Knowledge Base

AGOA Products, Eligibility Criteria and Origin Rules

What are AGOA preferences for the Category 9 handloomed / handmade / folklore and ethnic printed fabrics?

View full article

African exporters of certain handloomed, handmade, ethnic printed fabrics and folklore items may be able to export their products duty free under AGOA. Such exports are however subject to a country obtaining a special permission for Category 9 exports, named after the "Group 9" on the AGOA textile certificate of origin to which they relate.

Categories 1 to 8 represent mainstream garments of which production is basically industrial in nature, while Category 9 was added to encourage exports of small-scale cottage industry, handmade, folklore articles and ethnic printed fabrics from AGOA beneficiary countries.

These products become eligible through an application and bilateral consultation process between the applicant government (AGOA beneficiary's trade ministry) bilateral consultations between the government of an AGOA beneficiary country and the US government's the Committee for the Implementation of Textile Agreements (CITA).

Countries wishing to apply for Category 9 approvals should have already begun the approval process for the Textile Visa – the initial necessary step to become generally eligible for the textile benefits under AGOA.

Details of the relevant steps and the qualifying products are set out in this Guide.

To view individual countries' Category 9 authorisations, visit the AGOA.info country eligibility table here.

You can also view or download individual countries' Category 9 authorisations in the respective country sections.

AGOA’s benefits go beyond simple market access, and include or have facilitated closer collaboration between the US and African countries in many other areas, technical and economic assistance, aid, investment finance, political and strategic collaboration in certain areas, and so on. For example, trade capacity building is an important feature of AGOA as the legislation directs the US President to provide support in this area to AGOA beneficiaries, for example through the US Agency for International Development (USAID) which administers certain projects in support of AGOA for example under the ATI (Africa Trade and Investment project), which work to increase AGOA utilization and regional producers’ access to international markets.

One of the key benefits however remains preferential market access to the US market that is given to over 6,000 products when these originate in the African AGOA beneficiary country.

By removing US import duties on products covered by AGOA, producers and exporters in AGOA beneficiary countries indirectly receive a competitive advantage over exporters in other countries, who may need to pay standard US import duties, which for certain textile articles might be more than 30% on the value of the product. The preference claim is always made by the US importer.

This is a win-win scenario both for African producers and exporters as well as for US importers and consumers, as AGOA preferences result in more competitive sourcing of products, compared to US importers sourcing such goods from elsewhere. When the US importer clears goods under AGOA preference, the applicable AGOA program indicator must be chosen (symbol ‘D’ when completing the paperwork). Apparel products are classified separately in the tariff database under Chapter 98 and the US import filing includes must include the specific rules of origin category under which the preference claim is made. The US GSP program uses the 'A' program indicator but only allows preferential access when the GSP is active.

‘D’ – AGOA duty-free treatment

‘A’ – Generalized System of Preferences

While even a small duty rate can translate into a significant competitive advantage for African producers exporting to the US, the competitive dynamics of the product and industry and the size of the preference margin also play an important role in determining how valuable AGOA preferences are in each scenario: the greater the potential duty saving, the greater the relative advantage of using AGOA when clearing goods for import into the US, and for ensuring that the goods meet the minimum local content and processing requirements to be considered a product of the beneficiary country. In highly competitive sectors where even a small percentage saving can translate into a valuable advantage, AGOA preferences can play an important role in helping to facilitate trade between Africa and the US.

*** See later section on ‘Origin’ and its associated requirements under AGOA

In order for a product to qualify for AGOA preferences, a number of factors are considered.

These include the following:

(1) the product must be included in the list of AGOA eligible products (such products are denoted with the special program indicator 'D' in the US tariff schedule), or they must be a qualifying apparel or textile item;

(2) It must be imported into the United States directly from the AGOA beneficiary country or pass through another country in a sealed container and addressed to a location in the United States;

(3) The article must be the growth, product, or manufacture of the AGOA beneficiary country by fulfilling the relevant Rules of Origin requirements for general or apparel items, respectively

(4) If foreign materials are imported into the AGOA country first, to be used in the production of an AGOA-eligible product, the sum of the cost of the materials produced in the AGOA beneficiary country, plus the costs of processing, must equal at least 35 percent of the product’s appraised value when the product is sold for export into the United States (see section on Rules of Origin). Apart from the 35% local content requirement, any imported non-originating materials used in the calculation of local content (35%) must have been substantially transformed locally in the exporting country claiming AGOA origin through a double transformation (into a separate and distinct intermediate article of commerce having a distinctive name, character or use - see United States v. Gibson-Thomsen Co., Inc., 27 CCPA 269 (1940).

(5) In the case of clothing/apparel, the 35% rule does not apply directly, instead, the goods need to comply with the respective textile and apparel Rules of Origin requirements and be entered into the US under their respective RoO category;

(6) The US importer must request duty-free treatment under AGOA on the relevant customs entry form (Form 7501) by placing an “D” in column 27 in front of the US tariff number that identifies the imported article.

