General Documents

AGOA Countries: Challenges and considerations in exporting horticultural products to the United States

Congress, the Administration, and other stakeholders continue to be involved in serious efforts to improve upon the African Growth Opportunity Act (AGOA), which was first signed into law a decade ago, on May 18, 2000. To meet its objective of enhancing U.S. market access for subSaharan African countries that are pursuing market reforms measures, the AGOA preferential trade legislation was designed to encourage and support countries in this region ―that are taking often difficult but critical steps necessary to create more open, market and growth-oriented economies.‖1 AGOA eligibility currently extends to 38 African countries, with some benefitting from exports of natural resources such as oil and minerals, while others have been able to develop textile and apparel industries in which goods are more easily manufactured and exported without barriers to market in the United States. Nigeria and Angola are leading oil producers and suppliers to the U.S.; these two countries alone accounted for 80 percent of all AGOA imports in 2008. In contrast, the value of agricultural exports to the United States from 14 other AGOA-eligible countries was less than $1 million in 2009. In fact, three of these countries – Namibia, Seychelles, and Chad had less than $100,000 in agricultural exports under AGOA in 2009 (see Annex A).

Instructions for AGOA beneficiary governments to apply for approval of handloomed/handmade/folklore articles under Category 9

Section 112(b)(6) of the AGOA provides for the duty-free treatment of handloomed, handmade, folklore articles, or ethnic printed fabrics of a beneficiary sub-Saharan African country that are certified as such by the authorities of the country. It also requires the United States to determine which, if any, particular textile and apparel goods shall be treated as handloomed, handmade, folklore articles, or ethnic printed fabric after consultations with the beneficiary sub-Saharan African country concerned.

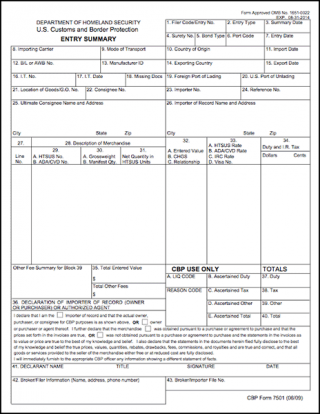

US Customs (CBP) Form 7501 for US Imports

United States CBP Customs Form 7501, for US importers, used for importing goods into the United States.

Export of handloomed textiles and folklore articles

Exporting handloomed fabrics to the United States under AGOA requires that the exporting country has an approved Textile Visa system and other measures to protect against illegal product sourcing (referred to as “illegal trans-shipment”). In addition, a Category 9 product approval is required for export of handloomed fabrics, hand-made articles from handloomed fabrics, folkloric articles and ethnic printed fabrics to the US. Each shipment must be accompanied by the paper documentation that the products meet rules of origin requirements: 1) Textile Certificate of Origin, and 2) commercial invoice embossed with a Textile Visa stamp.

What every member of the international trade community should know about recordkeeping

Two new concepts that emerge from the Mod Act are “informed compliance” and “shared responsibility,” which are premised on the idea that in order to maximize voluntary compliance with laws and regulations of U.S. Customs and Border Protection, the trade community needs to be clearly and completely informed of its legal obligations. Accordingly, the Mod Act imposes a greater obligation on CBP to provide the public with improved information concerning the trade community's rights and responsibilities under customs regulations and related laws. In addition, both the trade and U.S. Customs and Border Protection share responsibility for carrying out these requirements. For example, under Section 484 of the Tariff Act, as amended (19 U.S.C. 1484), the importer of record is responsible for using reasonable care to enter, classify and determine the value of imported merchandise and to provide any other information necessary to enable U.S. Customs and Border Protection to properly assess duties, collect accurate statistics, and determine whether other applicable legal requirements, if any, have been met. CBP is then responsible for fixing the final classification and value of the merchandise. An importer of record’s failure to exercise reasonable care could delay release of the merchandise and, in some cases, could result in the imposition of penalties.

What every member of the trade community should know about: Commercial samples

Guide to the importation into the United States of commercial samples