Research Documents

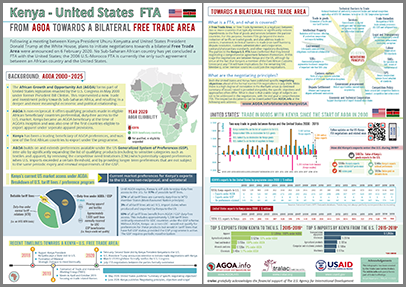

Brochure | Kenya-United States FTA

Information brochure on the proposed US-Kenya FTA, including trade data and negotiating principles. Double-sided A4. For printing purposes, set 'fit to page' on your printer.

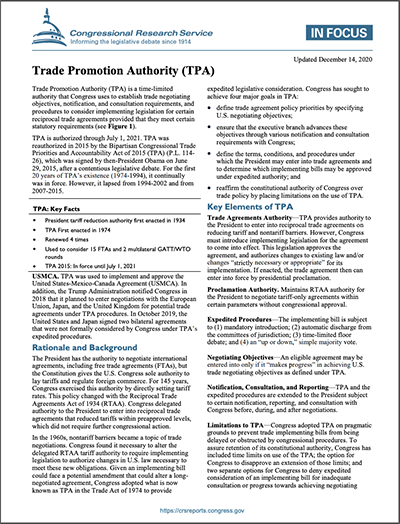

The United States Trade Promotion Authority (TPA) legislation

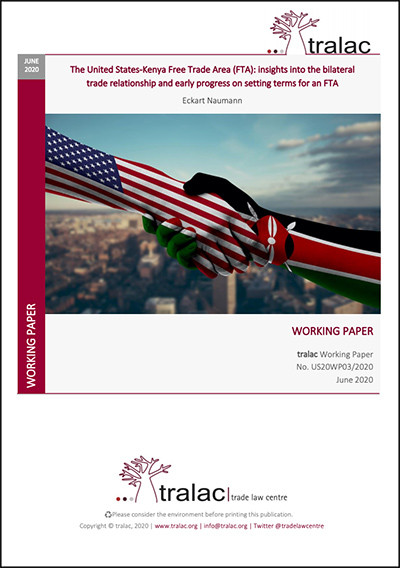

The US-Kenya FTA: insights into the bilateral trade relationship and early progress on setting terms for an FTA

On 6 February 2020, US President Donald Trump announced the United States’ intention to initiate negotiations with Kenya on a bilateral Free Trade Area (FTA). This followed a meeting between President Trump and Kenyan President Uhuru Kenyatta at the White House during a state visit by Kenyatta to the US. An FTA between the US and any country would be noteworthy, but even more so when it potentially involves the first country in Sub-Saharan Africa (SSA) and only the second on the African continent after Morocco. The US-Morocco agreement entered into force in 2006 and is considered a comprehensive agreement that has seen bilateral trade between the countries grow significantly (with the US enjoying a substantial trade in goods surplus with Morocco). A Kenya-US agreement would be remarkable for many reasons, including some issues and challenges that are potentially complex in the light of other existing arrangements and dynamics. In terms of US-African trade, Kenya was ‘only’ the seventh largest source of (imported) goods by the US from Sub-Saharan Africa during 2019, by comparison accounting for less than 10% of South Africa’s exports to the US, with South Africa being the largest SSA exporter to the US. This working paper looks at the planned Kenya-US FTA mainly from the perspective of the current trade relationship, reviewing developments and growth in Kenya’s US-bound exports since 2000 when the African Growth and Opportunity Act (AGOA) began to...

US Assistance to Sub-Saharan Africa: An Overview

Overview: Congress authorizes, appropriates, and oversees U.S. assistance to sub-Saharan Africa (“Africa”), which received over a quarter of U.S. aid obligated in FY2018. Annual State Department- and U.S. Agency for International Development (USAID)-administered assistance to Africa increased more than five-fold over the past two decades, primarily due to sizable increases in global health spending and more incremental growth in economic and security assistance. State Department and USAID-administered assistance allocated to African countries from FY2019 appropriations totaled roughly $7.1 billion. This does not include considerable U.S. assistance provided to Africa via global accounts, such as emergency humanitarian aid and certain kinds of development, security, and health aid. The United States channels additional funds to Africa through multilateral bodies, such as the United Nations and World Bank.

