AGOA.info Knowledge Base

Welcome to the AGOA.info Knowledge Base (KB), the new home of the AGOA FAQ section.

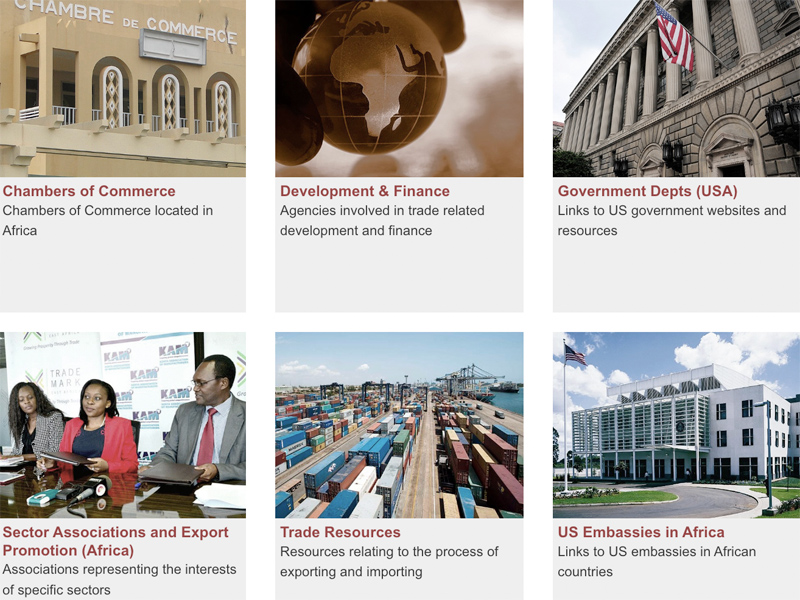

FAQ questions about AGOA can be found by clicking on the relevant KB blocks below. The keyword search functionality searches questions and answers (KB articles), and searches can be restricted to a thematic area or search across the entire KB.

Each Knowledge Base (KB) article can be referenced using its unique web reference (URL); to view the individual articles or obtain the web link, click on the 'view full article' link below each KB article.