General Documents

US end-market analysis for Kenyan home decor and fashion accessories

This report provides market data at a product level for use by Kenyan exporters interested in the United States (U.S.) market and to support the National African Growth and Opportunity Act (AGOA) Strategy and Action Plan for Kenya. The home décor and fashion accessories sector has the capacity to further the goals of increasing women and youth participation in manufacturing by providing greater access to economic opportunities. In 2016, the top preforming Kenyan product categories in this sector represented $5.2 million in exports to the U.S. The U.S. is the largest importer in the world in all categories, and the fourth largest in jewelry. This report analyzes the top supply growth opportunities for Kenya based on the U.S. import demand. It also presents the current market trends in the U.S. for Kenya to better compete internationally. In addition, the Kenya Vision 2030 makes the recommendation for "a better and more inclusive wholesale and retail trade sector." Accomplishing the goal of increasing efficiency, lowering transaction costs and strengthening trade as well as linking trade to wider local and global markets requires: Understanding the demands of the international market and the trends that influence the global exports to the U.S. market; Understanding the advantages of the Kenyan market in key product categories, competitiveness in raw material sourcing, and the international competitors participating on the global stage; Sharing a detailed explanation...

Defining and redefining US-AFRICA trade relations during the Trump Presidency

In an era in which multilateral trade arrangements have garnered more public notoriety than ever before, the suboptimal trade and investment relationship between America and Africa, as underpinned by the African Growth and Opportunity Act (AGOA), is one of the less controversial ones. AGOA could nevertheless use some adjustments or augmentations to facilitate deeper U.S.-Africa commercial relations. For instance, adjusting AGOA’s origin rules could nudge the private sector on both sides of the Atlantic towards gains for U.S. and African employment and the reduction of trade deficits. Africa must leverage the period before AGOA expires to redefine its trade relationship with the United States in innovative ways. The United States should welcome these measures, since the type of value that Africa would add to the global supply chain would not replace the high-quality jobs that the Trump Administration would like to see in the United States. In fact, this type of production would make U.S. manufacturing more competitive.

USTR request letter - Investigation into US-SSA trade

Request letter concerning USTR / USITC investigation into US trade with Sub-Saharan Africa.

AGOA Forum 2017: Brochure and Photos

AGOA Forum 2017 Brochure and Photo Report prepared by the 2017 Togo AGOA Forum Organising Committee.

AGOA Forum 2017: General Report on the AGOA Forum in Togo (french)

Very comprehensive summary and feedback report prepared by the 2017 Togo AGOA Forum Organising Committee. This report is in french.

AGOA Forum 2017: General Report on the AGOA Forum in Togo (english)

Very comprehensive summary and feedback report prepared by the 2017 Togo AGOA Forum Organising Committee.

2017 trade policy agenda and 2016 annual report of the president of the United States on the trade agreements program

On March 1, 2017, the Office of the U.S. Trade Representative (USTR) posted the 336 page 2017 Trade Policy Agenda and 2016 Annual Report of the President of the United States on the Trade Agreements Program. The reports are required to be submitted to the U.S. Congress by March 1, pursuant to Section 163 of the Trade Act of 1974, as amended (19 U.S.C. 2213). Chapter II and Annex II of the document are intended to meet the requirements of Sections 122 and 124 of the Uruguay Round Agreements Act with respect to the World Trade Organization. In addition, the report also includes an annex listing trade agreements entered into by the United States since 1984. Goods trade data are for full year 2016. Services data by country are only available through 2015. The Office of USTR states that it intends to submit a more detailed report on the President’s Trade Policy Agenda after the Senate has confirmed a USTR, and that USTR has had a full opportunity to participate in developing such a report. The Trade Policy Agenda portion outlines the trade policy objectives and priorities of the United States for 2017, and reasons therefor. The Agenda states that, “The overarching purpose of our trade policy – the guiding principle behind all of our actions in this key area – will be to expand trade in a way that is freer and fairer for all Americans.” It lists the following key objectives: Ensuring that U.S. workers and businesses have a fair opportunity to...

