'Can Uganda wiggle out of AGOA puzzle?'

Uganda faces the possibility of being removed from the African Growth and Opportunity Act (AGOA) beneficiary states thanks in no small part to what the United States calls human rights violations.

This comes hot on the heels of the recent enactment of anti- homosexuality legislation in Uganda.

The programme offers duty-free access to the world’s largest economy for Sub-Saharan African countries that meet democratic criteria, which is evaluated each year.

Boasting a staggering pool of more than 6,000 eligible products, AGOA has undoubtedly beckoned Ugandan businesses to dive into its extensive offerings.

Uganda, primarily relying on high-demand commodities such as coffee, cut flowers, fish, textiles, and apparel, has been quick to seize this golden ticket.

The country’s export portfolio extends to encompass footwear, minerals, and metals, all benefiting from AGOA’s preferential treatment.

However, beneath the surface, Uganda’s trade balance has been anything but steady, as it grapples with the challenges of fully capitalising on this programme. In fact, Uganda’s AGOA journey, though promising, has revealed mixed results.

In the 2022 fiscal year, the country recorded an impressive Shs39.8 billion in export revenue, largely driven by agricultural products under the scheme. However, this figure has oscillated between Shs13.9 billion and Shs37.4 billion in preceding years.

In stark contrast, South Africa’s AGOA narrative has been one of remarkable success. In 2021, it emerged as the US’s largest importer under the programme, raking in a substantial $2.7b (Shs10.1 trillion) in revenue, primarily from vehicle, jewellery, and metals exports.

What got Uganda trapped in the AGOA entanglements? Per the trade agreement, the spiralled benefits Uganda gets from AGOA have come with a number of requirements that include removing obstacles to US investment and trade, defending internationally recognised human rights, and refraining from actions that jeopardise US foreign policy or national security. Uganda, however, has a long history of violating human rights, and this year it passed a law that punishes homosexuality, including a death penalty for individuals involved in a same-sex affair that leads to the spread of HIV.

This set off the red lights on the dashboard. Some other AGOA beneficiary nations have been subjected to similar scrutiny. Ethiopia, for instance, saw its AGOA status revoked in 2022 due to “gross violations of internationally recognised human rights” during the Tigray conflict. This resulted in more than 100,000 job losses in industries such as clothing and leather of mostly young women working in textile factories in the southern part of the country who were not even connected to the conflict in the north.

Trade officials argue that the consequences of these suspensions do not even affect the intended state or its operations, but rather a large labour force sewing clothes in factories and the 60 !rms that bring in millions of dollars in annual exports.

Did the recent ban on any importation of used clothing inform the AGOA suspension?

The US is currently mulling over the possibility of revoking AGOA benefits for East African nations, driven by concerns raised by the Secondary Materials and Recycled Textiles Association (SMART). It contends that the ban on used clothing imports by some AGOA subscribers (Uganda and Rwanda) is causing economic hardship in the US used-clothing industry, violating World Trade Organisation and AGOA rules.

Some observers argue that this provision disproportionately affects smaller economies like Uganda, leading to currency depreciation with minimal benefits, while such requirements are not imposed in larger markets like China and India.

“Although exact numbers are unknown, hundreds of thousands of jobs have been created throughout the country, and any possible suspension of the country from this trade pact could trigger an erosion of jobs and affect survival of a lot of companies which on an annual average fetch Uganda more than $80m from the US economy,” said Mr Fred Muhumuza, a Ugandan micro-economist. Where does this all leave Uganda’s textile industry?

In hardly a great place.

When pacts like this were introduced, countries like Uganda, which make significant money from cash crops, saw it as a natural step to boost their economies such as with its formidable coffee product, the country’s biggest export.

However, the country’s aspirations to fully embrace AGOA are challenged by a range of obstacles.

Industry players note that a dearth of critical infrastructure in logistics and machinery, deficient export-processing zones, and a lacklustre supervision in various production chains have hindered Uganda’s ability to meet the exerting US market standards.

Also, despite government initiatives and foreign investments, consumer demand remains largely unmet. With about 250,000 smallholder farmers producing 68,913 bales of cotton annually, of which 90 percent is exported, the Uganda Manufacturers Association emphasises the critical need of providing support to these farmers.

These farmers are impacted by volatile prices, weather changes, low income for value-added investments, and high production-enhancing power costs, which discourage them from producing large quantities of inputs to support high local textile production in quantity and quality while also bringing in adequate export receipts.

Efforts to reinvigorate the textile industry include contemplating a ban on the importation of used clothing, which enjoys popularity due to its affordability.

So who are the losers in all of this?

Per Odrek Rwabogo, the chairperson of the presidential advisory committee on exports and industrial development, “while the Ugandan trade through AGOA was insubstantial, growth of our exports to the US and other partners was an important pillar of our economic strategy going forward.” He adds, rather ominously, in a statement that “Uganda’s farmers and small business owners will suffer.”

Uganda aspires to bolster cotton yields and enhance production conditions to reduce its dependence on imported textiles but its ambitious endeavour necessitates substantial investment and comprehensive policy support, manufacturers assert.

The country had a plan to revitalise its cotton production and improve yields to about 185,000 tonnes by 2006, but it was never realised.

It then embarked on the 2021/25 Cotton, Textile Apparel strategy that would merit innovators in this space to do public partnerships and use of tax policies to spur investment, but it fell short on fiscal operations.

As a result, even the duty-free status provided by the AGOA became too large to provide Uganda with an economic boom, which textile and apparel producers say can occur if local textiles transition from low-cost fast fashion to circular production.

“Costs associated with manufacturing also need to be reduced so that substantial profits are realised through tax reliefs, asking foreign !rms to use local inputs and export incentives for !rms targeting international markets,” said Mr Denis Mugambwa, a smallholder textile producer in Kampala.

What next then?

Striking a balance between economic prosperity and human rights protection remains a formidable challenge, not just for Uganda but for all AGOA beneficiary countries. American officials see AGOA as more than just a trade pact, but a foreign policy lever.

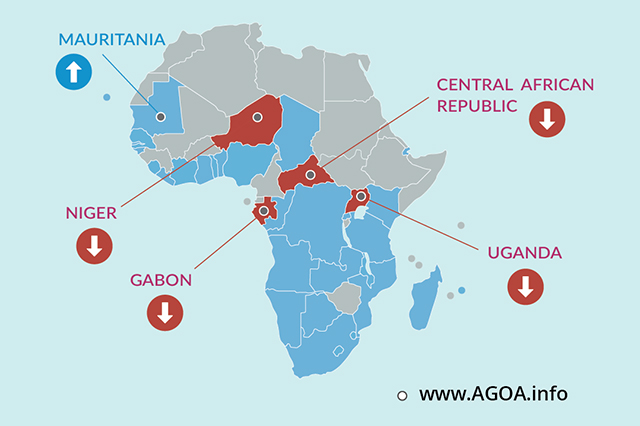

Out of the 45 countries that are supposed to benefit from the scheme, which expires in 2025, 10 are already ineligible, with additional four facing being kicked out next year. Uganda is now open to discussing the issue with the United States, but AGOA is an act of Congress (the legislature of the federal government of the US); not a two-way deal. This makes the negotiation a hurdle for Kampala.

“Uganda does not only lose out on this trade programme but also other economic benefits like the trade and investment support from USAID that goes to countries under AGOA, which supports policy reforms, spurs the private sector and laboratories for testing of various products. AGOA also attracts other investors into the country that really want their products to reach the US market tax-free,” said Mr Muhumuza.