AGOA Overview 2020 - Congressional Research Service

The Office of the U.S. Trade Representative (USTR) is announcing the initiation of the annual review of the eligibility of the sub-Saharan African countries to receive the benefits of the African Growth and Opportunity Act (AGOA). The AGOA Implementation Subcommittee of the Trade Policy Staff Committee (AGOA Subcommittee) is developing recommendations for the President on AGOA country eligibility for calendar year 2021. The AGOA Subcommittee requests comments for this review. Due to COVID–19, the AGOA Subcommittee will foster public participation via written submissions rather than an in-person hearing. This notice includes the schedule for submission of comments and responses to questions from the AGOA Subcommittee related to this review.

South Africa under GSP country review: what implications for preferential exports to the United States?

On 25 March 2019, the United States Office of the United States Trade Representative (USTR) issued a notice through the Federal Register on its annual Generalized System of Preferences (GSP) product and country review. This is a relatively routine review process relating to the country’s nonreciprocal trade preference scheme(s). Exactly seven months later, on 25 October 2019, the USTR announced GSP “enforcement action” relating to seven countries, including South Africa, having accepted a petition by the International Intellectual Property Alliance (IIPA) regarding South Africa’s ongoing compliance with the GSP eligibility criteria. A subsequent Federal Register notice on 19 November sets out some of the more detailed timelines around this process as it pertains to South Africa’s case. What is at stake for South Africa’s trade under GSP and AGOA? Developments in South Africa (and any action taken by the IIPA or the US) might impact, influence, or indeed form some kind of persuasive precedent for what might or might not follow in other African markets later.

AGOA - What it means for Namibian business

Namibia is a small and open economy with a total population of 2.4 million in 2017. In addition to the small population, the extreme unequal distribution of wealth and income limits the demand for domestically produced goods and services. In order to exploit economies of scale, companies need to explore export markets. Imports and exports combined accounted for 102.6% of GDP in 2017, which is below previous years’ averages. Namibia exported a narrower range of products to the USA than to other markets. Over the ten-year period, Namibian exports to the USA fell into 1,447 HS8 tariff lines compared to 7,208 tariff lines for total exports. However, a higher share of Namibia’s exports to the USA fell into tariff lines that were eligible for AGOA preferences as compared to the country’s exports to other destinations. In contrast, however, these tariff lines accounted for a lower share of total exports to the USA than of exports to other countries. Despite preferential access to the US market, Namibia exports these products mainly to other markets.

Mozambique: Politics, Economy, and US Relations

Mozambique, a significant recipient of U.S. development assistance, is a southeastern African country nearly twice the size of California, with a population of 27.9 million people. It achieved rapid growth following a post-independence civil war (1977-1992), but faces a range of political, economic, and security challenges. These include a political scandal over state-guaranteed, allegedly corrupt bank loans received by state-owned firms, which created public debt that the government did not disclose to the International Monetary Fund (IMF). This placed the country’s relations with the IMF at risk and has had major negative repercussions for the economy, donor relations, and Mozambique’s governance record. Other challenges include unmet development needs, a range of governance shortcomings, organized crime, an ongoing economic slump, and political conflict and violence involving both mainstream political actors and violent extremists.

Trade Promotion Authority - Frequently Asked Questions

Legislation to reauthorize Trade Promotion Authority (TPA)—sometimes called “fast track”— the Bipartisan Congressional Trade Priorities and Accountability Act of 2015 (TPA-2015), was signed into law by former President Obama on June 29, 2015 (P.L. 114-26). If the President negotiates an international trade agreement that would reduce tariff or nontariff barriers to trade in ways that require changes in U.S. law, the United States can implement the agreement only through the enactment of legislation. If the trade agreement and the process of negotiating it meet certain requirements, TPA allows Congress to consider the required implementing bill under expedited procedures, pursuant to which the bill may come to the floor without action by the leadership, and can receive a guaranteed up-or-down vote with no amendments.

Overview of US textile requirements

The slides in this presentation are intended to be used in a training event with verbal elaboration by a knowledgeable presenter. The slides highlight key U.S. product safety requirements for this discussion. The text is not a comprehensive statement of legal requirements or policy and should not be relied upon for that purpose. You should consult official versions of U.S. statutes and regulations, as well as published CPSC guidance when making decisions that could affect the safety and compliance of products entering U.S. commerce. Note that references are provided at the end of the presentation and a handout on phthalates prohibitions in children’s toys and child-care articles is also available.