AGOA Forum 2016 - Labour and Trade Ministers Readout

Readout from the Labour and Trade Ministers session at the 2016 AGOA Forum

AGOA Forum 2016 - Civil Society Readout

Readout from the 2016 AGOA Forum Civil Society Sessions

AGOA market specialty food enterprises mapping report- Kenya, Madagascar and Mauritius

Specialty foods are defined as foods or beverages of the highest grade, style, and/or quality in their respective categories. Their specialty nature comes from a combination of some or all of the following qualities: uniqueness, origin, processing method, design, limited supply, unusual application or use, extraordinary packaging, or channel of distribution/sale. Approximately 60% of the US population spends over $80 billion in Specialty products. This speciality foods mapping report covers the countries Kenya, Madagascar and Mauritius.

Tanzania - National AGOA Strategy

This strategy has identified four sectors that can be developed rapidly for the purpose of increasing Tanzanian participation in AGOA market access opportunities. First, the garments and textiles sector where harvesting low-hanging fruits in the garments subsector can generate the resources for subsequent investment in the textiles segment of the value chain. Second, the agro-processing sector, which includes horticultural products, spices and edible nuts, was also a natural choice. Third and fourth, the leather goods and footwear, and handicrafts sectors, respectively. Both are important in view of their potential for inclusion of rural communities, women and the youth in mainstream economic activities and should be revived. In addition to identifying the targeted sectors, this strategy also identifies issues and challenges as well as specific private sector needs in those areas and the kind of interventions required for effective implementation. There is only one goal—increasing Tanzanian exports to the U.S. under AGOA. I take this opportunity to assure my fellow Tanzanians of two things. First, the Ministry of Industry, Trade and Investment is committed to working closely with public and private sector stakeholders for the realization of the underlying goals and objectives of this strategy. Second, the strategy is aligned to the IIDS and will benefit from initiatives for its implementation.

2016 Biennial Report on the implementation of the African Growth and Opportunity Act

The U.S. Trade Representative presented to Congress today a comprehensive report on implementation of the African Growth and Opportunity Act (AGOA) – the cornerstone of the U.S. trade and investment relationship with sub-Saharan Africa. The report is statutorily mandated by Congress under the Trade Preferences Extension Act of 2015 to be submitted one year following the enactment of the Act, and biennially thereafter. The 2016 Biennial Report on the Implementation of the African Growth and Opportunity Act details the U.S.-sub-Saharan African trade relationship, analyzes country compliance with eligibility criteria, highlights regional integration efforts, and summarises the trade capacity building assistance that various U.S. government agencies provide to Africa. The report also provides information, requested by Congress, regarding out-of-cycle AGOA eligibility reviews and potential trade agreements with sub-Saharan Africa.

Mali - National AGOA Strategy

La République du Mali est située au coeur de l’Afrique de l’Ouest. Avec une superficie de 1.241.238 km2, c’est un pays continental, qui partage environ 7.000 kilomètres avec 7 pays voisins. Les principaux ports d’approvisionnement du pays sont : Dakar (à 1 400 km environ de Bamako), Abidjan (à 1 200 km), Nouakchott (à 1 600 km), Conakry (à 900 km), de Lomé et de Tema (à 1973 km). L’économie malienne est essentiellement agricole. L’Agriculture contribue pour environ 35 % au Produit intérieur brut et près de 70 % de la population vit en campagne. ...

Rwanda - National AGOA Strategy

The Ministry of Trade and Industry is pleased to present the AGOA Action Plan for Rwanda, which was prepared thanks to the valuable support of the United States Agency for International Development, through the East Africa Trade and Investment Hub. The document, produced in close collaboration with the MINICOM, constitutes the road map that will allow Rwanda to harness the benefits brought about by the African Growth and Opportunity Act, recently extended until 2025. Most importantly, implementing the actions contained herein will enable Rwandan businesses to utilize the next nine years (until 2025) to become competitive and be able to sustain a position in the US market even after the end of AGOA.

Federal Register: Details of new AGOA country eligibility petition process

The Trade Preferences Extension Act of 2015 (TPEA) requires the President to establish a petition process to review the eligibility of countries for the benefits of the African Growth and Opportunity Act (AGOA). This authority has been delegated to the Office of the United States Trade Representative (USTR). Comments on this interim final process required by April 18, 2016.

