 | 3.24 | 3.78 | 7.42 | 11.01 | 1.88 | 1.21 | 1.25 | 7.28 | 12.45 | 5.93 | 3.67 | 1.17 | 0.88 | 0.88 | 1.3 | 48.02% |

| No program claimed | 8716 | TRAILERS AND SEMI-TRAILERS; OTHER VEHICLES, NOT MECHANICALLY PROPELLED; AND PARTS THEREOF | 0.13 | 0.33 | 0.4 | 0.56 | 0.33 | 0.21 | 0.21 | 0.07 | 0.16 | 0.08 | 0.22 | 0.14 | 0.16 | 0.12 | 0.08 | 0.38 | 1.74 | 1.15 | 0.69 | 0.22 | 0.15 | 0.07 | 0.07 | 0.79 | 1071.75% | |

| No program claimed | 8711 | MOTORCYCLES (INCLUDING MOPEDS) AND CYCLES FITTED WITH AN AUXILIARY MOTOR, WITH OR WITHOUT SIDECARS; SIDECARS | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.02 | 0.05 | 0.01 | 0.09 | 0.2 | 0.27 | 0.27 | 0.07 | -72.59% | |||||||||||

| No program claimed | 8707 | BODIES (INCLUDING CABS), FOR TRACTORS, PUBLIC-TRANSPORT PASSENGER VEHICLES, MOTOR CARS, GOODS TRANSPORT VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 6.67 | 0.7 | 0.17 | 0.4 | 0.14 | 1.37 | 0.57 | 0.08 | 0.11 | 0.05 | 0.34 | 0.13 | 0.15 | 0.13 | 0.02 | 0.11 | 0.11 | 0.15 | 0.1 | 0.03 | 0.13 | 0.02 | 0.02 | 0.07 | 216.93% | |

| No program claimed | 8706 | CHASSIS FITTED WITH ENGINES FOR TRACTORS, MOTOR VEHICLES FOR PASSENGERS, GOODS TRANSPORT VEHICLES AND SPECIAL PURPOSE MOTOR VEHICLES | 0.02 | 0.01 | 0.01 | 0.01 | 0.03 | 0.05 | 0.03 | N/A | ||||||||||||||||||

| No program claimed | 8705 | SPECIAL PURPOSE MOTOR VEHICLES, NESOI, INCLUDING WRECKERS, MOBILE CRANES, FIRE FIGHTING VEHICLES, CONCRETE MIXERS, MOBILE WORKSHOPS, ETC. | 0.01 | 0.24 | 1.07 | 0.01 | 0.01 | N/A | ||||||||||||||||||||

| No program claimed | 8701 | TRACTORS (OTHER THAN WORKS TRUCKS OF HEADING 8709) | 0.01 | 0.02 | 4.67 | 6.13 | 1.36 | 0.33 | 0.5 | 0.81 | 0.01 | N/A | ||||||||||||||||

| No program claimed | 8713 | CARRIAGES FOR DISABLED PERSONS, WHETHER OR NOT MOTORIZED OR OTHERWISE MECHANICALLY PROPELLED | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | N/A | ||||||||||||||||||||

| No program claimed | 8712 | BICYCLES AND OTHER CYCLES (INCLUDING DELIVERY TRICYCLES), NOT MOTORIZED | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | -100% | ||||||||||||||||

| No program claimed | 8709 | WORKS TRUCKS, SELF-PROPELLED, NOT FITTED WITH LIFTING OR HANDLING EQUIPMENT; TRACTORS USED ON RAILWAY STATION PLATFORMS; PARTS THEREOF | 0.08 | 0.01 | 0.01 | 0.06 | 0.09 | 0.03 | 0.11 | 0.12 | 0.02 | 0.01 | 0.01 | N/A | ||||||||||||||

| Total: | 150.28 | 359.01 | 572.88 | 776.19 | 591.57 | 287.06 | 472.46 | 575.85 | 1,927.50 | 1,443.75 | 1,622.10 | 2,140.58 | 2,013.58 | 2,193.73 | 1,377.92 | 1,450.51 | 1,580.70 | 1,257.97 | 617.28 | 406.01 | 590.74 | 863.12 | 1,558.03 | 1,375.31 | 1,768.93 | 28.62% |

