How the ECOWAS-EU EPA could affect AGOA

In what could be a 'breakthrough' for both the Economic Community of West African States (ECOWAS) and the European Union (EU), the EU announced that "the two entities reached a deal at the level of senior officials on EPAs, more than a decade after negotiations began. A final meeting to officially endorse the deal as it stands is foreseen in Brussels for early February. It will then have to be endorsed by West African Heads of State."

While similar reports in the past were premature, there is strong evidence that this may be correct since in late December, trade and development ministers of five EU member states called on the EC to show more flexibility in EPA negotiations with ACP countries.

ECOWAS must be complimented on gaining a number of important concessions from the EU. Instead of getting 80% of trade liberalization between the EU and ECOWAS over the next 15 years, the burgeoning agreement focuses on a 75% figure over a 20-year period. The EU has also agreed to stop all export subsidies to West African countries.

Nonetheless, while details are not readily available, the one thing is clear: The ECOWAS – EU EPA in its current form is a threat to the renewal or even enhancement of the African Growth and Opportunity Act (AGOA). In the first place, the paradox inter alia was spelled out in USTR Michael Froman’s speech at the AGOA Forum in Addis this past August. Speaking simply, Ambassador Froman suggested that as they worked on renewing AGOA, the U.S. government as a whole did not want American firms to be put at a competitive disadvantage in ‘the rapidly growing and dynamic African market.’ Froman reiterated this sentiment in his September 30, 2013 charge to the United States International Trade Commission.

He specifically requested a study into EPAs - seeking to investigate the agreements and their impact on current or potential reciprocal trade agreements between sub-Saharan African and non-sub-Saharan African partners. For its part, the USITC will specifically investigate and identify those American sectors or products impacted or potentially impacted by EPAs, including any tariff differentials.

But perhaps the greatest complication this ECOWAS-EU EPA could generate is on the approval of the Trans-Atlantic Trade and Investment Partnership with the European Union. Simply, even if the Europeans were justified in fearing a loss of market share to the Chinese and other countries, the mega deal they were negotiating with the United States could be in jeopardy. With Congress already skittish about the Trans Pacific Partnership (TPP) and TTIP, this EPA could present conditions to scuttle something an agreement worth more than $200 billion annually.

First, it may not sit well with the Congress if it emerges that the European Union has gained advantages that ensure that Africa can provide preferences to others, and thus, discriminate against U.S. exporters. Secondly, because the United States is on record for supporting regional integration, this EPA may be viewed as a serious obstacle to continental integration. Additionally, the MFN clause of this EPA presents another impediment to American efforts to negotiate a free trade agreement with sub Saharan Africa in a post AGOA period. The clause insists that that any concession given to the U.S. currently not available to the EU must be automatically provided to the EU. This was the main reason the U.S. was unable to negotiate an FTA with South Africa and its partner countries in the Southern African Customs Union (SACU) a decade ago.

Back to the TTIP, while it is true that the U.S. stands to benefit from trade with the EU, the simple fact is that the EU needs this deal even more. With the U.S. economy well on its way to economic recovery – growing at a robust 3.2% - the additional growth .3 of one percent of GNP as a result of the agreement is positive but not that crucial. To Europe, this agreement is estimated to grow GNP by .75 percent of one percent, or two and one half times the positive contribution the U.S. will garner. Thus, it does not help that Congress is already skittish about anything that is seen to disfavor the U.S.

Nonetheless, there are, perhaps, a few palliative measures to address these issues: For instance, if there was flexibility in allowing whatever concessions are agreed upon to be adjusted; if Africa was given respite to develop its building bloc approach to FTAs and customs unions on a continental basis, the EPA may be seen more developmental than it is right now. Secondly, a real premium should be placed on the EU negotiating with the Tripartite Arrangement of COMESA, the EAC and SADC. As with ECOWAS, the EU can agree to wait until integration goals are achieved for such negotiations to take place.

This could be palatable to the U.S. and the East and Southern Africans who have, thus far, resisted the EU. Penultimately, timing is important. Any concession detrimental to the U.S. manufacturer ought to be back loaded - allowing the 10 to 15-year renewal of AGOA to play its role before these can be fully implemented. Lastly, with more details emerging on the MFN clause, it must have sufficient flexibility in allowing the U.S. to negotiate agreements unimpeded by EU demands. Reiterating an earlier point, the 20-year phase in period should be designed to allow for a non-reciprocal AGOA to renewed for a 15-year period by not phasing in earlier concessions which directly harm U.S. exports to Africa.

Ultimately, if this agreement is signed without palliative measures to address U.S. concerns and its impact on regional integration, the EU may as well bid farewell to a deal with an ebullient American economy, and it will have made the already challenging role of the African Union in regional integration even more arduous.

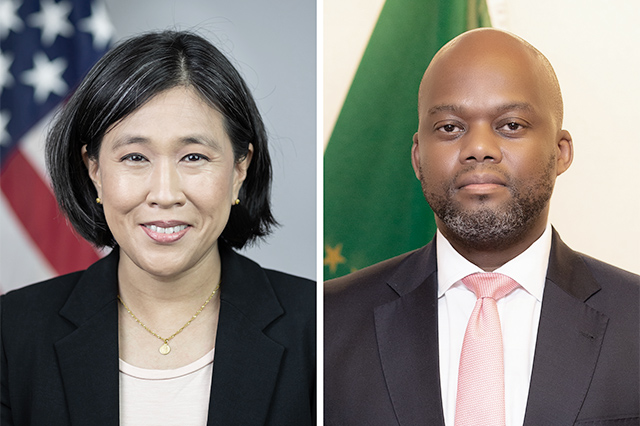

By Stephen Lande and Dennis Matanda from Manchester Trade