Differentiated Impact of AGOA and EBA on West African Countries

Abstract: The “African Growth Opportunity Act” (AGOA) and “Everything But Arms” (EBA), two preferential agreements extended by the US (AGOA) and the EU (EBA) to some developing countries seem to have contributed somewhat to boost Sub-Saharan Africa’s exports since 2001. However, not all African countries have benefited from them, among which West African countries. Paradoxically, these latter countries host two of the most advanced regional economic communities in Sub-Saharan Africa: The West African Economic and Monetary Union (WAEMU) sharing a common monetary policy that has consistently maintained inflation low and forming a Customs Union with a compensation mechanism to uphold the Common External Tariff; and the Economic Community of West African States (ECOWAS) maintaining a regional military force (ECOMOG) and peer pressure that have rooted out military coups in its member countries. Simulations derived from a Pseudo Poisson Maximum Likelihood gravity model estimation show that West Africa could be exporting 2.5 to 4 times more to the EU and the US if AGOA and EBA were not implemented in a differentiated manner, in terms of country eligibility, product coverage and rules of origins. Given such trade creation potential for a group of countries committed to deep regional integration, a revision of AGOA and EBA, or a special ECOWAS/WAEMU provision would make these preferential trade agreements a driving force behind the success of regional integration...

Eligibility Process and Economic Development in Sub-Saharan Africa

The U.S. government uses the annual eligibility review process required by the African Growth and Opportunity Act (AGOA) to engage with sub-Saharan African countries on their progress toward economic, political, and development reform objectives reflected in AGOA's eligibility criteria. Managed by the Office of the United States Trade Representative, the review process brings together officials from U.S. agencies each year to discuss the progress each country is making with regard to AGOA's eligibility criteria and to reach consensus as to which countries should be deemed eligible to receive AGOA benefits. Over the lifetime of AGOA, 13 countries have lost AGOA eligibility, although 7 eventually had it restored (see figure). To encourage reforms, the U.S. government will engage with countries experiencing difficulty meeting eligibility criteria and may specify measures a country can take. For example, U.S. officials met with Swaziland officials over several years to discuss steps to improve labor rights. However, Swaziland did not make the necessary reforms and lost eligibility effective in January 2015.

Overview of the Cotton, Textile and Apparel Sectors in East Africa Region and Benchmarking with Sri Lanka and Bangladesh

Overview of the Cotton, Textile and Apparel Sectors in East Africa Region and Benchmarking with Sri Lanka and Bangladesh is a USAID Hub report that serves as a reference for businesses looking to source from East Africa. It provides easily searchable and mapped information on sector players that could be used to identify textile, apparel and apparel accessory producers who can supply products to local and regional clients and U.S. buyers. It also benchmarks the business climate for apparel-related trade and investment in six East African countries (Kenya, Uganda, Tanzania, Madagascar, Mauritius and Ethiopia) against two global apparel producing competitors in Asia – Sri Lanka and Bangladesh – to provide a basis for the selection of suitable sourcing and investment for local and global buyers as well as policy improvements and interventions by East African governments.

Is the banning of importation of second-hand clothes and shoes a panacea to industrialization in East Africa?

The objective of this study was to investigate if the banning of importation of second-hand clothes and shoes is a panacea to industrialization in East Africa. Qualitative and quantitative secondary data were employed to validate the research objectives. The study found that most people used second-hand clothes and shoes bacause they were cheaper, good quality and fashionable. Likewise, the trade of second-hand clothes and shoes created employment, generated revenue and filled the gap during shortage. Nevertheless, the second-hand clothes and shoes trade contributed to the collapse and hamper the current initiative to revive the textiles and leather industries. Similarly, the trade has been associated with some skin diseases, had negative impact on self-esteem of the consumers and conflicted with some African values and traditions. Besides, there were some socio-economic and technical factors, influx of clothes and shoes from Asia as well as un-competitive local environment which contributed to the collapse of the former industries. In view of the above, the following were recommended: First, the phase-out of second-hand clothes and shoes should be gradual and implemented over a longer period of time (5-10 years) to lessen the impact of the ban on the lives of the consumers and traders. Second, the governments should put in place effective policies to control unfair competition of Asian products....

