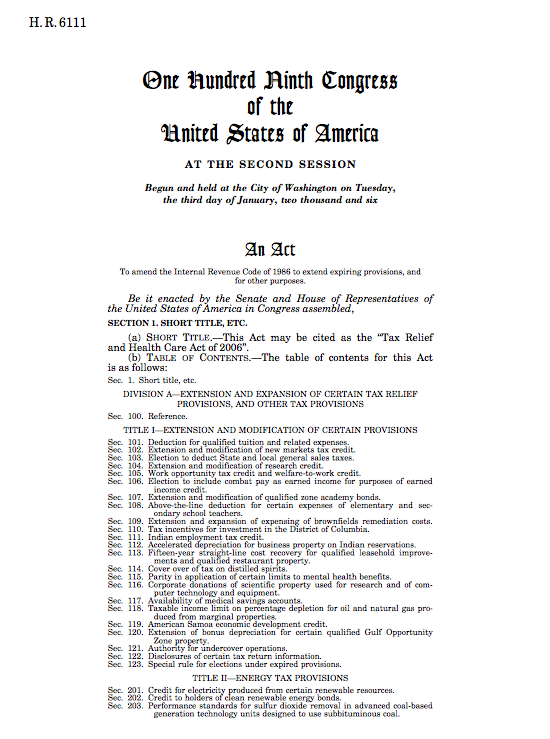

AGOA IV - as Title VI of the Tax Relief and Health Care Act of 2006

'AGOA IV' legislative amendments, which were signed into law as a package under Title VI of the (unrelated) Tax Relief and Health Care Act of 2006.

| Legislation introduced | Sep 19, 2006 |

| Passed House of Representatives | Dec 05, 2006 |

| Passed Senate with Changes | Dec 07, 2006 |

| Signed into law by the President | Dec 20, 2006 |

The relevant sections which amend the AGOA legislation are set out below

Title VI: African Growth and Opportunity Act - Africa Investment Incentive Act of 2006 - (Sec. 6002) Amends the African Growth and Opportunity Act to extend, through September 30, 2012, duty-free treatment to imported apparel articles wholly assembled or knit-to-shape and wholly assembled, or both, in one or more lesser developed beneficiary sub-Saharan African countries (regardless of the country of origin of the fabric or the yarn used to make such articles) in an amount not to exceed a certain percentage of all apparel articles imported into the United States in the preceding 12 month period.

Requires the United States International Trade Commission, upon the filing of a petition by an interested party, to determine the quantity of fabric or yarn that is available in commercial quantities for use by lesser developed beneficiary sub-Saharan African countries and used in the production of apparel articles receiving preferential treatment. Authorizes the President to deny preferential treatment to apparel articles otherwise eligible for preferential treatment that contain a fabric or yarn determined to be available in commercial quantities unless: (1) the fabric or yarn in such articles was produced in one or more beneficiary sub-Saharan African countries; or (2) the Commission has determined that the quantity of the fabric or yarn available in lesser developed beneficiary sub-Saharan African countries has been used in the production of apparel articles receiving preferential treatment.

Authorizes the President to remove preferential treatment for fabric or yarn of an article that was determined on the basis of fraud to: (1) be eligible for such treatment; or (2) not be available in commercial quantity.

Grants preferential treatment to textiles under HTSUS that are products of a lesser developed beneficiary sub-Saharan African country and are wholly formed in one or more such countries from fibers, yarns, fabrics, fabric components, or components knit-to-shape that are the product of one or more such countries.

(Sec. 6004) Extends certain trade benefits to sub-Saharan Africa through FY2015.

In summary:

- the legislation extends the AGOA legislation through 2015

- it extends the third country fabric benefits to September 2012

- requires the USITC to determine commercial availability of yarns and fabric that is available in commercial quantities for use by lesser developed AGOA beneficiaries in the production of apparel articles receiving preferential treatment (known as the Abundant Supply provisions - although these were later repealed).