AGOA rules: The intended and unintended consequences of special fabric provisions

Preferential import policies that allow developing markets to export to advanced economies are intended to dynamically promote development rather than just provide basic gains from trade. This column argues that the Africa Growth and Opportunities Act achieves the latter but not the former, distorting incentives along the value-added chain. While beneficial, preferential trade deals are not a panacea and are certainly not a replacement for pro-development policies.

The US and EU often claim credit for granting duty-free quota-free access to products from the least developed countries. Such preferential treatment is of interest not only because it might provide one-time benefits in the form of higher incomes and increased employment, but also because trade is often associated with dynamic benefits that lead to faster growth and development. By providing preferential access to developed economies, it is hoped that poor countries will ‘learn by doing;’ that they will over time upgrade their product sophistication, diversify into other products and markets, and ultimately become competitors no longer in need of preferential treatment.

Whether developed markets are actually open to manufactured exports from the least developed economies is unclear. Some preference programs are disingenuous because they include rules of origin that require more local production than these poor countries are capable of. In the case of preference programs in apparel, these rules are particularly stringent, sometimes requiring that at least two (in the case of the EU) or even three (in the case of the US) transformation processes (e.g. yarn, fabric, assembly) in the preference-receiving or granting countries to qualify for duty-free entry. Despite having preferential access, therefore, developing countries often fail to export.

The Africa Growth and Opportunities Act (AGOA) which gave sub-Saharan countries duty-free quota-free access to the US is the exception that proves the rule. It highlights the importance of rules of origin. AGOA contained an unusual and generous waiver for wearing apparel that was granted to ‘Lesser Developed Beneficiary Countries’ (LDBCs). The waiver allowed these LDBC countries to use third-country fabrics or yarn and still export clothing under the AGOA preferences. All that was needed was an inspection by US officials that certified that real production was taking place.

The results were impressive. In 2004, just three years after Lesotho became eligible for preferences under AGOA, clothing exports to the US from one of Africa’s poorest land-locked nations had trebled to $460 million, providing employment for over 50,000 workers. Exports from other African countries such as Kenya, Madagascar, Malawi, Swaziland and others also increased dramatically.

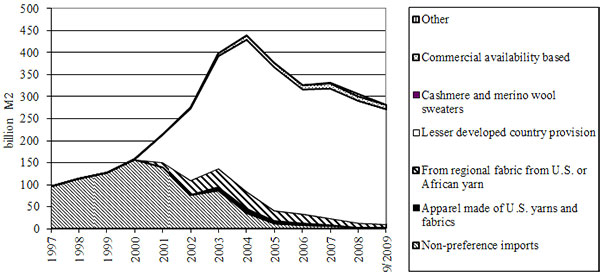

The rule clearly matters. As shown in Figure 1, almost all AGOA apparel exports enter the US under the lesser developed country provision.

This finding has broader implications. In their Vox column, de Melo and Portugal-Perez (2012) indicate that the gains from rich nations applying more relaxed rules on imported inputs are six times greater than the simple act of removing tariffs. Frazer and Van Biesebroeck (2010) and Edwards and Lawrence (2010) similarly find large export responses to the more relaxed rules of origin, although Rotunno, Vézina and Wang (2012) argue that much of this growth was simply the transshipment of apparel from China to the US via Africa.

Despite this impressive growth in export volumes, there is more disquieting evidence in AGOA’s performance that relates to the issue of dynamic benefits. After 12 years of AGOA support, beneficiary countries still do not appear to have viable internationally competitive industries that could survive without the preferences, or to have diversified horizontally into new products and markets or vertically into greater domestic value addition.

Factories in Lesotho, for example, continue to concentrate on just a narrow range of garments: the most basic low unit value categories of knitted tee-shirts, slacks, blouses and blue-jeans. The slice of the production chain they participate in is narrow and does not seem to be expanding. Most apparel manufacturing in Lesotho remains CMT (Cut-Make-Trim). The firms, almost entirely foreign owned, typically provide assembly, packaging and shipping services and depend on their Asian headquarters to generate orders, design the clothes and send them the fabric they need. Productivity levels remain low and worker skills do not appear to have increased over time (Morris 2006). Most of the value is thus added to other parts of the value chain that is located in other countries.

The combination of a productivity disadvantage and almost no domestic textile industry makes the industry’s survival totally dependent on the preferential treatment. Each time the expiration of the special rule has drawn near, studies have issued credible and dire warnings about the industry’s ability to survive without them. This was recently evident in the successful lobbying for the extension of the special rule deadline from September 2012 to September 2015. Clearly there has been trade, but no development.

Why this disappointment? One explanation is that these countries are too far from the threshold of global competitiveness for exports to ignite the industrialization process. Another is the weak integration of the foreign factory owners into the local community (Lall 2005). The expiration of the Multi-fiber Arrangement in January 2005 also led to much stronger competition from China and other previously quota constrained countries in those products exported by AGOA beneficiaries.

In our recent paper we argue that a key reason for these outcomes is that preferential import policies combined with the third country fabric rule have powerful incentive effects that can distort production decisions (Edwards and Lawrence 2010). We show that the implicit subsidy of the preference is greatest for products with very low value addition and thus at the margin, the tax on adding additional value can be very high. For example, the 17% preference margin granted by AGOA through MFN tariff relief on clothing is equivalent to a 34% effective subsidy for products where value addition makes up 50% of total costs, but 85% for products where value addition is only 20% of total costs. This allows AGOA producers to offset cost disadvantages due to the lower productivity of their workers and greater distance from suppliers and markets and helps explain why the initial responses to AGOA were so powerful.

At the same time as they encourage exports of low value-added products, the preferential policies have two deleterious effects.

- On the one hand, the incentives are most powerful in lower quality products that require less value-addition.

This limits the dynamic benefits that are hoped for from these preferences by discouraging skills development and other forms of quality upgrading.

- On the other hand it encourages the use of more expensive imported fabrics rather than the cheaper fabrics that are more likely to be produced in poor countries.

This makes it less likely that there will be backward linkages into domestic textile industries that are still at rudimentary stages of development.

Conclusion

The experience of AGOA underscores the importance of distinguishing between trade and development. Trade preferences do have major advantages.

- First, they can offer powerful inducements to beneficiary exporters that are financed through foregone tariff revenues by developed countries rather than taxpayers in developing countries.

- Second, by providing a form of infant industry protection in export rather than domestic markets, they ensure that products have to meet the requirements of consumers in advanced economies.

- Third, since they are externally imposed, they do not give rise to domestic rent-seeking.

The experience also shows that preferential trade deals are not a panacea and certainly not a substitute for other development policies.

The special third country fabric provision rule distorts decisions on value-addition and fabric use in opposite directions, both of which are undesirable and discourage the dynamic benefits expected from these preferences. Preferential import policies can perhaps complement rather than substitute for more comprehensive industrial strategies that involve complementary domestic policies to improve private and governmental capabilities. This does not mean that these preferential rules are unimportant, but suggests they are likely insufficient.

Lawrence Edwards is Associate Professor in the School of Economics, University of Cape Town, and Robert Z. Lawrence is Professor of International Trade and Investment, John F Kennedy School of Government Harvard University, Senior Fellow, Peter G. Peterson Institute for International Economics, and a former member of of the President’s Council of Economic Advisors under President Clinton.