Rethinking the AGOA model: How to create a pro-structural transformation of the US-AFRICA trade partnership

Seventeen years into the life of the African Growth and Opportunities Act (AGOA), two key issues stand out: first, that the preference utilization rate—as indicated by the meagre increases in African exports to the United States—remains marginal; and second, that the AGOA initiative has not helped build diversified African econo- mies. This reality in turn raises two critical issues: that Africa’s structural challenges need to be addressed; and that extensions of the AGOA in and of themselves may not be the solution for the continent’s economic development. Therefore, looking toward 2025 is an opportunity to have a fresh discussion with the United States, one focused on placing the African economic development challenge at the heart of the dialogue. This requires designing a new model grounded in Africa’s aspirations for structural transformation of its economies from primary product to industrial product exporters.

Defining and redefining US-AFRICA trade relations during the Trump Presidency

In an era in which multilateral trade arrangements have garnered more public notoriety than ever before, the suboptimal trade and investment relationship between America and Africa, as underpinned by the African Growth and Opportunity Act (AGOA), is one of the less controversial ones. AGOA could nevertheless use some adjustments or augmentations to facilitate deeper U.S.-Africa commercial relations. For instance, adjusting AGOA’s origin rules could nudge the private sector on both sides of the Atlantic towards gains for U.S. and African employment and the reduction of trade deficits. Africa must leverage the period before AGOA expires to redefine its trade relationship with the United States in innovative ways. The United States should welcome these measures, since the type of value that Africa would add to the global supply chain would not replace the high-quality jobs that the Trump Administration would like to see in the United States. In fact, this type of production would make U.S. manufacturing more competitive.

Forging a New Era in US-South African Relations

As one of the African continent’s largest and most sophisticated economies, South Africa offers a myriad of opportunities for engagement with the United States on diplomatic, commercial, security, and social fronts. It is a self-sufficient, complex, and dynamic country in a struggling, complex, and dynamic region. Yet, the centrality of South Africa to the United States’ relationship with the wider continent is underappreciated by Washington’s policy community, which has become distracted by the displays of dysfunctionality and high-level corruption that have come to characterize South African politics. These political dramatics have knocked US relations with South Africa off track by obscuring the enduring social inequities at the heart of South Africa’s problems, both in media depictions of South Africa and in serious policy discussions. As Anthony Carroll details in the Africa Center’s newest report, Forging a New Era in US-South African Relations, the United States has a significant stake in South Africa’s future. The country has the potential to serve as a peacekeeper and economic flagship for the whole of Africa. Currently, it falls far short of this potential—but the upside trade and security benefits of an improved relationship between Washington and Pretoria are significant. At the same time, the downside risks of ignoring the relationship are severe: increased social unrest in South Africa would have disastrous consequences...

The next generation of US-AFRICA trade instruments

This essay examines the challenges and opportunities for regional trade lawmaking in the U.S.-Africa relation- ship. On the eve of the conclusion of an African continental free trade agreement, the U.S. trade law relationship with the continent remains focused on regional groups. Questions remain as to whether the existing trade law regime offers the flexibility necessary to accommodate alternative models to free trade agreements that may best serve the needs of African and U.S. constituencies. The essay proceeds in four parts. First, I sketch the current state of play in U.S.-Africa trade relations. Next, I outline how the U.S. and African approaches to trade lawmaking have differed. I then turn to two sets of challenges—one domestic and one international—that may impede inno- vation in developing a U.S.-Africa trade law relationship consistent with African interests. Finally, the essay con- cludes with an exploration of possible alternatives and issues not yet considered in the transcontinental dialogue on trade.

The phase-out of second-hand clothing imports: what impact for Tanzania?

The East African Community has begun phasing-out imports of second-hand clothing to promote the development of the domestic garment sector. Using trade data and information obtained from the exporters, this study produces the first estimate of disaggregated imports of second-hand clothing in Tanzania. The net import of used clothing is estimated at over 540 million pieces per year, compared to a domestic production of new clothing of 20 million pieces and import of 177 million pieces of new clothing. This study assesses the short-term impact of the phase-out on the domestic garment sector. Depending on the substitutability between new and used clothing, the phase-out could prompt increased import of new clothing. It could also prompt employment losses and generate costs for the poorest consumers. In the longer term, the phase-out is unlikely to promote the development of the garment sector unless the existing constraints are properly addressed.