Source: USITC

Automotive (Ch 87) exports from SOUTH AFRICA to USA by preference programme

$ million, full year data 2000 - 2023 YTD

Automotive (Ch 87) exports from SOUTH AFRICA to USA by preference programme

$ million, full year data 2000 - 2023 YTD

** On mobile & Desktop if the table is too wide, please use the scroll left and right to view the data off screen.

| Program | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2022 YTD to MAY | 2023 YTD to MAY | 2022-2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AGOA (excluding GSP) | 241.17 | 483.19 | 634.23 | 422.03 | 138.07 | 354.54 | 467.43 | 1,821.19 | 1,369.04 | 1,553.06 | 2,023.25 | 1,925.22 | 2,120.78 | 1,307.03 | 1,357.91 | 1,504.15 | 1,188.40 | 544.74 | 344.25 | 551.63 | 799.66 | 1,504.66 | 341.21 | 721.39 | 111.42% | |

| GSP | 67.1 | 47.75 | 42.98 | 72.84 | 85.77 | 72.6 | 68.67 | 64.3 | 46.84 | 39.16 | 42.37 | 36.6 | 44.93 | 39.85 | 46.93 | 38.89 | 48.53 | 30.23 | 27.4 | 17.25 | 15.15 | 18.77 | 20.96 | 7.96 | 5.88 | -26.20% |

| No program claimed | 83.18 | 70.09 | 46.71 | 69.13 | 83.77 | 76.39 | 49.25 | 44.12 | 59.47 | 35.55 | 26.67 | 80.73 | 43.43 | 33.1 | 23.96 | 53.71 | 28.02 | 39.34 | 45.15 | 44.51 | 23.96 | 44.69 | 32.41 | 11.38 | 28.83 | 153.41% |

| Total: | 150.28 | 359.01 | 572.88 | 776.19 | 591.57 | 287.06 | 472.46 | 575.85 | 1,927.50 | 1,443.75 | 1,622.10 | 2,140.58 | 2,013.58 | 2,193.73 | 1,377.92 | 1,450.51 | 1,580.70 | 1,257.97 | 617.28 | 406.01 | 590.74 | 863.12 | 1,558.03 | 360.54 | 756.09 | 109.71% |

Source: USITC

Note: South Africa has accounted for well over 99% of all automotive sector exports to the US since AGOA's inception.

Blank fields denote 'no trade'

AGOA forms one of the cornerstones of African automotive sector exports to the United States. Approximately 90 tariff lines (at the HS8 level) falling within Chapter 87 (automotives and parts) are covered by the AGOA legislation.

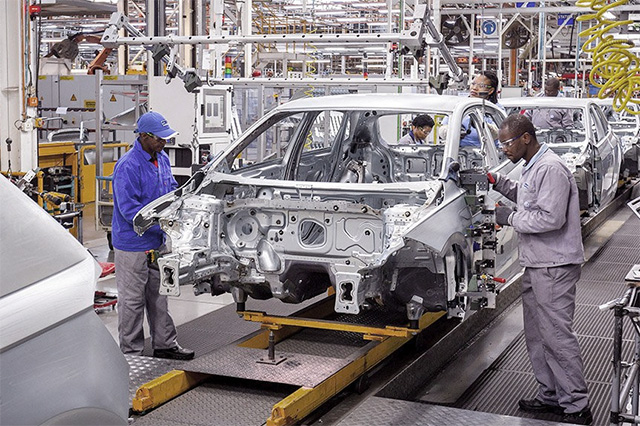

Automotive sector production and exports form part of a capital-intensive industry, and currently virtually all exports from this sector are exported from South Africa.

Over the years, very small amounts of automotive products have also been exported to the US under AGOA from other AGOA beneficiaries, for example from Kenya and Nigeria (see first data table alongside). Other beneficiary countries however provide some of the necessary inputs to the South African automotive sector, for example Botswana, which supplies premium quality leather that is used in OEM car seats during vehicle manufacture.

Within the auto sector export category, passenger vehicle form the bulk of Sub-Saharan African exports to the US, reaching $1.5 billion (out of $1.6 billion in total sector exports) during 2016 - see the data tables alongside for more detailed statistics. These exports have directly benefited from AGOA by being granted duty-free access to the US.

Less than 2% of automotive sector exports ($29m out of $1,587m) from AGOA beneficiaries - South Africa) - did not claim any specific duty preferences. In comparison, during the year 2000 when AGOA was originally enacted, total auto sector exports to the US from AGOA beneficiaries werevalued at only $151m, with $83m of that not claiming any preference and $67m claiming GSP status.

Auto exports have thus seen a ten-fold increase in value over the 2000-2016 period, predominantly due to AGOA.

