What are product classification codes and why does my product need one?

Accurate product classifications are a critical part when exporting to the United States - or any other international destination. Without the correct Harmonized Tariff Schedule code (HTS), traders can face legal issues, fines, delays in clearing shipments, or having their shipment seized.

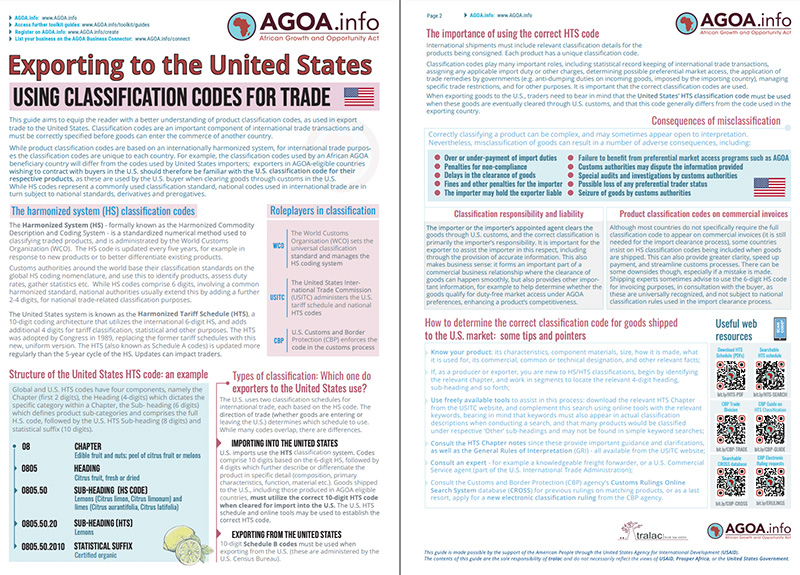

A HTS Code is used to identify and classify goods that are to be cleared through customs.

A 10-digit import classification is required on the documents to clear goods into the US (even though preference status, such as AGOA eligibility, is determined at the 8-digit level - use the tool here).

For trade with the United States, it is important to establish the unique 10-digit code as used by the US. While the first 6 digits of this code are harmonized globally (this is the 'Harmonized System nomenclature', or HS), the following 4 digits are unique to the US and usually differ from classification codes used by other countries.

You can download and review each chapter of the US classification system, as well as the associated general notes, at this link.

In order to identify the correct and full classification code, the relevant Chapter can be used as a basis to help identify the correct and full product classification of the product to be shipped. It should be noted that it is important to review the Notes to each HTS Section (found in the first Chapter of each Section), together with the product-specific classifications. At times, the correct 10-digit classification would be under a 'Other' classification code. It is sometimes best to consult experienced freight forwarders and classification specialists for assistance.

A general recommendation for traders to establish the correct HTS code for their product would be to peruse the HTS Schedule (chapter documents). If the trader is already familiar with HS codes, or has the 6-digit code available, the AGOA Product lookup tool (at this link) can help identify the AGOA status of the product. However, note that while the tool provides details on the AGOA eligibility and associated import duties (for non-eligible goods, or goods not meeting the rules of origin), the 10-digit code can be found in the HTS Chapter listings.

You can also view and download an AGOA.info Guide to the US tariff classification system at this link.