'Here's why the used clothing trade deserves more attention'

While friction over the ban of used clothing exports from the US to East Africa seems to have come to an end, some fundamental issues still remain, according to Shannon Brady and Sheng Lu from the University of Delaware. Their latest research throws up complex economic, social, legal and political factors linked with the trade in second-hand clothes and questions the effectiveness of preference programmes such as AGOA as a tool for economic development

Back in March 2016, the East African Community (EAC) which includes Kenya, Rwanda, Tanzania, Uganda and Burundi first announced plans to phase out imports of used clothing so that its nascent local textile and apparel industry would have the chance to develop and grow.

The decision raised strong objections from the US-based Secondary Materials and Recycled Textiles Association (SMART), among whose members the EAC was one of the largest export markets of used clothing. Seeing that EAC was determined to implement the import ban, SMART turned to the Office of the US Trade Representative (USTR) for help.

In response, on 30 July 2018, President Trump said he would suspend Rwanda's eligibility to export apparel to the United States duty-free under the African Growth and Opportunity Act (AGOA).

The AGOA trade preference programme was established in 2000 to help developing countries in sub-Saharan Africa (SSA) grow their economies through expanded exports to the US. Losing AGOA benefits means Rwanda's apparel exports to the US are now subject to the most-favoured-nation (MFN) tariff rate, which averages 12.8% for knitted apparel (HS chapter 61) and 10.1% for woven apparel (HS chapter 62).

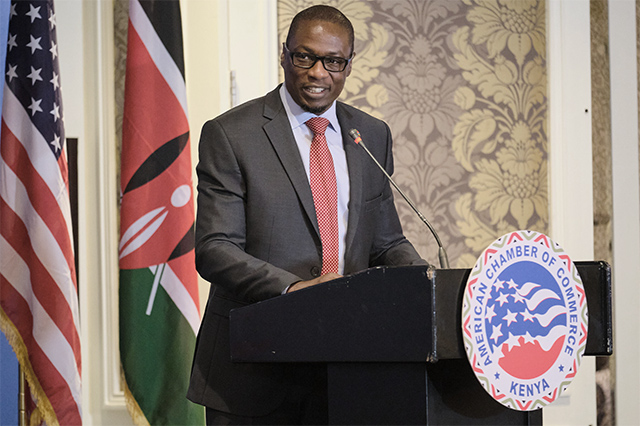

We recently conducted several in-depth interviews with decision-makers and stakeholders involved in the dispute, including senior US trade policymakers for textile and apparel, industry leaders from the US apparel industry, leadership of SMART, and industry representatives from EAC countries.

And one key takeaway is that while the dispute between the US and EAC on the used clothing ban seems to have ended, some fundamental issues linked with the case are far from over.

EAC countries want to develop their local textile and apparel industries. Historically, the labour-intensive apparel sector often was the first industry a country picked to start the industrialisation process. However, the effectiveness of the used clothing import ban on promoting the development of the local textile and apparel industries in EAC countries is unclear.

On the one hand, because the textile and apparel industries in several EAC countries remain at the nascent stage of development, there is limited economic data available for an in-depth quantitative evaluation of the effectiveness of the used clothing import ban.

On the other hand, according to several interviewees, used clothing is NOT the only competition faced in EAC countries. For example, some argue that banning used clothing imports will do little to alleviate competition from cheap new clothing imports from Asia, particularly China.

Statistics from UN Comtrade show that between 2005 and 2017, China's new apparel exports to EAC countries surged dramatically, including Rwanda (up 6,926%), Kenya (up 3,573%), Tanzania (up 1194%) a rise of 471% for the SSA region as a whole. Additionally, some interviewees believe that apparel locally made in the EAC is mainly for export, whereas used clothing imports benefit low-income consumers in these countries.

A concern to interviewees is that the import ban will result in more smuggling of used clothing into the EAC and the loss of tariff revenue for the government, rather than boosting local textile and apparel production.

It is a common perception among US consumers that donating used clothing is good for the environment and can help people in need, especially those living in the local community. However, they are largely unaware that most of their donations are eventually exported across the ocean to sub-Saharan African countries for a profit.

As noted by several interviewees, the for-profit export business of US companies that collect donated used clothing is often their single largest source of income that supports other non-profit activities (such as philanthropic initiatives).

The used clothing trade is also a debate in importing countries. For example, the buying, selling, repairing and altering of imported used clothing creates thousands of jobs and provide a means of living for local people. However, the impact of the used clothing import ban on net job creation in EAC countries is hard to tell.

The used clothing trade involves moral debates too.Multiple interviewees noted that the increasing saturation of used clothing imports has left EAC countries (particularly their governments) feeling as though they have become a dumping ground for discarded clothing from developed countries.

As one interviewee told us, the colloquial term for used clothing in many EAC countries is "Mitunda" (or some close variation). Directly translated, "mitunda" means "bundles" which refers to the way used clothing is typically shipped. However, this word carries a deeper connotation that the used clothing is sent from a rich western country to a poor African country and this hurts national pride. In EAC countries such as Rwanda, which have a long history of civil war, the sense of national pride as an independent and unifiedcountry is not a trivial issue. Moreover, as one interviewee pointed out: "In history, no country ever achieved its industrialisation based on consuming other countries' secondhand stuff."

Interviewees also pointed out that making AGOA work better is even more critical to the future development of the textile and apparel industry in EAC countries than the used clothing import ban.

"One important policy goal of AGOA is to promote sub-Saharan Africa's apparel exports to the United States. However, still only 1.3% of US apparel imports came from the AGOA region last year [2017], which was no improvement compared to a decade ago," one said.

Others also noted that despite the expressed interest in sourcing more from AGOA, few US companies have actually made investments in sub-Saharan Africa (including EAC members), such as opening factories and providing capacity building support. Instead, most foreign investments in the AGOA region have come from Asia.

Additionally, several interviewees didn't feel the "third-country fabric provision" in AGOA provides sufficient incentives for building the region's local textile and apparel supply chain. Notably, this provision allows most sub-Saharan Africa countries to export finished apparel to the US duty-free, even though yarns and fabrics may be sourced from anywhere in the world."It was hoped that the increased volume of apparel exports through the 'third-country fabric provision' would eventually attract investors to build textile mills in the AGOA region. However, it has not happened yet," one interviewee commented.

Last but not least, several interviewees expressed concerns that the temporary nature of AGOA as a trade preference programme had made US fashion brands and apparel retailers hesitant about making a long-term commitment to sub-Saharan Africa. However, should AGOA become a permanent free trade agreement, which follows the principle of reciprocity, sub-Saharan African countries would have to lower their trade barriers to US products including eliminating the tariffs and non-tariff barriers for used clothing in exchange for the reciprocal market access benefits from the United States. Most AGOA members don't seem to be ready for that stage yet.

To sum up, the US-EAC dispute over the used clothing import ban is far more complicated than it first seemed. It involves complex economic, social, legal and political factors, ranging from the principle of dignity to the dynamics of trade.

The debate also draws attention to the needs of African countries, many of which are still struggling hard to develop their domestic textile and apparel industries as a means of industrialisation. In particular, two critical yet daunting tasks are how to improve the effectiveness of trade preference programmes such as AGOA as an economic development tool, and how they can be modernised so they are relevant to the nature of the21stCentury global economy.

Authors: Shannon Brady is a 2018 University of Delaware summer scholar. Dr Sheng Lu is an Associate Professor in Fashion and Apparel Studies at the University of Delaware.