Parts and accessories of motor vehicles accounted for $62 million worth of exports during 2016, of which $42 million was shipped under the GSP, $1 million under AGOA (non-GSP) and $18 million without preference.

Mercedes Benz factory in East London, South Africa

Read related news articles

Loss of ‘bedrock’ AGOA will hurt South African motor industry, warns new report

Loss of access to US trade benefits through the African Growth and Opportunity Act (Agoa) would hurt not only the SA motor industry but also many more across Africa that depend on it for their future growth, says a new report. Attempts to create a pan-African motor industry and quintuple the size of the continent’s new-vehicle market could be undermined if the SA industry, the strategy’s main driver, is weakened, the report by motor...

02 September 2023

South Africa: 'Losing AGOA status would be disastrous for automotive sector'

The geopolitical fallout from Russia’s invasion of Ukraine is disrupting long-established relations and making the international economic and political landscape difficult to navigate. Such disruption could threaten the ability of SA manufacturers to compete globally. In particular, the possibility of exclusion from the US’s legislated Africa Growth & Opportunity Act (Agoa), or even economic sanctions, is causing consternation...

28 June 2023

Possible US tariffs on car imports might mean job losses in South Africa

The decision by US president Donald Trump within the next three months on whether or not to impose tariffs on the imports of vehicles and their components will have a significant effect on SA, and could result in job losses. US embassy spokesperson Robert Mearkle confirmed that the US secretary of commerce Wilbur Ross had formally submitted the results of an investigation by that country's department of commerce into the effect of...

01 March 2019

South Africa: Minister says South African interest groups plan to challenge US move on auto tariffs

South Africa is to launch a lawsuit against the US, arguing that proposed US tariffs on South African motor car imports will violate South Africa’s rights under the African Growth and Opportunity Act (AGOA). SA’s Trade and Industry Minister Rob Davies said that “interested groups” planned to challenge this latest US move in a growing global trade war. Davies told journalists at the BRICS Forum in Sandton that the international...

25 July 2018

South Africa's Rob Davies fights possible US tariffs on automotive products [Video]

SA has raised its concern with the US government about possible duties on vehicle and vehicle component imports, pointing out that their imposition on South African exports would significantly erode the benefit the country is meant to enjoy under the Africa Growth and Opportunity Act (AGOA). Following its decision to impose import duties on steel (25%) and aluminium (10%), the US decided to investigate whether it should do likewise with...

13 July 2018

South Africa: Car makers in strong plea to US on duty-free access under AGOA

The automotive industry has made a strong plea to the US trade administration for it to continue enjoying the benefit of duty-free access to the US market under the African Growth and Opportunity Act (AGOA). Nico Vermeulen, director of the National Association of Automobile Manufacturers of SA, and Renai Moothilal, the executive director of the National Association of Automotive Components and Allied Manufacturers, argue in a letter to Edward...

18 August 2017

Too early to speculate on US trade policy, says South African auto body

It is too early to speculate on the effects the incoming Trump administration may have on automotive trade between South Africa and the US, says National Association of Automobile Manufacturers of South Africa (Naamsa) director Nico Vermeulen. “It is best to wait for the installation of the new administration so that we can gain clarity on US trade policy.” In an interview with German newspaper Bild, published on Monday, US...

17 January 2017

Ford's R2.5bn investment proof of AGOA benefits: South Africa's Minister Davies

Ford’s commitment to spend an additional R2.5-billion at its Pretoria assembly plant has been held up as an important sign of confidence in South Africa and proof of the two-way benefits of the Africa Growth and Opportunity Act, known as Agoa. Noting the importance of the automotive industry to the country, South African Minister of Trade and Industry Dr Rob Davies said: “To date we have invested more than R25-billion in the motoring...

07 April 2016

South Africa: AGOA row threatens to stall automotive sector

The festering inter-governmental trade squabble between the US and South Africa is threatening to seriously dent the automotive industry’s lucrative trade with the US. This follows a report last week that the US had vowed to press ahead with a review that could cut South Africa’s access to the Africa Growth and Opportunity Act (Agoa) trade benefits after South Africa missed a key deadline for resuming US poultry imports. The South...

26 October 2015

Mercedes-Benz optimistic about South Africa

The C-Class is an icon in the South African luxury vehicle market. It has been two decades since the first C-Class was manufactured locally and next year Mercedes-Benz South Africa (MBSA) will start production on the latest C-Class model, the W205. Last year MBSA manufactured more than 60 000 units of the W204 C-Class – of which three out of every four units was exported to the United States – under the existing African Growth and...

12 February 2013