Find additional details at this link on AGOA's product eligibility principles.

If a product does not qualify for AGOA benefits, does that mean that import duties must be paid when such goods are shipped to the USA?

View full article

When a product is not covered by AGOA preferences, standard import terms and conditions apply when such goods are imported into the US, irrespective of whether the good was produced in an AGOA beneficiary country.

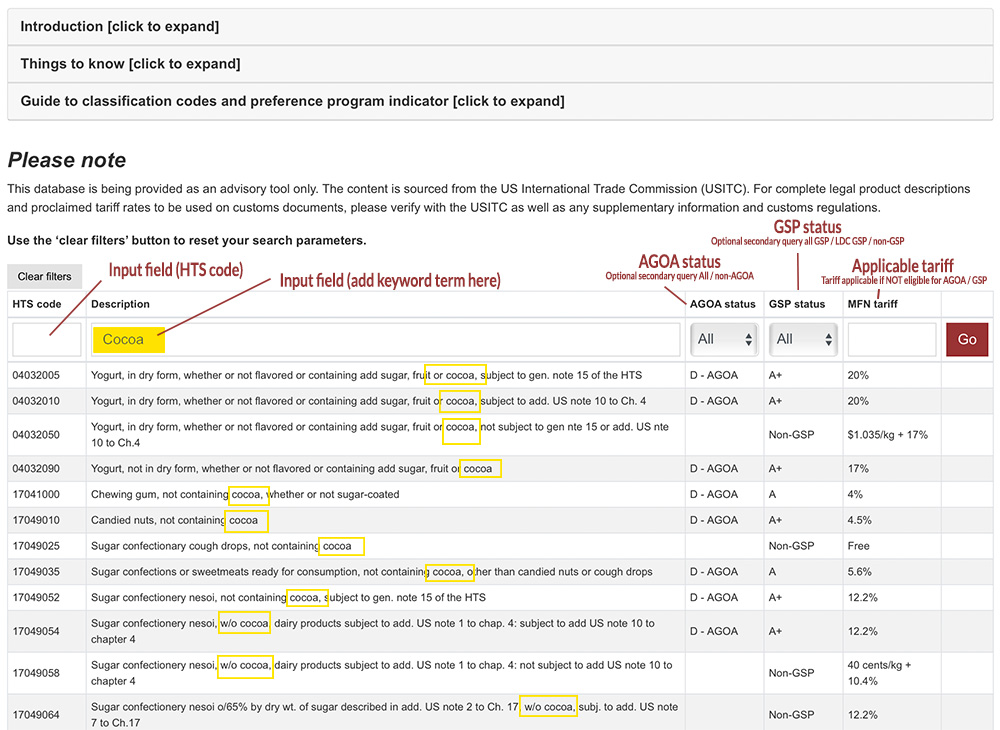

However, even if a product is not covered by the AGOA preference program, this does not necessarily mean that an import duty will always be due. Many products - in fact well over 4,000 tariff lines - are not subject to an import duty in the US tariff schedule under normal tariff relations (NTR). The AGOA.info classification and tariff lookup tool can assist the user correctly establish the status of their product at this link.

AGOA covers more than 6,700 products based on the HTS-8 tariff classification. This includes approximately 5,100 products (tariff lines) that fall under the GSP as well as more than 1,600 tariff lines that are duty-free only for exports to the US from AGOA beneficiaries. A searchable list of products eligible for duty-free export to the US is available at this link.

What is the HTS-8 product classification?

The HTS refers to the US Harmonised Tariff System nomenclature, and is based (up to the 6th digit) on the internationally standardized Harmonized Commodity Description and Coding System, managed by the World Customs Organisation. It classifies all traded products into sections, chapters, headings, sub-headings and so on.

Let’s take, for example, "pineapples in packages":

- Section II represents vegetable products (and comprises Chapters 6 - 14)

- Chapter 08 covers ‘edible fruit and nuts, peel of citrus/melons’

- Heading 0804 covers dates, figs, pineapples, avocadoes etc.

- Sub-Heading 0804.30 covers pineapples

- The 8-digit sub-division 0804.30.40 covers ‘pineapples in crates or other packages’

Using the above example and using the AGOA product lookup tool here:

Tariff line 08043040 has a standard US import duty of 1.11 / kg (as of 2023)

It also has the AGOA ‘D’ code in the US tariff book, meaning that when imported into the US from an AGOA beneficiary, this import duty is not applicable. The same product is also eligible for GSP preferences (program indicator A+) which indicates that when the GSP is in force, imports into the US from least-developed beneficiary countries under the GSP would also be able to claim preferential entry.

Link to AGOA Eligibility Lookup Tool

.