Zambia - National AGOA Strategy (updated version below)

The team identified four areas for consideration that would assist Zambia in implementing the AGOA strategy. Governance: Zambia would benefit from establishing an AGOA Steering Committee consisting of key stakeholders from specific private sector organisations, industry associations, and government agencies. Education and Outreach: Zambia should promote opportunities for educating businesses about AGOA. With that intent, a booklet was developed in collaboration with key stakeholders to educate Zambian businesses on the purpose and benefits of AGOA and provide guidance on the necessary steps to benefit under the trade act. An informational AGOA-Zambia website (www.agoazambia.com) provides comprehensive information about AGOA. For outreach, the team recommends that a roadshow be organised to establish credibility and promote Zambia as a viable commercial partner. Access to Financing: Zambia would benefit from connecting local businesses with agencies that provide financial resources to secure financing. Businesses can leverage available agencies such as the Citizens Economic Empowerment Commission (CEEC), Zambia Development Agency (ZDA), Industrial Development Corporation (IDC), and Overseas Private Investment Corporation (OPIC), a U.S.

South Africa and AGOA: Recent developments 2015-2016 and possible suspension

The African Growth and Opportunity Act (AGOA) has received much publicity and attention over the past year in particular, for two main reasons: (a) the legislation was set to expire at the end of September 2015 amid uncertainty and many questions about whether it should be renewed, and in which format, and (b) the legislation’s eligibility requirements were brought to the fore amid serious questions around South Africa’s continued compliance with these underlying provisions. South Africa had in the meanwhile become the largest and most diversified AGOA beneficiary . Fast-forward to end 2015. AGOA has since been renewed by ten years, and South Africa remains in the fold, albeit on somewhat precarious ground, and very much in the spotlight. Special provisions targeting South Africa – in the sense of compelling a mandatory formal review of South Africa’s compliance with AGOA’s eligibility provisions – were included in the new legislation. Overhauled eligibility requirements and associated processes and reviews, as well as possible sanctions for non-compliance, feature in the new AGOA. The process relating to South Africa was partly concluded in November 2015 when President Obama wrote to Congress, in line with the provisions of the new AGOA legislation, to give advance-warning of an intention to suspend some of South Africa’s market preferences under AGOA. In January 2016, Obama followed-through with this threat and formally suspended South Africa’s...

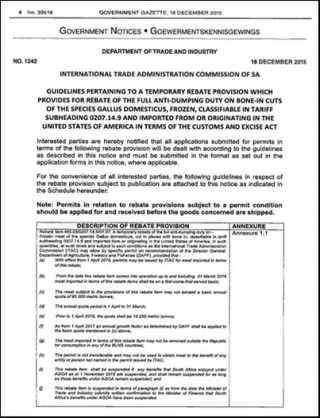

South Africa Government gazette - tariff rebate on US chicken imports

A temporary rebate provision under rebate item 460.03/0207.14.9/01.07 has been created for frozen meat of the species Gallus domesticus, cut in pieces with bone in, classifiable in tariff subheading 0207.14.9 and imported from or originating in the United States of America. This is created for such quantities, at such times and subject to such conditions as the International Trade Administration Commission (ITAC) may allow by specific permit on recommendation of the Department of Agriculture, Forestry and Fisheries (DAFF).

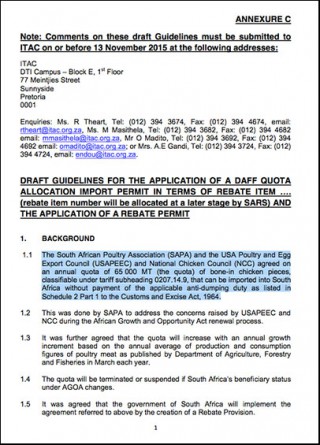

DRAFT guidelines for for the application of a DAFF quota allocation import permit

ITAC - DRAFT guidelines for for the application of a DAFF quota allocation (for imports of poultry) permit - 30 Oct 2015. Background: The South African Poultry Association (SAPA) and the USA Poultry and Egg Export Council (USAPEEC) and National Chicken Council (NCC) agreed on an annual quota of 65 000 MT (the quota) of bone-in chicken pieces, classifiable under tariff subheading 0207.14.9, that can be imported into South Africa without payment of the applicable anti-dumping duty as listed in Schedule 2 Part 1 to the Customs and Excise Act, 1964.