Knowledge Base

AGOA Paperwork

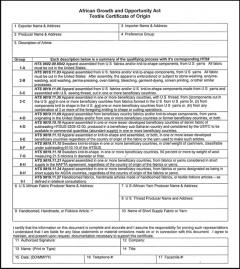

A certificate of origin is a document that confirms that a product meets the local processing requirements needed to confer origin status for a particular trade preference scheme. The certificate can be seen as a declaration by the exporter that the the products in the shipment meet the relevant rules of origin.

In international trade, the responsibility of clearing goods through customs rests primarily with the importer or the importer’s appointed agents. AGOA makes provision for a certificate of origin - known as a movement certificate - only for textile goods, in line with AGOA’s 'wearing apparel' provisions.

Only exporters in countries that are authorized to ship textiles and apparel under preference (under the separate wearing apparel provisions), and have developed an authorised ‘visa’ system (which manages and tracks the utilization of non-originating textile inputs), are able to obtain a textile certificate of origin for AGOA purposes.

A certificate of origin is required for each shipment of textiles and apparel claiming AGOA preferences. The US importer obtains the certificate of origin from the manufacturer prior to presentation of such entries to the US Customs Service claiming an AGOA preference. The importer is required to possess the certificate of origin and to be able to present it upon demand by the US Customs Service (CBP). The visa arrangement establishes documentary procedures for each shipment of eligible textile and apparel products from a designated beneficiary sub-Saharan African country to the US.

In the AGOA beneficiary table at this link a user can check which countries have fulfilled the wearing apparel provisions. You can also visit the individual country sections and download the wearing apparel authorization for each country that has obtained it.

For non-AGOA goods, the responsibility for compliance with the RoO lies jointly with the producer/exporter and the importer, although it is the importer that clears the goods into the United States and makes the relevant declarations. The importer must take steps and obtain relevant evidence and assurances from the producer / exporter in the AGOA beneficiary country that the goods in question fulfil the 35% local content rule that confers origin status on the African AGOA beneficiary country.

It is important to note that the textile certificates have to be provided by the exporter and not the importer - please contact your local customs office or chamber of commerce for assistance with the relevant local rules for obtaining and completing a certificate of origin.

Download a sample certificate here.

No, an exporter is not required to "register" in relation to the AGOA legislation in order to take advantage of its benefits when exporting goods to the US.

However, each country has different rules and regulations and many countries require that an exporter be registered for export purposes (this is unrelated to AGOA per se) with local customs or revenue authorities. Often this also involves receiving a unique exporter authorization number. These are national country-specific measures and different from country to country: it is advisable to contact the customs or revenue authorities in the home country to see what registration measures and related formalities may be required.

What is however important to bear in mind is that while the exporter is not required to register as a 'participant' under the AGOA program,

(a) the country must be a current AGOA beneficiary country (see relevant section here),

(b) the product(s) must be AGOA-eligible, and

(c) the product must originate in an African AGOA beneficiary country in accordance with AGOA’s Rules of Origin provisions.