How to drive US investment to Africa - Opinion

When it was established during the Obama administration, the President’s Advisory Council on Doing Business in Africa—or its acronym PAC-DBIA—was an important initiative, and it still is highly relevant.

After all, the body was charged with providing recommendations to the president of the United States through the secretary of commerce on how to increase the U.S. commercial presence in Africa.

Who better to provide advice than some of the leading American companies on the continent?

The U.S. companies represented on the PAC-DBIA have the advantage of understanding the challenges and opportunities of doing business in Africa. Moreover, a larger U.S. business presence in Africa is a priority for many African governments. Not only do our partners on the continent want closer commercial ties with the U.S. but they appreciate that most American companies create jobs, enhance skills, and comply with global best business practices, including anti-corruption.

Nevertheless, it is fair to ask: What has the PAC-DBIA accomplished over the course of seven meetings and five reports? After all, when President Obama established the committee in 2014, U.S. direct investment in Africa was at an all-time high—nearly $69 billion. Seven years later it dropped to about $45 billion.

Why?

Africa has experienced its share of challenges over the last decade. Ebola, the COVID-19 pandemic, the impact of Russia’s invasion of Ukraine, debt distress and the effects of climate change are several deterrents to new investments. Conflicts in Ethiopia, Mozambique, the Sahel and most recently, Sudan, have also weakened the investment climate. Not only do these shocks heighten the perception of risk but they divert domestic resources and policymakers’ priorities away from creating an enabling environment for investments.

A course of action

In its most recent report, the PAC-DBIA makes an important recommendation on reducing private sector risk. Indeed, financial instruments are important for transferring some risk to the government as firms assess the bankability of projects amid an uncertain global macroeconomic backdrop. The U.S. International Development Finance Corporation plays a key role in making available government-backed loan guarantees that can shift risk allocation and boost investor confidence. There are two types of financial products that can be leveraged. The first is a partial credit guarantee, which provides unconditional commitments to fulfill a share of the borrower’s debt obligations in the instance of a default. The second is risk insurance, which provides protection against currency volatility and specified political risks.

The energy sector is one area in which direct loans or guarantees backed by the U.S. government would de-risk private investment in Africa. Globally, just 14% of direct investment in renewable energy is publicly funded. But in Africa, public financing plays a more dominant role, as only a few projects have been able to mobilize sufficient private capital due to legal, economic, and political risks. Debt accounted for 88% of all public financing for renewable energy between 2010 and 2020. Financial de-risking instruments in the energy sector can bring the private sector to the table, thereby reducing the fiscal burden on heavily debt-laden countries.

The PAC-DBIA report makes a second essential cross-cutting recommendation, namely, the development of infrastructure in virtually every priority sector, including energy and environment, digital and ICT (information and communication technologies), agribusiness and food security, and health.

The report highlights the importance of blended finance and optimizing the U.S. government’s resources to develop bankable projects and catalyze the private sector. Africa has some of the highest infrastructure costs in the world due to underperforming, or an absence of, quality infrastructure. In 31 out of 43 sub-Saharan African countries, for example, freight costs on imports are 50% higher than the average for developing countries. At the same time, according to Moody’s Analytics research and as cited by the African Development Bank, Africa has the lowest default rate on infrastructure projects among the world’s regions–5.5%– compared to 12.9% in Latin America and 8.8% in Asia. Infrastructure development should be a top priority for the U.S. government.

The importance of commercial diplomacy

It is against this backdrop that commercial diplomacy can help address perceptions and misperceptions of risk, reduce trade barriers, support foreign procurement, facilitate export transactions, and create a more enabling environment for foreign direct investment.

In fact, the importance of commercial diplomacy cannot be underestimated. As Meg Whitman, former business leader and current U.S. ambassador in Kenya, remarked last month to a high-level business gathering in Nairobi, “When I was CEO—I’ll be honest—I probably thought of Africa about 1% of the time.” The ambassador’s refreshing candor underscores that most U.S. business leaders do not see Africa as a target market.

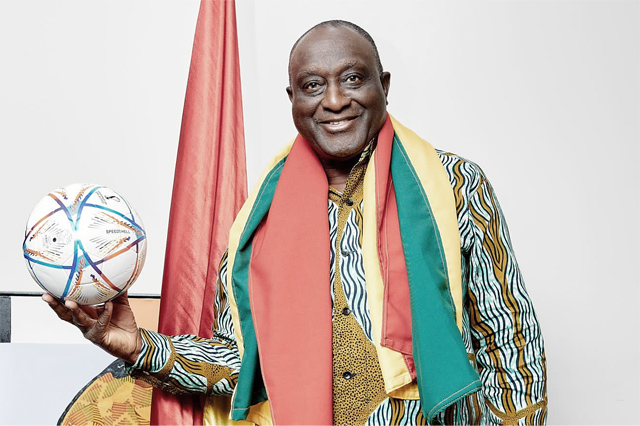

In fact, the U.S. has significantly stepped up its support of the private sector in vital ways, including the creation of the DFC and Prosper Africa and, most recently, Vice President Harris’ recent visit, to name a few of the impactful initiatives. However, since Commerce Secretary Penny Pritzker and the DBIA undertook a fact-finding mission to Nigeria and Rwanda in 2016, U.S. commerce secretaries have spent a cumulative one day on the continent (Wilbur Ross visited Ghana on July 6, 2018, with the advisory group).

We recommend that the secretary of commerce lead a PAC-DBIA trade mission to Africa on an annual basis. Not only would this signal to U.S. business leaders that Africa is a priority market for the American government, but it would be an opportunity to begin the implementation of the many relevant recommendations made by the PAC-DBIA since its inception.

Moreover, robust commercial diplomacy inevitably will play an important role in fulfilling the private sector commitments, worth $15.7 billion, that were made at the 2022 U.S.-Africa Leaders Summit and reversing the decline in in U.S. investment in Africa.

Witney Schneidman is Coordinator for Prosper Africa - USAID and former Brookings expert, and Gracelin Baskaran is nonresident Fellow - Global Economy and Development, Africa Growth Initiative, at Brookings .