Rules of Origin (RoO) are the criteria that define the origin of a product, and more specifically, describe the minimum content or processing that must be undertaken on any non-originating materials used, in order to confer local origin status on the product.

RoO form an integral part to any preferential trade arrangement in that they help ensure that any trade benefits accruing under such an arrangement are for goods that originate in the beneficiary country, rather than being claimed by goods that are produced elsewhere and that may have been transhipped through a beneficiary country, or with only minimal value being added.

RoO generally distinguish between two different types of goods:

(a) those that are wholly produced in the exporting country from local (originating) materials, and

(b) those that utilize local and foreign materials but are further processed locally in order to result in a substantial transformation.

In the former, the origin status of a product tends to be undisputed and can readily be attributed to the country where the product is grown or manufactured. Examples would include products made from minerals extracted from the soil, fish caught in inland waters and processed locally, agricultural products, and any product made exclusively from locally made inputs.

In the latter scenario, RoO become particularly important since the product is made up using both local and foreign inputs; here the RoO specify what minimum amount of processing and value-adding activity must take place locally, before a product can be deemed to be of local origin.

The AGOA legislation distinguishes between textile and non-textile goods in terms of origin criteria:

Textile goods (such as wearing apparel) can qualify based on the specific processing and origin criteria set out in a number of different textile categories - such as (local) "manufacture using third country fabric", or "manufacture from regional fabric" - whereas all other goods are subject to a general 35% local content rule. Up to 15% of the 35% may comprise materials produced in the US.

Under the 35% rule, only locally made materials and processing contributes to this threshold, and only imported materials that have undergone a double transformation and result in a substantially different material or intermediate good may be counted as 'local' content for the purpose of being included as part of the 35% minimum requirement.

RoO are intended to ensure that only goods that have attained the economic origin of the beneficiary country will benefit from trade preferences, thus ensuring local value-adding activities and preventing transshipment of goods from other countries.

All goods exported to the US and claiming AGOA preferences must meet the relevant RoO.

See the next section for further details.

What are some of the specifics of the textiles and apparel Rules of Origin under AGOA?

View full article

As outlined elsewhere, the general 35% (local content) rule does not apply to textiles and apparel, for which a number of separate and different rule categories apply.

AGOA beneficiary countries whose exporters wish to export textiles and apparel to the US under AGOA must first implement a so-called apparel visa system (see a related announcement relating to Madagascar), which pertains to the monitoring and control of inputs such as fabric used in the production of apparel, as well as maintaining adequate records pertaining to the use of any non-originating imported fabric. As of 2023, approximately 25 of the 35 current AGOA beneficiaries had implemented the requisite apparel visa system and were current AGOA beneficiaries, enabling them to ship qualifying apparel under AGOA.

The textile and apparel rules of origin (additional details about these provisions are available here) are set out in more than a dozen separate categories each with their own special classification code, for which the US tariff database uses a special tariff book chapter and associated headings, subheadings and 8-digit sub-divisions (>> see HTS Chapter HTS 98 / Heading HTS 9819 / Sub-heading HTS 9819.11 / division HTS 9819.11.03 onwards).

The three most prominent RoO categories (and HTS codes) for textiles and apparel relating to AGOA exports - with the bulk of AGOA trade - are as follows:

Textiles:

>> HTS 9819.11.33

Textiles classified under chapters 50 through 60, as well as chapter 63, which are produced in a LDC AGOA beneficiary, and which are made from fibers, yarns, fabrics, fabric components or components knit-to-shape in one or more such AGOA beneficiaries. (Note that South Africa is currently the only AGOA beneficiary that is not considered an LDC country, meaning that textile preferences do not apply to South African exports)

Apparel:

>> HTS 9819.11.12

Apparel articles assembled or knit-to-shape in a LDC AGOA beneficiary, regardless of the country of origin of the fabric or the yarn used to make such articles. This provision applies to almost all current AGOA beneficiaries that qualify for textiles and apparel exports under AGOA, with the exception of South Africa (not a LDC beneficiary under AGOA). South African exporters are therefore more limited in terms of where they can source fabric from and still meet the Rules of Origin provisions.

>> HTS 9819.11.09

Apparel articles assembled in an AGOA beneficiary country from fabric wholly formed in one or more such AGOA beneficiaries from yarn originating in the US or in an AGOA beneficiary (or former beneficiary) country. This provision applies to South African exporters, as South Africa is not classified as an LDC beneficiary country. This means that apparel must be assembled from AGOA beneficiary country fabrics or knit to shape components, which in turn must have been made from US or AGOA beneficiary country yarns. Exporters from South Africa may however use certain components sourced from third countries (including collars, cuffs, drawstrings, belts attached to garments, padding, shoulder pads) provided the value of such items is less than 25% of the total cost of the garment. Under the de minimis provisions, up to 10% by weight may also comprise non-originating fibers and yarns.

Follow this link to the AGOA textile data section.